Today’s Top News & Analysis

MASR Q3 2023: Strong net profit growth on higher revenues and gross profit margin

ATQA Q3 2023: Non-operational activities save the day again

IDHC Q3 2023: Turned into profitability

Arabian Cement Q3 2023: Higher net profits on higher revenues, GPM, and finance income

Kafr El Zayat Pesticides Q3 2023: Still growing

TMGH Q3 2023: Higher net profits on higher revenues and other income

CIB borrows a loan from EBRD

PIF raised its stake in e-Finance

CORPORATE

MASR Q3 2023: Strong net profit growth on higher revenues and gross profit margin

Madinet Masr for Housing and Development [MASR] reported its 9M 2023 full results posting a 151% y/y growth in net profits to EGP1.4bn on:

· higher revenues of EGP4.6bn (+50% y/y).

· the gross profit margin massively grew to 62% (+22.5pp y/y).

Regarding Q3 2023, MASR posted a 159% y/y growth in profits on:

· higher revenues of EGP2.4bn (+90% y/y).

· gross profit margin grew by 9.2pp y/y to 64%. (Company disclosure)

ATQA Q3 2023: Non-operational activities save the day again

Misr National Steel (Ataqa) [ATQA] released its 9M 2023 financial results, posting net profits of EGP594mn (+414% y/y) despite a 14% y/y decline in revenues to EGP1.7bn. The strong growth in net profits is attributable to:

· the gross profit margin that increased by 3.3pp y/y.

· the investment income that grew to EGP376mn (+351% y/y).

· net change in fair value of financial investments grew to EGP205mn vs. only EGP24mn last year.

· the lower FX losses of EGP72mn (-32% y/y).

Regarding Q3 2023, ATQA posted a 535% y/y growth in net profits to EGP183mn, however, the revenues were not a reason for the net profit growth despite it growing by 21% y/y to EGP789mn, the gross profit margin largely dropped to 1.9% vs. 12.7% a year earlier. The net profits grew on:

· the investment income grew to EGP254mn vs. only EGP29mn last year.

· the lower FX losses of only EGP1.2mn vs. EGP107mn last year. (Company disclosure)

IDHC Q3 2023: Turned into profitability

Integrated Diagnostics Holding Co [IDHC] posted a 0.6% y/y decrease in 9M net profits to EGP401mn, despite the revenues growing to EGP3bn (+9% y/y). Meanwhile, the gross profit margin declined by 4.9pp y/y to 37.2%.

Regarding Q3 2023, IDHC posted a net profit of EGP178mn vs. net losses of EGP18mn last year on:

· Higher revenues of EGP1.2bn (+40% y/y).

· Finance income grew by 81% y/y to EGP16mn.

The gross profit margin came in flat at 40.6% (-0.7pp y/y). (Company disclosure)

Arabian Cement Q3 2023: Higher net profits on higher revenues, GPM, and finance income

Arabian Cement [ARCC] 9M 2023 net profits increased by 91% y/y to EGP500mn on:

· Higher revenues of EGP4.6bn (+34% y/y).

· Better gross profit margin of 19.8% (+2.7pp y/y).

· Finance income of EGP23mn vs. only EGP3mn last year.

Regarding Q3 2023, ARCC posted a 14% y/y growth in net profits to EGP163mn on:

· Higher revenues of EGP1.4bn (9% y/y).

· Higher gross profit margin of 18.7% (+6.2pp y/y).

· Finance income grew to EGP5mn vs. only EGP2mn last year. (Company disclosure)

Kafr El Zayat Pesticides Q3 2023: Still growing

Kafr El Zayat Pesticides [KZPC] 9M 2023 net income came in at EGP176mn (+120% y/y) on:

· Higher revenues of EGP1.7bn (+58% y/y).

· Better gross profit margin of 26.1% (+9.1pp y/y).

· Other income increased to EGP1.1mn vs. only EGP228,639 last year.

Regarding Q3 2023, KZPC posted net profits of EGP34mn vs. EGP2mn last year on:

· Higher revenues of EGP679mn (+98% y/y).

· Better gross profit margin of 26.7% (+14.8pp y/y).

· Other income increased to EGP179,494 vs. other expenses of EGP16,962 last year. (Company disclosure)

TMGH Q3 2023: Higher net profits on higher revenues and other income

Talaat Moustafa Holding [TMGH] posted its 9M 2023 results with net profits of EGP2.7bn (+34% y/y) on:

· Higher revenues of EGP18.4bn (+32% y/y).

· Higher other income of EGP853mn (+171% y/y).

However, the gross profit margin slightly decreased to 30.4% (-0.8pp y/y).

Regarding Q3 2023, TMGH posted a 27% y/y growth in net profits to EGP1.1bn on:

· Higher revenues of EGP7.7bn (+13% y/y).

· The solid other income of EGP316mn vs. only EGP60mn last year.

However, the gross profit margin slightly decreased to 28.6% (-0.9pp y/y). (Company disclosure)

CIB borrows a loan from EBRD

The European Bank for Reconstruction and Development (EBRD) to give the Commercial International Bank [COMI] a loan worth USD150mn. The loan is aimed to boost its capital base and support COMI's growth plans. (Enterprise)

PIF raised its stake in e-Finance

The Saudi Public Investment Fund (PIF) raised its stake in e-Finance [EFIH] to 27% from 25% after buying from the free-float shares. It is reported that PIF eyes a 28% stake in EFIH. (Alarabiya)

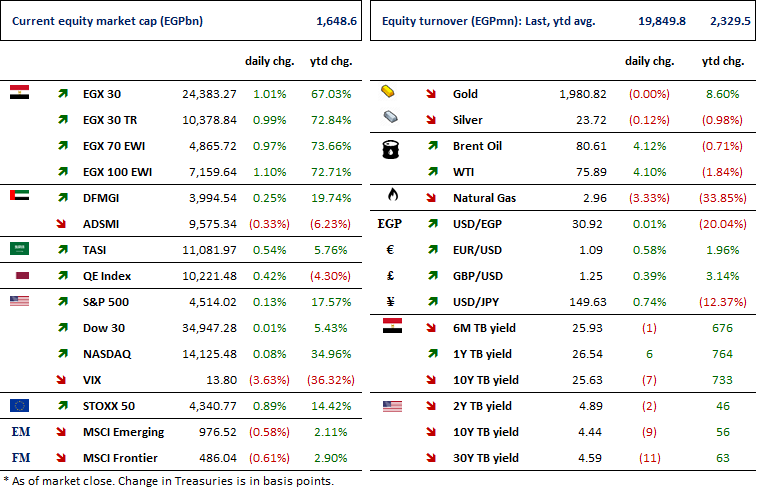

MARKETS PERFORMANCE

Key Dates

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

30-Nov-23

DOMT: Cash dividend / Payment date for a dividend of EGP0.20/share.

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).