1. Today’s Trading Playbook

KEY THEMES

Chinese equities bounced back, leading an upward movement in Asian shares on Wednesday, in light of rising hopes that China will announce more economic stimulus. Meanwhile, investors continued to watch Ukraine-Russia peace talks and the U.S. Federal Reserve. We note that U.S. equities rebounded notably on Tuesday, ahead of the Fed’s most anticipated decision and remarks regarding the prospect of U.S. monetary policy. Furthermore, oil prices held their ground above the USD100/bbl, after the sell-off that took place at the beginning of the week. Gold prices were broadly back-seated by the general improvement in sentiment for risk assets. This comes contrary to the beliefs that sentiment improvement is purely temporary, and the continuation is hinging on genuine resolution of the Ukraine-Russia crisis.

Elsewhere, caustic soda prices continued to be elevated, with prices crossing over the USD700/ton level. This promises great performance by chloralkali manufactures, as prices of both of the electrochemical unit components will favorably enrich margins. Caustic soda prices improved in light of higher electricity prices globally and exceptionally tight supply, especially after the situation between Ukraine and Russia. Here at home, Misr Chemical Industries [MICH] is a clear winner, with 7M 2021/22 earnings at EGP112mn (+20% y/y). We note that MICH is currently traded at 2021/22e P/E of only 5x. We also remind you that MICH is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an Overweight rating on MICH, with a 12MPT of EGP13.9/share (ETR +45%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The government is seeing the FY2021/22 budget deficit target to widen to 6.9% from 6.7% previously. This comes as war-related global price surges putting a strain on the state budget. (Enterprise)

The IMF thinks EMs including Egypt will need to hedge against the economic risks associated with the war in Ukraine. (Enterprise)

President Abdel Fattah El Sisi ordered the government to set a fixed price for unsubsidized bread yesterday, in the latest move to hold down local prices amid surging global inflation. (Enterprise)

CORPORATE NEWS

Edita Food Industries’ [EFID] BoD has suggested cash dividend distribution for 2021 of EGP0.28/share, implying 4% in yield. (Mubasher)

Obour Land Food Industries’ [OLFI] OGM has ratified the BoD suggestion for a cash dividends distribution of EGP0.65, implying 11% in yield. (Mubasher)

Contact Financial Holding [CNFN] has signed a partnership agreement with Shatablee,the first digital interior design platform in Egypt. Under the agreement, CNFN will support Shatablee’s expansion plan in the Egyptian real estate sector through offering financial solutions to its customers. (Arab Finance)

Delta for Printing and Packaging [DTPP] announced that its OGM has approved amendments to the cash dividend for 2021 to reach EGP1.0/share, implying 5% in yield. (Arab Finance)

Raya Contact Center [RACC] has announced that it bought a total of 2.2mn shares as part of its share buyback program during yesterday’s trading session. (Company disclosure)

Arab Real Estate Investment [RREI] net profit in 2021 dropped to EGP6.7mn (-2%y/y), where revenue shrank to EGP32.8mn (-23%y/y) vs. EGP42.4mn from a year earlier.Meanwhile, GPM decreased to 12% (-7pp). (Company disclosure)

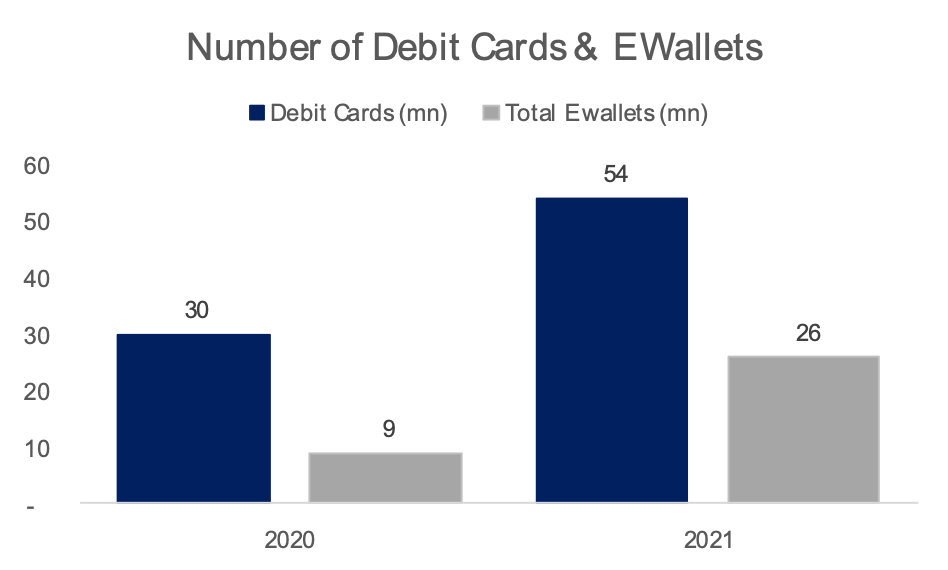

3. Chart of the Day

Research Team

Source: Al-Mal.

The number of Egypt Debit Card has surged 80% to 54mn, while the number of Total E Wallets has leaped189% to 26mn.