Overweight / Medium Risk

12MPT: EGP36.2 (was EGP21.0)

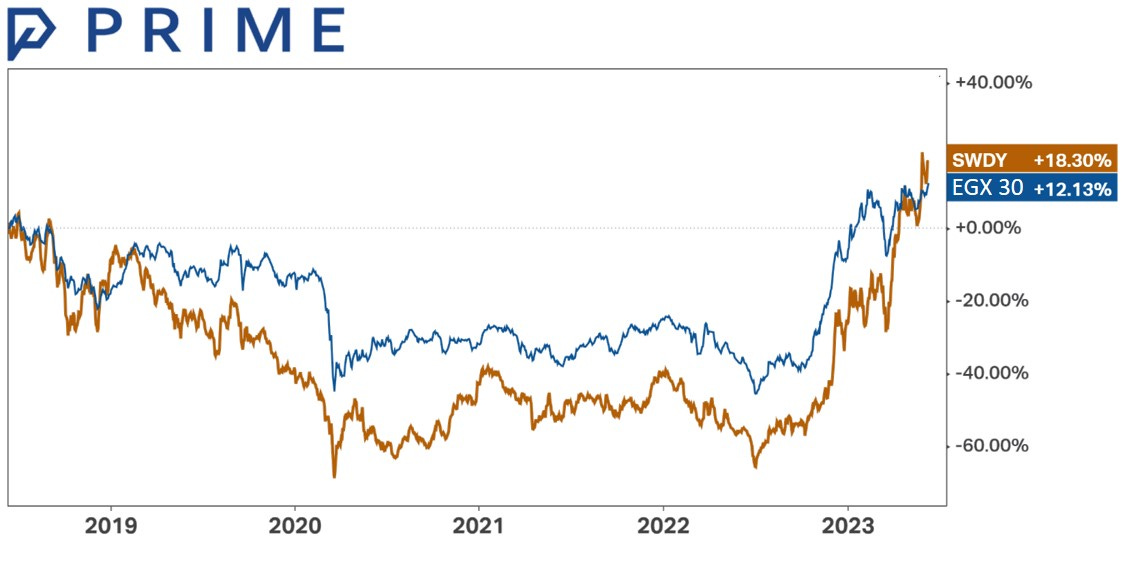

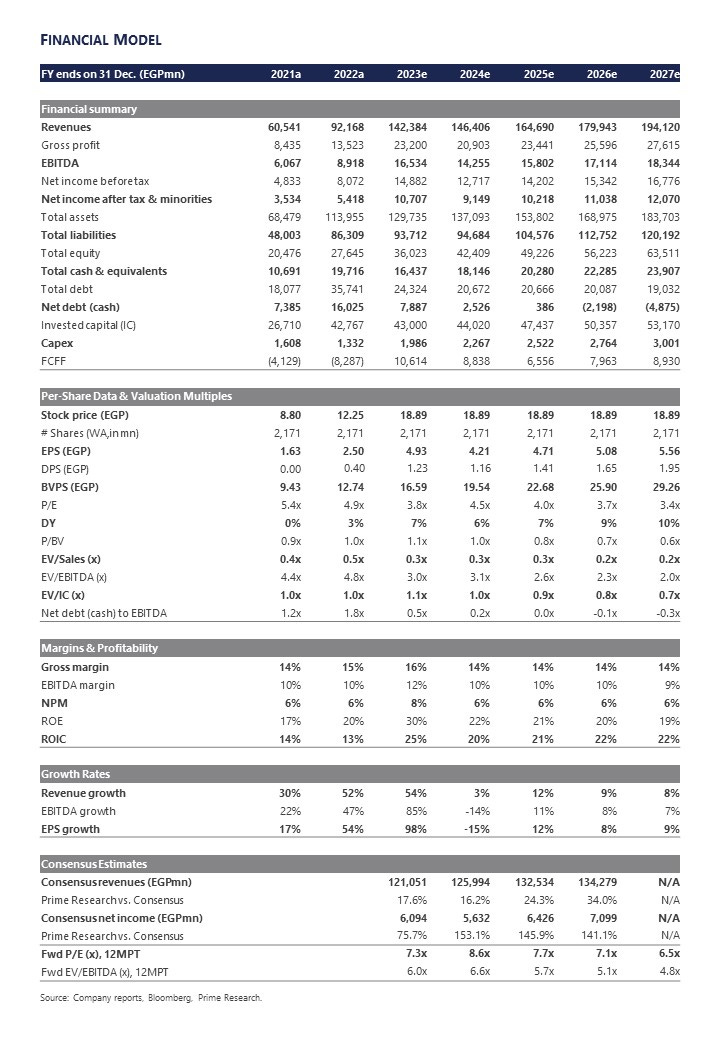

Despite slowing global commodity prices over the last few months, Elsewedy Electric’s [SWDY] top line still grew on a stronger USD, driven by its export-oriented business model. Meanwhile, SWDY’s turnkey segment has been gaining more exposure to new markets, such as the GCC, further solidifying its performance. In Q1 2023, SWDY’s revenues rose and margins widened concurrently due to its wise inventory management combined with higher selling prices on a higher FX rate. Today, we reiterate our positive view on the company and its stock, maintaining our Overweight rating after raising our 12MPT by 91% to EGP36.2/share. SWDY is currently trading at an attractive TTM P/E and EV/EBITDA of 5.4x and 4.7x respectively, and an extraordinarily low 5y forward PEG ratio of 0.3.

Above and beyond: SWDY’s Q1 2023 results were astonishing, where the company’s earnings jumped 282% to EGP2.9bn (54% of 2022 full-year earnings) on 80% y/y higher revenues of EGP33.3bn (36% of 2022 full-year revenues). Q1 2023 results included FX gains of EGP1.3bn, without which earnings would have still risen by 106% y/y on a like-for-like basis. Meanwhile, margins also improved on the back of the company’s active inventory management, having locked in low-cost inventory in H2 2022, paired with higher prices on a stronger USD during Q1 2023. Indeed, the wires and cables segment performed strongly during Q1 2023 despite commodity prices easing off over the prior few months. Meanwhile, the turnkey segment exhibited outstanding growth, raking in EGP37bn of new awards in Q1 2023 alone, almost equal to the 2022 full-year figure, which should subsequently lead to higher revenues going forward.

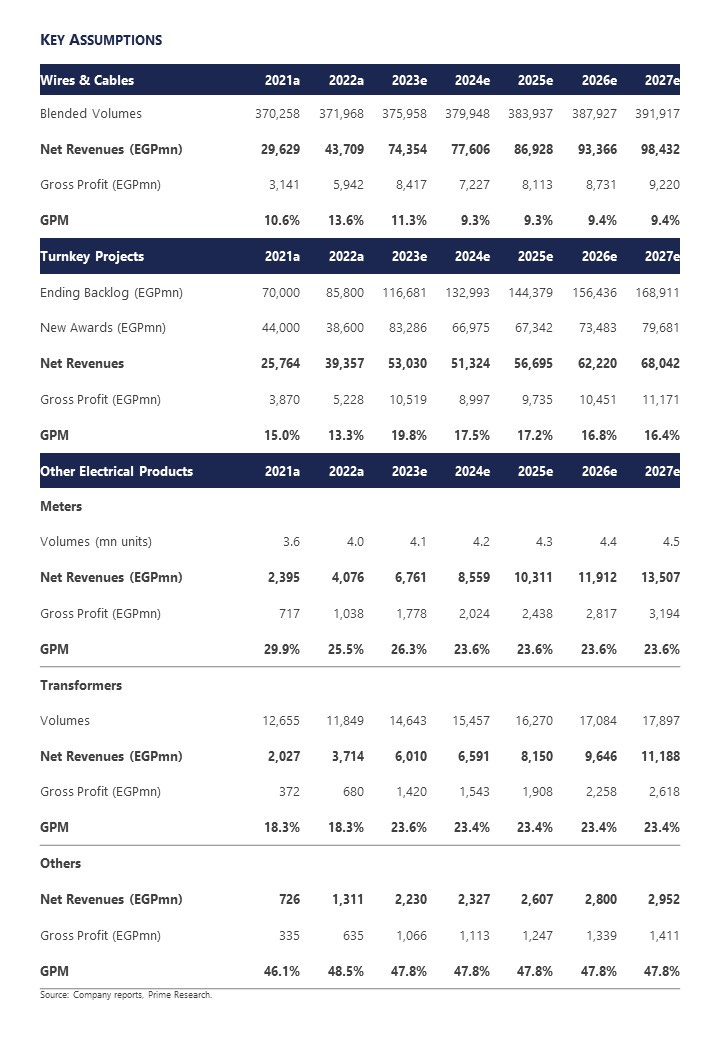

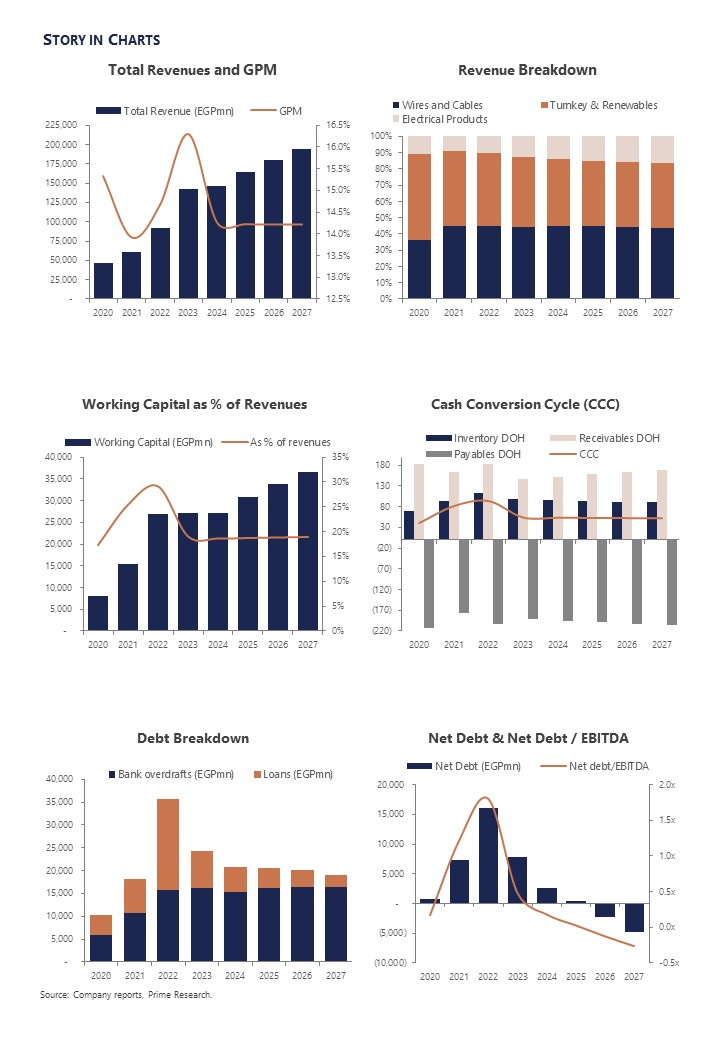

Copper, the new gold: We expect SWDY’s revenues and earnings to grow at 5y CAGRs of 16% and 17% to EGP194bn and EGP12bn by 2027, respectively. This should be powered by higher revenues despite an expected tightening in margins over the coming period as inventory cost catches up to the higher FX rate. Revenues can be broken down into:

Wires and cables: We expect revenues to grow at a 5y CAGR of 18% to EGP98bn by 2027 on higher export volumes and a stronger FX rate.

Turnkey projects: We expect revenues to grow at a 5y CAGR of 12% to EGP68bn by 2027 on a healthy backlog of projects in Egypt and the GCC region.

Electrical products: We expect revenues to grow at a 5y CAGR of 25% to EGP28bn by 2027, powered by higher utilization rates for transformers and demand from export markets.

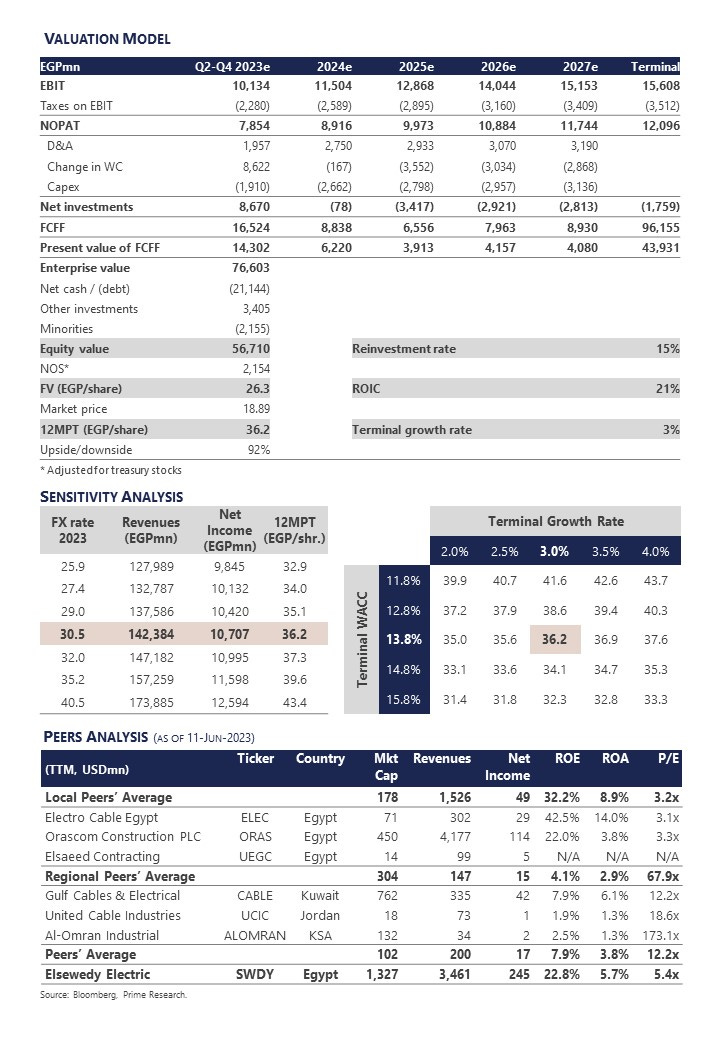

12MPT raised to EGP36.2/share, rating maintained at OW/M: Our updated 5y DCF model yielded a fair value of EGP26.3/share and a 12MPT of EGP36.2/share, mainly on a stronger USD. Still, our 12MPT implies conservative multiples: 2023e P/E of 7.3x and 2023e EV/EBITDA of 6.0x. With an upside potential of 92%, we maintain our Overweight / Medium Risk rating. Key Catalysts: A stronger for longer USD. Higher global commodity prices. Expansion of the turnkey segment in the GCC region. Key Risks: Higher interest rates. Lower government infrastructure spending.