Forecast: Cloudy with a Chance of Investments

Stocks mentioned: VODE, ETEL, HRHO, DSCW, EGCH, COMI, SPMD

Today’s Top News & Analysis

Egypt’s budget deficit hits 5.55% in 9M FY23, with taxes making up 80% of revenues

World Bank reduces Egypt's economic growth forecasts

Another improvement in Egypt's Net Foreign Reserves

USD11bn wind power agreement signed

Amarenco to establish a green hydrogen plant in Tarboul industrial city

QIA may acquire 25-30% of VODE

EFG Holding’s Ignis to sell EUR300mn solar power projects

Dice 2023: Turning into net profits

Kima approves Tecnimont’s implementation offer for the new plant

COMI submits listing documents for capital increase shares

SPMD's EGP111mn capital increase covered by 98.6%

MACRO

Egypt’s budget deficit hits 5.55% in 9M FY23, with taxes making up 80% of revenues

Egypt’s budget deficit rose to EGP545.7bn or 5.55% of GDP in 9M FY23 vs. 4.89% in 9M FY22. Tax collection made up 80% of Egypt’s revenues during 9M FY23, having accumulated EGP740.7bn. Taxes grew 22% y/y as a result of an increase of tax collection from government entities by 46% to EGP134.2bn and nongovernmental entity tax collection grew 18% to EGP606.6bn. Egypt is targeting to collect taxes worth EGP1.4tn in FY24 (vs. estimates of EGP833bn for FY23). (Al-Mal)

World Bank reduces Egypt's economic growth forecasts

The World Bank reduced Egypt's economic growth forecasts to 4% in 2023 and 2024 (the previous forecast was 4.5% for 2023 and 4.8% for 2024). (Asharq Business)

Another improvement in Egypt's Net Foreign Reserves

For the ninth month in a row, Egypt's Net Foreign Reserves (NIR) increased in May 2023 to USD34.66bn from USD34.55bn in April 2023. (CBE)

USD11bn wind power agreement signed

The Egyptian government signed an agreement with a consortium led by UAE-based Masdar, which includes Infinity Power (a JV between Masdar and Infinity Energy) and Hassan Allam Utilities, to establish a wind power station. The station will have a capacity of 10,000 MW costing c.USD11bn, making it one of the largest wind stations in the world. (CNBC Arabia)

Amarenco to establish a green hydrogen plant in Tarboul industrial city

GV Investments is reportedly close to signing an agreement with French-based Amarenco to establish a green hydrogen plant in Tarboul industrial city. The agreement is expected to be signed by the end of this month with an investment cost of c.USD2.5bn. The project will cover an area of 100,000 sqm along with 6mn sqm of land allocated to a solar energy project and will take approximately three years to be completed. (AL-Mal)

CORPORATE

QIA may acquire 25-30% of VODE

Qatar Investment Authority (QIA) is reportedly targeting a 25-30% stake in Vodafone Egypt [VODE], which is 45% owned by Telecom Egypt [ETEL]. (Al-Mal)

EFG Holding’s Ignis to sell EUR300mn solar power projects

Ignis, the Spanish renewable energy company partially and indirectly owned by EFG Holding [HRHO], intends to sell a portfolio of solar power projects for around EUR300mn. (Reuters)

Dice Q1 2023: Turning into net profits

Dice Sport & Casual Wear [DSCW] reported consolidated Q1 2023 results, turning to net profits of EGP17mn vs. net losses of EGP7mn last year. The net profits came on the back of:

· Higher revenues of EGP689mn (+77% y/y).

· A higher gross profit margin of 31% (+15pp y/y).

Despite the strong increase in revenues, bottom-line growth was partially subdued by huge FX losses of EGP98mn vs. FX gains of EGP5mn. (Company disclosure)

Kima approves Tecnimont’s implementation offer for the new plant

Egyptian Chemical Industries (Kima) [EGCH] approved the offer of the Italian engineering and construction company, Tecnimont, to implement Kima’s new ammonium nitrate and nitric acid plant for a total of USD297mn (EGP1.6bn and USD245mn). The new plant has a daily capacity of 600MT/day of nitric acid and 665MT/day of ammonium nitrate. However, no specific launching time frame nor financing structure for the project was announced yet by Kima. We note that back in 2020, Tecnimont handed over the ammonia and urea plant to Kima, in addition to settling all disputes over the plant in 2022. (Company disclosure)

COMI submits listing documents for capital increase shares

Commercial International Bank [COMI] submitted the documents to list 20.4mn shares at a par value of EGP10/share. The bank had previously announced increasing its paid-in capital from EGP29.9bn to EGP30.2bn by EGP204.4mn as a part of the bank's employee reward system. (Bank disclosure)

SPMD's EGP111mn capital increase covered by 98.6%

Speed Medical's [SPMD] EGP110.9mn capital increase or 554.6mn shares at a par value of EGP0.2/share was covered 98.6% or 547.0mn shares. The second phase of the capital increase for the remaining shares or 7.6mn shares will start once approved by the Financial Regulatory Authority (FRA). (Company disclosure)

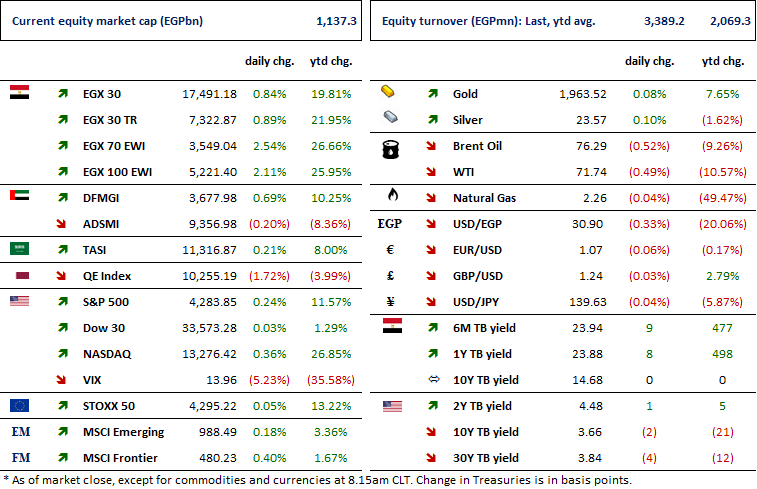

Markets Performance

Key Dates

7-Jun-23

ATQA: EGM / To renew the company's license for 25 years starting from the end of the previous license (30 May 2023).

8-Jun-23

JUFO: Cash dividend / Payment date for a dividend of EGP0.15/Share.

BTFH: OGM / Approving financial statements ending 31 Dec. 2022.

BTFH: EGM / Amending Article No. 29 of the company's bylaws.

14-Jun-23

EXPA: Right Issue / Last day for eligibility for subscription in the rights issue.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

EXPA: Capital increase / Capital increase subscription starting date.

EXPA: Right Issue / First day of trading the rights issue.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.