Today’s Trading Playbook

KEY THEMES

It's the last trading session in the holy month! We see some optimism starting to engulf global markets after a very edgy week. For a starter, U.S. equities ended higher on Wednesday after a notable slippage the day before, helped by tech stocks despite worries about slowing global economic growth and rising interest rates still in place.

In general, global stocks stabilized on Thursday, as the earnings season brought some fine figures. On the other hand, a collapse in the yen after Japan doubled down on anchoring bond yields drove the U.S. dollar toward its highest levels in a very long time. We note that the U.S. dollar index (DXY) has strengthened to surpass its best levels in more than two years, trading above the 103 level.

Meanwhile, oil prices fell on early Thursday trading, as traders remained cautious about slowing fuel demand in China, in light of the unknown fate of renewed COVID-19 restrictions.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Talks between Egypt and the IMF on a fresh support package have reached the “technical stage,” the multilateral lender’s head of Middle East and Central Asia, told reporters. The IMF “has identified three fundamental sectors that need quick reform, 1) Monetary policy reform to return inflation to 7-8% this year, 2) Greater flexibility in the exchange rate, and 3) Stepping up structural reforms aimed at job creation and boosting growth. (Enterprise)

The government has approved the executive regulations of the Sovereign Sukuk Act. (Cabinet statement)

Egypt’s budget deficit narrowed to 4.9% of GDP in 9M FY22, from 5.4% in the same period last year. (Ittihadiya)

The Trade Ministry has agreed to release perishable goods from ports to importers who failed to secure the required letters of credit (LCs). (Al-Mal)

CORPORATE NEWS

Ezz Steel's [ESRS] decreased its selling prices by 4% to reach EGP19,170 per tonne including VAT due to a recent drop in input prices (Company release)

Elswedy [SWDY] to partner with Wolong Electric to distribute several brands of electric motors, build the region's biggest service center and find ways to develop the local industry. (Press release)

Alexandria Container and Cargo Handling [ALCN] announced its preliminary 9M 2021/22 results, reporting a bottom line increase of 25% y/y to EGP1.27bn. While revenues increased 6% y/y coming in at EGP1.83bn. (Company disclosure)

Zahraa El-Maadi Investment’s [ZMID] net profit in 2021 grew to EGP259mn (+22% y/y), while revenue increased to EGP213mn (+6% y/y). ZMID is currently trading at a 2021 P/E of 9.5x. (Company disclosure)

Central Egypt Flour Mills [CEFM] reported preliminary 9M 2021/22 results, showing a net profit of EGP73.8mn (+1% y/y). Meanwhile, revenues declined to EGP379.1mn (-2% y/y), while GPM retreated to 41.17% from 43.54% in the same period last year. (Company disclosure)

North Cairo Flour Mills [MILS] reported 9M 2021/22 results, showing a net profit of EGP4.3mn compared to a net loss of EGP12.3mn in the same period last year. Meanwhile, revenues increased to EGP434.9mn (+16 % y/y), while GPM hiked to 15.22% from 10.14% in the same period last year. (Company disclosure)

Arab Developers Holding [ARAB] has reached an agreement with Amer Group Holding [AMER] to discontinue the use of its Porto brand. (Arab finance)

El-Shams Housing & Development’s [ELSH] OGM approved DPS of EGP0.15/share (i.e. 2.2% yield). In addition, ELSH’s EGM agreed to increase its capital by c.EGP45mn through 25% bonus share distribution. (Arab finance)

Minapham Pharmaceuticals [MIPH] shareholders approved dividend distribution of EGP2.8/share, implying a dividend yield of 2%. (Company disclosure)

EPICO [PHAR] announced delaying its first dividend installment due to a mix-up in payment procedures with MCDR. (Company disclosure)

GLOBAL NEWS

The Bank of Japan on Thursday doubled down on its commitment to maintain its massive stimulus programme and a pledge to keep interest rates ultra-low, triggering a fresh sell-off in the yen and sending government bonds rallying. (Reuters)

Indonesia widened the scope of its export ban on raw materials for cooking oil to include crude and refined palm oil,its chief economic minister said on Wednesday, leaving markets in shock over the latest policy reversal. (Reuters)

Russia's Gazprom cut Poland and Bulgaria off from its gas on Wednesday for refusing to pay in roubles, and threatened to do the same to others, cranking up retaliation for Western sanctions imposed for Moscow's invasion of Ukraine. (Reuters)

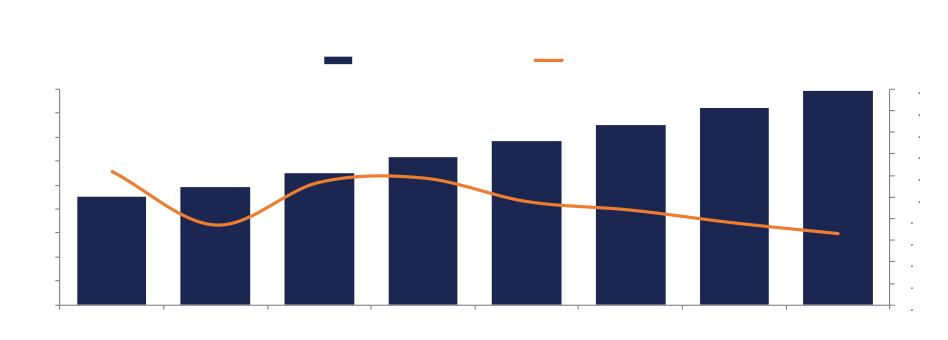

3. Chart of the Day

Nouran Ahmed | Equity Analyst

Source: Fitch Solutions.

According to Fitch Solutions, Egypt's baked goods are expected to grow at a 4-year CAGR of 9.1% to EGP9.4bn by 2025. Annual sales growth of Egypt's baked goods is expected to slow down from 9.8% in 2022 to 8.3% by 2025.