Today’s Top News & Analysis

Sumitomo Electric's new factory broke grounds

ORAS Q1 2023: Not what we expected!

IDHC Q1 2023: The after-pandemic scenario, yet conventional revenues up 43% y/y

EFG Holding concludes advisory on ADNOC Logistics & Services' USD769mn IPO

Beltone signs an EGP500mn sale-and-leaseback agreement with Hassan Allam Properties

Rameda acquires 11 new drugs for chronic diseases

MACRO

Sumitomo Electric's new factory broke grounds

Sumitomo Electric's USD150mn factory broke ground in on its first phase in Tenth of Ramadan city. The new factory is expected to provide 3,500 jobs and to produce pigtail cables for 1mn cars annually. (Enterprise)

Corporate

ORAS Q1 2023: Not what we expected!

Orascom Construction’s [ORAS] Q1 2023 net income came at USD36.1mn (+176 y/y), 26% below Prime Research expectations (PRe). Revenues registered USD805mn (-18% y/y), 15.5% below PRe, with 55.6% of revenues coming from the MEA region, while the remaining 44.4% came from the USA. EBITDA recorded USD35.5mn (-29% y/y), 19% below PRe. Meanwhile, GPM recorded 8.6% (-0.7pp y/y). Backlog reached USD5.5bn (-1.2% y/y), with new awards during the period recording USD858mn (+39% y/y). (Company disclosure)

IDHC Q1 2023: The after-pandemic scenario, yet conventional revenues up 43% y/y

Integrated Diagnostics Holding [IDHC] reported Q1 2023 net profits of EGP173mn (-42% y/y) on the back of:

· Lower revenues of EGP915mn (-22% y/y) due to the absence of COVID-19-related revenues. Non-COVID-19 (i.e. conventional) revenues increased by 43% y/y to EGP915mn. This was driven by an increase in average revenue per conventional test to EGP114 (+27% y/y) and a higher number of conventional tests performed to 8mn (+12% y/y).

· GPM narrowed by 10pp to 35% due to the normalization of margins after phasing out COVID-19-related tests and higher direct salaries and wages of EGP190mn (+14% y/y) because of inflationary pressures.

· A higher SG&A-to-revenues ratio of 21% (+10pp y/y). (Company disclosure)

EFG Holding concludes advisory on ADNOC Logistics & Services' USD769mn IPO

EFG Holding [HRHO] announced the successful completion of its advisory services on the initial public offering (IPO) of ADNOC Logistics & Services, the shipping and logistics subsidiary of Abu Dhabi National Oil Company (ADNOC). The transaction took place on the Abu Dhabi Securities Exchange (ADX) with a value of USD769mn. The listing, the second-largest in the Middle East this year for 19% of ADNOC's total capital, was covered 163x. (Company disclosure)

Beltone signs an EGP500mn sale-and-leaseback agreement with Hassan Allam Properties

Beltone Leasing, a subsidiary of Beltone Financial Holding [BTFH], signed an EGP500mn sale-and-leaseback agreement with Hassan Allam Properties Group (HAP). The agreement has a seven-year lease tenor and is to finance assets for two HAP subsidiaries. (Company disclosure)

Rameda acquires 11 new drugs for chronic diseases

Rameda [RMDA] acquired 11 new drugs specialized in chronic disease treatment (i.e. diabetes and high cholesterol). The acquisition gives RMDA exposure to five different growing fields in a market worth EGP2.2bn. The market that RMDA is entering grew by 37% in the last 12 months ending Q1 2023 vs. only 11% for the pharmaceutical overall sales over the same period. (Company disclosure)

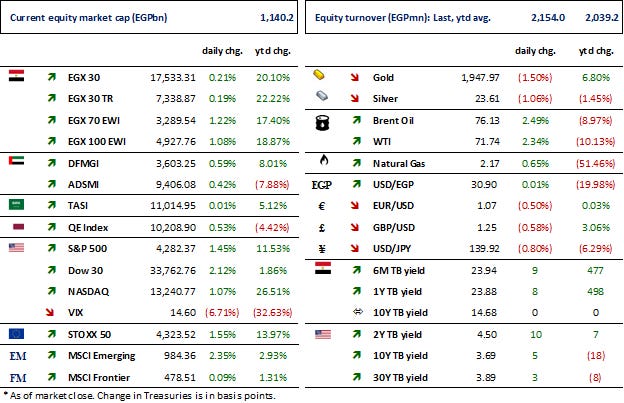

Markets Performance

Key Dates

4-Jun-23

HELI: OGM / Approving financial statements.

5-Jun-23

PMI: Egypt PMI / May 2023 reading

JUFO: Cash dividend / Deadline for eligibility for a dividend of EGP0.15/Share.

6-Jun-23

BTFH: Capital increase / Capital increase subscription starting date.

JUFO: Cash dividend / Ex-dividend date for EGP0.15/Share.

CSAG: OGM / Approving the estimated budget of FY 2023/2024.

CSAG: EGM / Amending Article No. 3 of the company's bylaws.

7-Jun-23

ATQA: EGM / To renew the company's license for 25 years starting from the end of the previous license (30 May 2023).

8-Jun-23

JUFO: Cash dividend / Payment date for a dividend of EGP0.15/Share.

BTFH: OGM / Approving financial statements ending 31 Dec. 2022.

BTFH: EGM / Amending Article No. 29 of the company's bylaws.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

MCQE: OGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.