Today’s Top News & Analysis

Maersk interested in Zafarana Wind Farm

Egypt’s auto sales decrease 64% y/y in June 2023

Sugar prices increase by 26% m/m

ABUK prelim 2022/23: Exactly as expected

SODIC H1 2023: Earnings slip on lower revenues and margin

SUGR prelim Q2 2023: Strong y/y performance

Sheeni's prelim 2022/23: Turned profitable despite weak operating performance

EAST denies raising its prices

Beltone interested in an Egyptian microfinance company and a digital banking license

FRA licenses ADIB's subsidiary for microfinancing activities

FAB undertakes steps to reconcile BTFH's capital increase errors

MACRO

Maersk interested in Zafarana Wind Farm

The shipping giant Maersk is reportedly interested in acquiring half of the 545MW Zafarana Wind Farm from the Egyptian government. Thus, Maersk could acquire 270 MWh of electricity producing assets, which is enough for the company to produce green fuels. (Enterprise)

Egypt’s auto sales decrease 64% y/y in June 2023

According to Automotive Marketing Information Council (AMIC), Egypt’s auto sales volumes declined 64% y/y to 6,300 vehicles in June 2023 (-14% m/m), as:

· Passenger car sales fell to less than 5,000 units (-60% y/y, -12% m/m).

· Bus sales fell to 636 units (-8% m/m).

· Truck sales fell to 703 units, the lowest since 2018. (Enterprise)

Sugar prices increase by 26% m/m

The Head of the Sugar Division said that sugar prices rose 26% m/m to EGP24,000/ton by the end of July. He added that Egypt produces 2.8mn tons of sugar and imports 400,000 tons of sugar to close the gap between supply and demand (3.2mn tons of sugar), saying that there is no reason for any price hikes. (Asharq Business)

CORPORATE

ABUK prelim 2022/23: Exactly as expected

Abu Qir Fertilizers’ [ABUK] preliminary results for 2022/23 showed net income has increased by 61% y/y to EGP14.6bn. This is exactly in line with our expectation of EGP14.7bn for the year. Meanwhile, revenues came in 33% y/y higher at EGP21.6bn, reflecting elevated global urea prices in H1 2022/23. GPM also came in as we expected at 59%, which is 10bps lower than last year due to the new gas formula that links the gas cost to global urea prices.

As for Q4 2022/23, net income fell sharply by 70% q/q to EGP1.7bn, absent FX gains. Q4 sales also declined by 28% q/q to EGP4.3bn as global urea prices plunged to their lowest prices since the beginning of 2023. (Company disclosure)

SODIC H1 2023: Earnings slip on lower revenues and margin

SODIC’s [OCDI] H1 2023 net profits dropped 13% to EGP292mn on 6% lower revenues of EGP2.7bn, while GPM slipped by 4.8pp y/y to 33.6%. Key operational highlights included:

· Gross contract sales of EGP8.17bn.

· Cancellations came at 10% of gross contract sales.

· Cash collections of EGP4.1bn.

· 402 units delivered during the half. (Company disclosure)

SUGR prelim Q2 2023: Strong y/y performance

Delta Sugar [SUGR] reported H1 2023 preliminary net profits of EGP1.1bn vs. EGP544mn a year ago. Revenues came in at EGP3.5bn (+41% y/y), while gross profit margin improved by 12pp y/y to 47%. Meanwhile, SUGR recorded net profits of EGP765mn (+64% y/y) in Q2 2023 on higher revenues of EGP2.8bn (+45% y/y), while gross profit margin improved by 12pp y/y to 51%. (Company disclosure)

Sheeni's prelim 2022/23: Turned profitable despite weak operating performance

The General Co. for Ceramics & Porcelain Products’ (Sheeni) [PRCL] 2022/23 results showed net profits of EGP9.9mn vs. a net loss of EGP69mn the previous year. PRCL incurred a higher gross loss of EGP18.5mn (vs. EGP16.2mn a year ago), implying a GLM of 7.7%, despite 21% y/y higher revenues of EGP241mn. Although detailed financials are yet to be released, based on 9M 2022/23 results, the reported earnings seem to be due to booking FX gains and capital gains. (Company disclosure)

EAST denies raising its prices

Eastern Co. [EAST] denied the rumors of raising its prices by EGP3/pack as taxes starting from August. (Al-Borsa)

Beltone interested in an Egyptian microfinance company and a digital banking license

Beltone Financial Holding [BTFH] announced the signing of an MoU to acquire an existing licensed Egyptian microfinance company. Unnamed sources added that the company could be Cash Microfinance which operates in the Egyptian market since 2020. BTFH is yet to carry out its due diligence to complete the potential acquisition whether directly or through one of its subsidiaries. Additionally, it has been reported that BTFH will apply for the new digital banking license as a part of the company's expansion strategy. (Company disclosure, Al-Borsa)

FRA licenses ADIB's subsidiary for microfinancing activities

The Financial Regulatory Authority (FRA) has granted Abu Dhabi Islamic Bank - Egypt's [ADIB] new 98%-owned subsidiary ADIB - Egypt Microfinance the license for microfinancing activities with a capital of EGP25mn. (Bank disclosure)

FAB undertakes steps to reconcile BTFH's capital increase errors

Due to technical issues in BTFH's latest EGP10bn capital increase, FAB Misr, the receiving bank of capital increase subscriptions, has bought a number of shares to reconcile some of the errors that took place to protect rights of subscribers to the capital increase. (Masrawy)

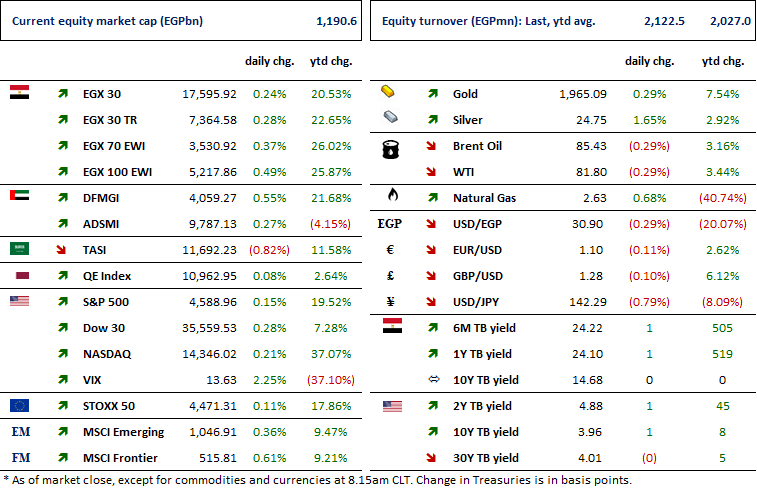

Markets Performance

Key Dates

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).