Today’s Top News & Analysis

Three companies compete for the credit rating license

Egypt launches a global tender for 600K tons of petrochemicals

Egypt targets USD3.9bn of investments in Suez Canal Economic Zone in FY2023/24

CCAP injects USD2bn in Egypt over two years

MACRO

Three companies compete for the credit rating license

In Egypt, three alliances of local companies in cooperation with foreign institutions are competing to obtain a license to engage in the activity of evaluating, rating, and ranking securities. The FRA received three applications from:

· The "I Score" alliance, in technical partnership with "Standard & Poors," which is one of the top three credit rating agencies in the world.

· The "Beltone Capital" alliance, in technical partnership with the Italian group "Crif Ratings."

· The "MGM" Financial and Banking Consulting alliance, in technical partnership with "Infomerics Valuation and Rating."

It should be noted that Egypt currently has only one local credit rating agency: The Middle East Rating & Investors Service (MERIS), a joint venture between Moody's Investors Service and FinBi (Finance & Banking Consultants International), providing ratings for financial institutions and issuers of structured finance transactions. (Asharq business)

Egypt launches a global tender for 600K tons of petrochemicals

Egypt has reportedly launched a global tender to import about 600K tons of petroleum products for delivery in December. This includes 400K tons of diesel and about 200K tons of gasoline. The Egyptian General Petroleum Corporation plans to increase the country's crude oil imports by 40% starting from the next fiscal year 2024-2025, in an effort to stop importing refined petroleum products. (Asharq business)

Egypt targets USD3.9bn of investments in Suez Canal Economic Zone in FY2023/24

Egypt aims to attract USD3.9bn in foreign investments to the Suez Canal Economic Zone during the current fiscal year 2023-2024, according to Ahmed Saad, the Executive Director of the General Authority for the region. The zone attracted investments worth USD3.6bn in the last fiscal year (2022-2023), and USD1.3bn in the first four months of the current fiscal year. (Asharq business)

CORPORATE

CCAP injects USD2bn in Egypt over two years

Qalaa for Financial Investments [CCAP] plans to inject new investments in Egypt worth USD2bn over the next two years, according to Ahmed Heikal, the chairman of the group. He also added that the group's total investments in Egypt since its inception have reached USD11bn. (Asharq business)

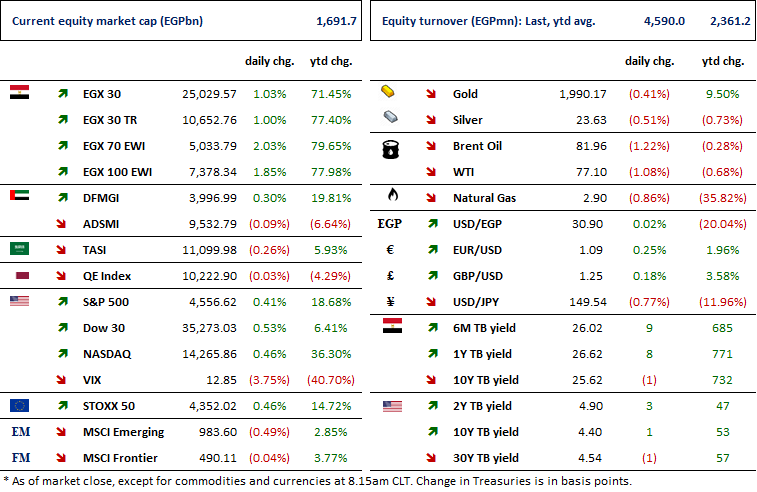

MARKETS PERFORMANCE

Key Dates

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

CIRA: Conference Call / Discussing FY22/23 financial results.

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

30-Nov-23

DOMT: Cash dividend / Payment date for a dividend of EGP0.20/share.

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).