1. Today’s Trading Playbook

KEY THEMES

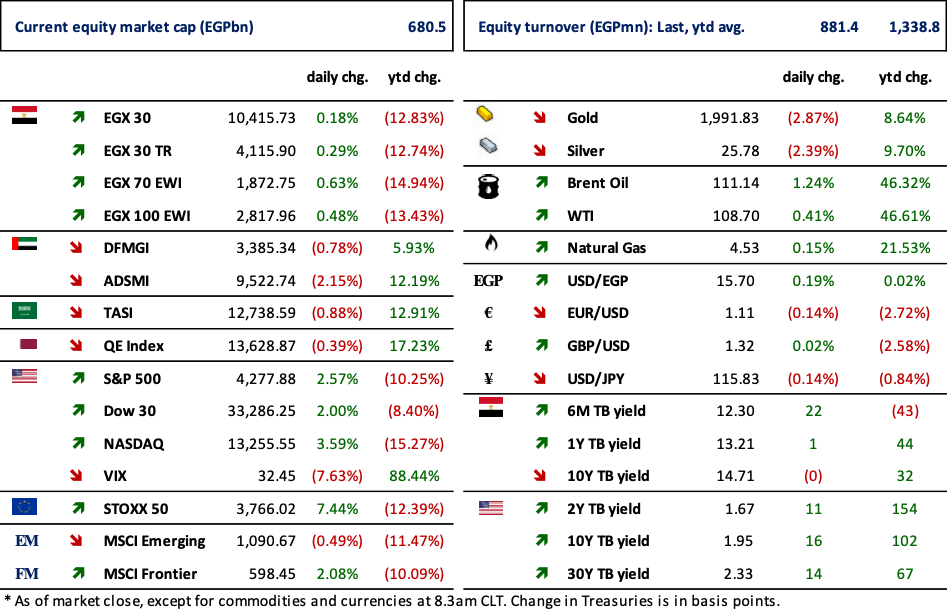

U.S. equities rebounded notably yesterday, lifted by tech stocks, with indices up between 2% and 3.5%. Sentiment for risk assets generally improved on hopes of planned diplomatic talks between Ukraine and Russia will either alleviate the pressure, or help de-escalate the situation. Meanwhile, oil prices retreated in the fastest pace since the early days of pandemic, right after trading near a 14-year high. As we speak, Brent oil prices are now trading near the USD111/bbl level. This took place after the UAE announced yesterday its willingness to boost output, in order to combat the worsening supply shock.

Here at home, the market took a break yesterday from sharp declines, closing the day with modest gains. Here is an interesting chart, the forward 1-year P/E for the EGX 30 is now at its lowest levels in ten years. The index forward P/E right now is 5.97x, which is even 10% lower than March 2020 reading.

Elsewhere, Ezz steel [ESRS] has upped its rebar selling prices to reach EGP17,000 per ton. This represents a 10% from the recently recorded price of EGP15,500. Such upping in prices was necessary, given that Turkish rebar prices reached USD930/ton. Such price hike will surely help decorate top line growth for ESRS in 2022. We note that HRC prices have rallied as well. However, the impact on margins might not be that strong, given that both iron ore and scrap prices have rallied aggressively in comparison. Meanwhile, it is very important that such price hike does not hinder local volumes growth, given that all building materials prices have skyrocketed ever since the situation in Ukraine broke out of control.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Banks now have until 14 September 2022 to comply with the new capital requirements in the 2020 Banking Act after the central bank agreed to extend the deadline by a year. (Enterprise)

CORPORATE NEWS

e-finance [EFIH] announced its 2021 results showing a bottom line of EGP520mn (+47% y/y) on higher revenues of EGP1,963mn (+59% y/y). Although gross profit margin decreased to 47% (-132 bps y/y) during the same period. EFIH is currently traded at 2021 P/E of 60x. BoD has suggested a DPS of EGP/0.10, implying 6% in yield,(Company disclosure)

Raya Contact Center [RACC] announced its 2021 results showing a bottom line of EGP23mn (-36% y/y). This came despite higher revenues (including rebates) of EGP798mn (+9% y/y). Meanwhile, GPM came at 35% (+188 bps y/y). (Company disclosure)

MOPCO [MFPC] 2021 consolidated net income jumped by 92% y/y to EGP4.8bn, backed by a 40% y/y increase in revenues to EGP10.3bn. Meanwhile MFPC's gross profit increased by 65% y/y to EGP5.7bn, implying GPM of 55%. Meanwhile, net financing costs decreased significantly to EGP73.4mn from EGP415.4mn a year before. (Company disclosure)

Egyptian Chemical Industries [EGCH] reported preliminary H1 2021/22 financial figures recording EGP331mn net profit vs. EGP631mn in net losses a year earlier. Top line grew significantly with +206% reaching EGP2,116mn. Meanwhile, GPM turned to 46% from -7% a year earlier. (Company disclosure)

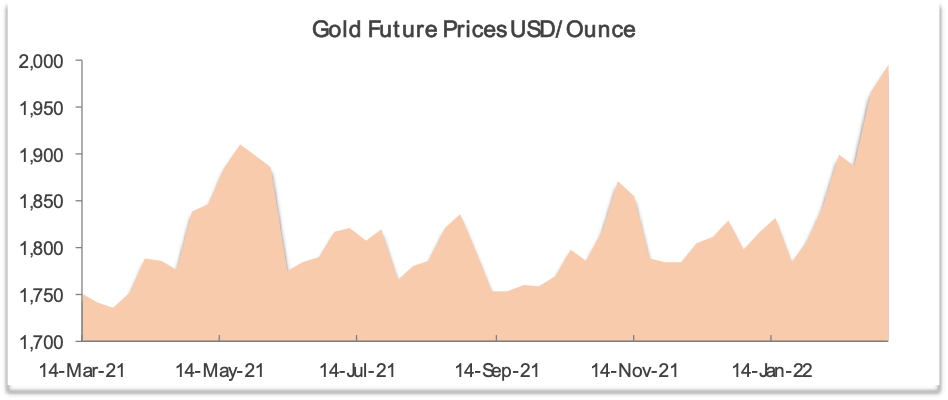

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: Investing.com.

The price of gold increased 14% y/y to c.USD2,000/ounce, having surged by some 8% in a month due to the conflict between Russia and Ukraine.