Today’s Top News & Analysis

Egypt's trade deficit widens by 21% y/y to USD3.58bn in October 2022

New amendments to the Value-Added Tax Law

SFE reportedly adds five state and military-owned companies to pre-IPO fund

New discovery of natural gas in the Nile Delta

The interbank market records USD750mn of transactions

EGP Treasury bills auction oversubscribed

Prime Minister sheds light on the future of exchange rate

Record-breaking standalone earnings for QNBA

Taaleem reported its Q1 2022/23 results

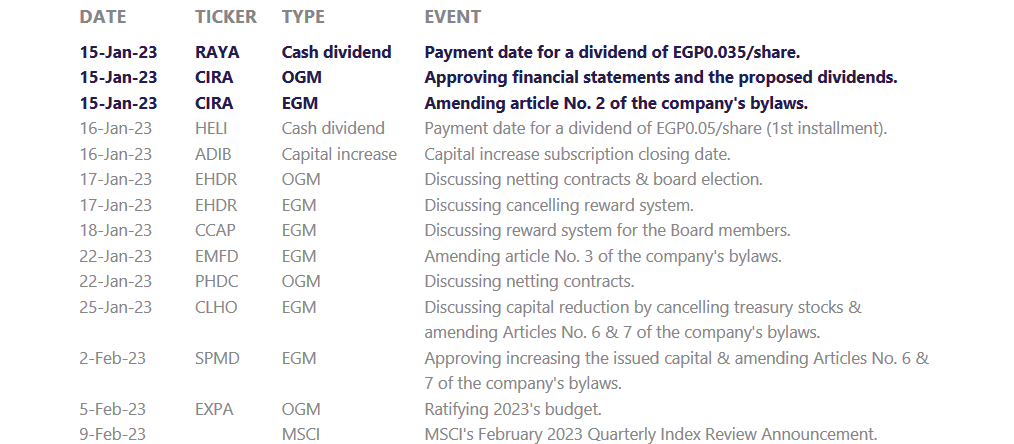

Al Ahly CIRA signs an agreement with a Canadian college

MACRO

Egypt's trade deficit widens by 21% y/y to USD3.58bn in October 2022

Egypt's trade deficit increased by 21% y/y to USD3.58bn in October 2022 compared to USD2.95bn a year before, according to CAPMAS. (Hapi Journal)

New amendments to the Value-Added Tax Law

The Egyptian government amended the Value-Added Tax (VAT) Law to suspend VAT on industrial machinery purchases and to encourage investment in economic zones of a special nature by not charging the goods or services received for these projects with VAT. Suspension of tax payment will be for a one-year period from the date of release of machinery and equipment from customs or purchase from the local market. It is permissible for justified reasons acceptable to the authority to extend this period for another period or periods if the total of additional periods does not exceed one year as a maximum. (Hapi Journal)

SFE reportedly adds five state and military-owned companies to pre-IPO fund

The Sovereign Fund of Egypt (SFE) has reportedly added military-owned firms Safi and Wataniya along with state-owned Misr Life Insurance, Banque du Caire [BDQC], and Egyptian Linear Alkyl Benzene (Elab) to its pre-IPO fund, preluding the sale of 20-30% stakes in each of these companies to strategic investors, with a roadshow to market the assets set to take place this month. (Asharq Business)

New discovery of natural gas in the Nile Delta

Germany’s Wintershall Dea has found natural gas in its East Damanhour exploration site in the onshore Nile Delta. Exploration activities began in November 2021. Development of the site will be linked with the infrastructure of the neighboring Disouq gas project, a joint venture between Wintershall Dea and EGAS. Early testing of the site has revealed production capabilities of 15mn cu ft/day. Ownership of the site is split between Wintershall Dea, Cheiron Energy, INA, and EGAS. (Al-Mal)

The interbank market records USD750mn of transactions

For the first time in many months, the Egyptian interbank market recorded huge transactions of USD750mn last Wednesday, against an average of USD150mn. Sources reported that around USD250mn of the aforementioned volume came through foreign inflows to the system from international institutions. (CBE, Hapi Journal)

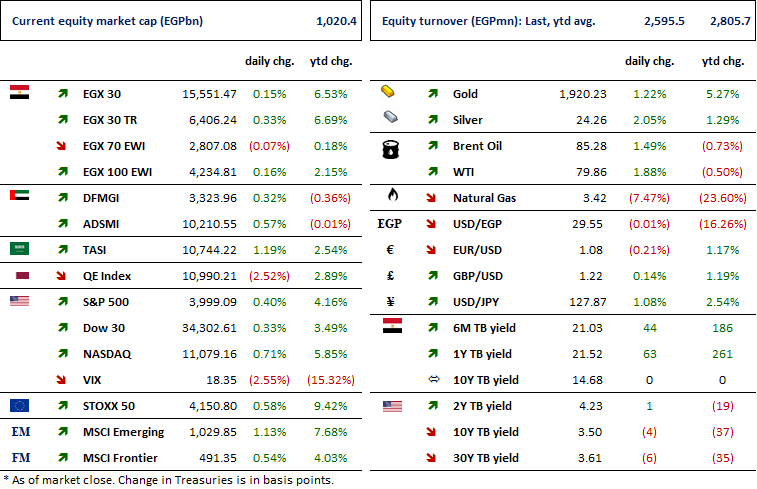

EGP Treasury bills auction oversubscribed

The auction for Treasury bills held by the CBE last Thursday witnessed a leap in accepted bids, where EGP51.8bn were sold with an average yield of 21% on the 182-day T-bills against EGP2.6bn the week before. Meanwhile, EGP30.4bn were sold on the 364-day T-bills with an average yield of 21.5% against EGP3.75bn the week before. (CBE, CNBC Arabia)

Prime Minister sheds light on the future of exchange rate

Prime Minister Moustafa Madbouly announced in a statement that the Egyptian government's aim is to end the FX black market in the future. Meanwhile, the government managed to clear goods worth of USD645mn last Wednesday and Thursday. (CNBC Arabia)

CORPORATE

Record-breaking standalone earnings for QNBA

QNB Al Ahli [QNBA] reported its 2022 standalone financials, where its net income hit an all-time high of EGP10.1bn (+36% y/y). This was on the back of:

· A 31% y/y surge in net interest income (NII) to EGP19.6bn.

· Other operating income leaping to EGP973mn on FX gains vs. operating expenses of EGP222mn a year before.

· A 300% increase in net trading income to EGP436mn.

The unprecedented profits are reflected in a higher NIM of 6.08% vs. 5.86% and a higher ROAE of 20.7% vs. 17.9% in 2021. While the bank has been booking sky-high provisions ever since the year of the pandemic, it still increased its provisioning rate to 1.8% from 1.2% where its provisions hit EGP3.7bn. Yet, its coverage ratio decreased to 123% from 147% on higher NPLs of 4.9% from 3.7%. However, this increase is justifiable given the strong growth in gross loans of 25% to EGP231bn, which was driven by growth in foreign currency loans due to revaluation, while local currency loans only grew by 14% y/y. We note that growth is also attributed to corporate short-term loans, where companies still look for working capital credit to meet their needs. QNBA’s deposits have also seen a significant increase of 37% y/y to EGP407bn, giving the bank the capacity to increase, not only its loans but also, its investment in financial assets by 18% y/y to EGP107bn, making the best use of the high sovereign yield and its interbank assets by 87% y/y to EGP30bn. This, in turn, caused GLDR to drop to 57% from 62% a year before.

This year was extremely efficient for QNBA as it managed to increase its effective yield to 12.2% while maintaining its cost of funds at 5.9%. Also, the cost-to-income ratio dropped to 17.7% from 24.7% and the bank’s CAR increased slightly to 22.99% despite the EGP devaluation. Overall, this amazing performance by QNBA for the year led the board to propose an EGP1.5/share dividend distribution, implying a payout ratio of 32% and a 7.7% yield. QNBA is now trading at a P/E of 4.1x and a P/BV of 0.8x. (Company disclosures: 1, 2)

Taaleem reported its Q1 2022/23 results

Taaleem Management Services’ [TALM] consolidated net profits rose to EGP107mn (+50% y/y) in Q1 2022/23 on the back of higher revenues of EGP230mn (+34% y/y). Revenues grew due to the number of student enrollments doubling in the academic year 2022/23, reaching 1,868 enrollments. Moreover, gross profit and EBITDA margins improved to 76% (+5pp y/y) and 65% (+4pp y/y), respectively. (Company disclosure)

Al Ahly CIRA signs an agreement with a Canadian college

Al Ahly CIRA, a subsidiary of CIRA Education [CIRA], signed an MoU with Toronto-based Seneca College. The partnership will bring two branches of Seneca College's applied arts and technology colleges to be located in West and East Cairo, Egypt. (Arab Finance)