Today’s Trading Playbook

KEY THEMES

Oil prices rose in early Tuesday trading as traders turned their attention to Libya outage, concurrent with some Chinese factories preparing to open after a COVID-19 shutdown which eased some demand worries. Meanwhile, U.S. equities slipped yesterday, as investors were digesting the latest results of this season, while keeping an eye out for rising bond yields. Furthermore, anticipation covered the sentiment of Asian equity market in light of expected measures by China to avoid economic slowdown, and the extent of the Fed’s hawkishness to impact global investment flows.

Here at home, the earnings season continues, with Alexandria Mineral Oils [AMOC] reporting Q3 2021/22 unaudited consolidated bottom line of EGP354mn (+143% y/y, +99% q/q). Astonishing bottom line performance was sparked by an 81% y/y improvement in its top line to EGP5.2bn (+53% q/q), coupled with an 8.6pp q/q improvement in GPM to 14.2%. Strong third quarter performance is anchored by (1) improvement in sales volumes, (2) higher average selling prices given the oil market condition, (3) better output mix, and (4) better crack spreads. We continue to have an optimistic view for AMOC as we expect the company to enjoy relative stability in the medium- to long-term future, given (1) its resilient balance sheet with a lush cash balance, (2) thin reinvestments required to operate, and (3) long-term prospects for HSFO-LSFO spread which will allow AMOC to demonstrate reasonable fundamentals compared to current market price. AMOC is currently traded at TTM P/E of only 4x.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt's external debt rose by the end of last December by 12.6%, or USD16.3bn,compared to December of the previous year, to reach USD145.5bn. (Economy Plus)

Five new countries, including Germany and Brazil, are considering importing fertilizers from Egypt to compensate for the lack of supply in its markets after the Russian government asked companies producing fertilizers to reduce production capacities, in response to the European sanctions. (Economy Plus)

Expectations for Egyptian tourism in 2022 are not higher than last year, Deputy Tourism Minister said. (Bloomberg)

CORPORATE NEWS

Alexandria Mineral Oils [AMOC] Q3 2021/22 preliminary consolidated bottom line came at EGP354mn (+143% y/y, +99% q/q). Astonishing bottom line performance was sparked by 81% y/y improvement in top line of EGP5.2bn (+53% q/q), coupled with 8.6pp q/q improvement in GPM to 14.2%. Strong third quarter performance is anchored by (1) improvement in sales volumes, (2) higher average selling prices given the situation of oil market, (3) better output mix, and (4) better crack spreads. AMOC is currently traded at TTM P/E of only 4x. (Company disclosure)

Orascom Development Egypt’s [ORHD] OGM approved its BoD to sign a contract of EGP2.5bn with Red Sea Construction & Development to carry out construction activities of projects in 2022. (Arab finance)

Regarding Cairo for Investment & Real Estate Development’s [CIRA] latest K-12 potential investments, CIRA has announced the addition of three schools in the upcoming 2022/23 academic year, including two in the cosmic village west of Cairo under the names of Futures Tech and Regent British School, a partnership with the Sovereign Fund, and one in Qena governorate under the name of Futures. This will bring the number of CIRA schools to 27 by next year. Another school will be launched in Assiut by 2024 under the brand name Regent. (Company disclosure)

Vodafone Egypt acquired a 9.99% stake in Bee and a 9.99% stake in Masary, Ebtikar’ subsidiaries. (Company source)

United Housing & Development [UNIT] has purchased 95,000 treasury shares, amounting to 2.6% of total capital. (Mubasher)

GLOBAL NEWS

The dollar index rose past 101 for the first time since March 2020 on Tuesday, as the greenback set its latest 20-year high on the yen and tested a two-year peak on the euro, supported by high U.S. Treasury yields and expectations of good economic data. (Reuters)

The World Bank will cut its global growth outlook for 2022 to 3.2% from 4.1% to reflect the economic fallout from the war in Ukraine, WB President told reporters yesterday. (Reuters)

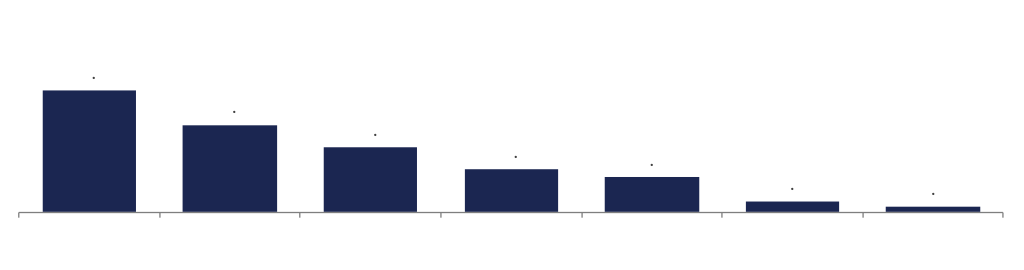

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: Companies' disclosures.

TMG Holding [TMGH] recorded the highest pre-sales in 2021 compared to its peers.