Today’s Top News & Analysis

Reaching IMF assistance at last

State-owned banks issue new three-year 17.25% p.a. CDs

Suez Canal revenues rose 27% y/y in October

CBE issues circular governing FX derivatives

Egyptians abroad will be allowed to import cars with customs and tax exemptions

GB Auto’s Affiliate sells a 21.7% stake to Chimera Investments

Taaleem announced its 2021/22 results

AMOC posts 78% annual growth in bottom line in Q1 2022/23

Al Shams Housing announced its preliminary 9M 2022 results

CI Ratings affirms CIB’s rating at BB

MACRO

Reaching IMF assistance at last

The International Monetary Fund (IMF) and Egypt have reached an agreement for USD3bn 46-month extended fund facility (EFF). Moreover, Egypt could obtain a multi-year financing package, including about USD5bn in FY23 that reflects broad international and regional support for Egypt. Furthermore, the government has requested financing under the newly created Resilience & Sustainability Facility (RSF), which could unlock up to an additional USD1bn. Accordingly, all fresh expected proceeds from the support program is amounting to USD9bn. (IMF)

State-owned banks issue new three-year 17.25% p.a. CDs

National Bank of Egypt (NBE) and Banque Misr announced new high-yield three years CDs that offer 17.25% p.a. Meanwhile, they also increased the previous three-year CDs from 14% to 16%. This comes right after the CBE's decision to hike interest rates by 200bps in order to curb inflation. (Al-Arabiya)

Suez Canal revenues rose 27% y/y in October

Suez Canal revenues rose 27% y/y in October, clocking in at USD703.4mn compared to USD552.9mn in October 2021. (Enterprise)

CBE issues circular governing FX derivatives

The Central Bank of Egypt (CBE) has issued a new circular that governs the way banks can trade or use FX derivatives. The CBE previously announced allowing banks to use these derivatives in order to mitigate FX risk and alleviate pressure on the local currency. According to the circular, the CBE urges banks not to give funding in foreign currency to clients with no foreign currency cash flow stream. (CBE)

Egyptians abroad will be allowed to import cars with customs and tax exemptions

President El-Sisi has signed into law a bill that will allow Egyptians living abroad to import cars and get customs and tax exemptions after paying upfront in FX. (Enterprise)

CORPORATE

GB Auto’s Affiliate sells a 21.7% stake to Chimera Investments

MNT Investments B.V., an affiliate of GB Auto [AUTO], has signed a definitive agreement to sell a 21.7% of its stake to Chimprop, on behalf of Chimera Investments. The agreement would include AUTO selling an indirect stake of 7.5%, with total proceeds of USD60mn, with an earn-out component that could potentially lead to a total of USD71.3mn. The agreement would reduce AUTO's stake to 49.5%. (Company disclosure)

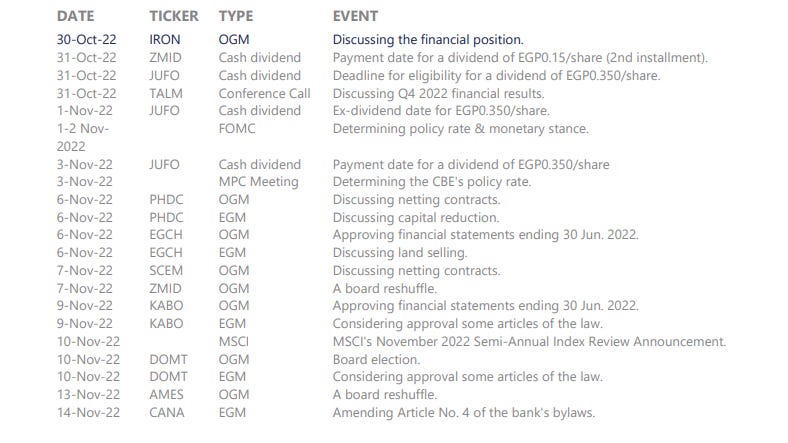

Taaleem announced its 2021/22 results

Taaleem Management Services [TALM] reported an increase in net profits to EGP230mn (+24% y/y), while revenues came in at EGP618mn (+3% y/y). Although GPM decreased to 67% (-4pp y/y), EBITDA margin scored 57% (+12pp y/y) due to a lower SG&A-to-sales ratio of 21% (-15pp y/y). (Company disclosure)

AMOC posts 78% annual growth in bottom line in Q1 2022/23

Alexandria Mineral Oils Co.’s [AMOC] preliminary Q1 2022/23 showed net earnings growing to EGP346mn (+78% y/y) in view of 60% higher top line of EGP5.85bn. GPM came in at 9% vs. 10% a year earlier. (Company disclosure)

Al Shams Housing announced its preliminary 9M 2022 results

Al Shams Housing & Urbanization [ELSH] recorded an increase in net profits reaching EGP141mn (+90% y/y) on higher revenues of EGP289mn (+66% y/y). However, GPM decreased to 76% (-7pp y/y). (Company disclosure)

CI Ratings affirms CIB’s rating at BB

Capital Intelligence Ratings (CI Ratings) confirmed Commercial International Bank's [COMI] rating at BB and described the core financial strength of the bank as "stable". While the agency rated the Long-Term Foreign Currency Rating (LT FCR) and Short-Term Foreign Currency Rating (ST FCR) of COMI at 'BB+' and 'B', respectively. (CI Ratings)