Earnings' Overflow

Stocks mentioned: ETEL, CIEB, SAUD, EXPA, TAQA, HELI, EGAS, EKHO, MICH, ADIB

Today’s Top News & Analysis

Egypt’s total budget deficit hits 3.2% of GDP in two months of FY2023/24

Israeli natural gas flows to Egypt increase by 60% in November

ETEL Q3 2023: Slow net profit growth despite the revenue growth

CIEB Q3 2023: Expenses erode top line growth

Al Baraka Q3 2023: Cost of funds curbs earnings’ growth

EXPA Q3 2023: Stellar growth

TAQA Q3 2023: Strong net profits on better revenues and net FX gains

HELI Q3 2023: Net losses despite the better revenues

EGAS 9M 2023: Higher investment income and FX gains save the net profits

EKHO Q3 2023: Weak operations drive a huge decline in net profits

MICH Q1 2023/24: Better net profits on higher revenues and investment income

ADIB Q3 2023: Over the top

MACRO

Egypt’s total budget deficit hits 3.2% of GDP in two months of FY2023/24

Egypt’s total budget deficit reached 3.2% of GDP during the first two months of FY2023/2024 versus 1.4% for the same period last year, under pressure from increased expenditures, particularly debt interest and government subsidies, according to the Ministry of Finance’s monthly report. Government debt interest rose by 161% to about EGP391.7bn by the end of last August. The value of government subsidies and grants increased by 21.5% to EGP60.3bn, while the value of wages and compensations for state employees decreased by 74% to EGP79.9bn. Interest and wages constitute about 76.5% of the Egyptian government's expenditures in the first two months of the current fiscal year. (Asharq Business)

Israeli natural gas flows to Egypt increase by 60% in November

It has been reported that, natural gas flows from Israel to Egypt have surged by up to 60% this month, after security concerns related to the war subsided, alongside the resumption of production at Tamar's major gas field. The source stated that supplies increased to either 350mn cbt/day or 400mn cbt/day, compared to about 250mn earlier in November. However, these flows still represent half the normal level of supplies before the war. Some sources also expect gas exports to Egypt to return to pre-"Gaza War" levels at 650mn cbt/day by this Thursday, then to increase gradually to 800mn cbt/day. (Asharq Business: 1, 2)

CORPORATE

ETEL Q3 2023: Slow net profit growth despite the revenue growth

Telecom Egypt [ETEL] posted its Q3 2023 consolidated net profits with only 3% y/y growth to EGP2.5bn despite a 16% y/y growth in revenues to EGP13.8bn. The weak net profit growth is mainly derived by a 4.9pp y/y decrease in the gross profit margin to 41.4%. (Company disclosure: 1, 2)

CIEB Q3 2023: Expenses erode top line growth

Credit Agricole - Egypt [CIEB] announced the results for Q3 2023. Here are our main takeaways:

· Net income increased by 121% y/y to EGP1.29bn. Yet sequential growth came almost flat at 1% q/q although net interest income (NII) grew strongly by 15% q/q to EGP1.9bn (+106% y/y).

· This was due to (1) a 78% q/q decline in gain on sale of investments to EGP13mn (2) the 16% q/q increase in Administrative expenses to EGP564bn and (3) 362% q/q higher provisions of EGP64mn.

· This increase in net interest income pushed the annualized NIM up to 9.2%. While ROAE slipped slightly to 39.5% from 43% in Q2 2023 yet still at very healthy levels.

· On the balance sheet front, loan book growth came in at 10% ytd to EGP38.5bn, with corporate loans still leading. NPLs remained at the same levels at 2.5%. While coverage ratio upped slightly to 163%

· Deposits, on the other hand continued to grow with a strong pace by 33% ytd to EGP81bn. Accordingly, GLDR fell to 47% which is the lowest since December 2018.

· Alternatively, CIEB resorted to due from banks account which increased by 64% ytd to EGP34bn. In addition to a 40% ytd growth in financial investments to EGP18.3bn. (Bank disclosure)

Al Baraka Q3 2023: Cost of funds curbs earnings’ growth

Al Baraka Bank [SAUD] announced the full results for Q3 2023, here are our main takeaways:

· Net income increased by 24% y/y to EGP587mn, on the back of a 19% y/y increase in net interest income (NII) to EGP1.05bn.

· However, on a quarterly basis, NII decreased by 7% due to a sharp q/q increase in the bank’s cost of funds that outpaced that of interest income’s. Hence, the decrease in SAUD’s annualized NIM in Q3 to 4.75% from 5.34% in Q2 2023.

· Additionally, net income came in almost flat q/q increasing by 2% only, where annualized ROE declined slightly to 26%

· SAUD booked 75% q/q lower provisions of EGP27mn only, giving space for bottom line growth since its coverage ratio is more than satisfactory.

· The bank also recorded other operating losses of EGP11mn against operating income of EGP44mn in Q2 2023. Luckily, effective tax rate declined by 4 pp q/q to 30%.

· On the balance sheet side, Loans showed healthy growth by 16% ytd to EGP41bn. NPL ratio maintained at 4.3, and coverage ratio of 144%.

· The bank managed to grow its deposits by 10.5% ytd to EGP82bn, with a GLDR of 50%. (Bank disclosure)

EXPA Q3 2023: Stellar growth

Export Development Bank of Egypt [EXPA] announced Q3 2023 results. Here are our main takeaways:

· The bank’s net income increased by 182% y/y to EGP956mn on the back of a stellar 71% y/y growth in net interest income (NII) to EGP1.4bn and a 166% y/y growth in net fees and commissions to EGP380mn.

· On a sequential basis, net income increased by 37% q/q and NII increased by 17%. EXPA also booked provisions of EGP88mn only (-47% q/q), almost half the annualized CoR of last quarter. This, coupled with other operating income of EGP35mn allowed for more growth in EXPA’s bottom line.

· On the balance sheet side, EXPA’s loan book grew by 21% ytd to EGP54bn. However, the bank managed to maintain its NPL at 2.3 and increase the coverage ratio slightly to 159%.

· Deposits on the other hand, grew by 18% ytd to EGP86bn, maintaining the bank’s GLDR at 63% like last quarter.

· Now, EXPA’s ROAE is now up to 33% from 27% last quarter, and the CAR went up slightly to 15.5% from 14.4% in Q2 2023. (Bank disclosure)

TAQA Q3 2023: Strong net profits on better revenues and net FX gains

TAQA Arabia [TAQA] released its 9M 2023 results posting a 6% y/y growth in net profits to EGP365mn despite a 28% y/y growth in revenues to EGP9.8bn. Meanwhile, the gross profit margin came in flat at 11.3%. The weak net profit growth is attributable to the higher net finance expense of EGP141mn vs. EGP34mn last year.

Regarding Q3 2023, TAQA posted a 31% y/y growth in net profits to EGP198mn due to:

· The higher revenues of EGP3.6bn (+27% y/y).

· Recording net FX gains of EGP6.8mn vs. net FX losses of EGP8.1mn last year.

Meanwhile, the gross profit margin was flat at 11.9%. (Company disclosure)

HELI Q3 2023: Net losses despite the better revenues

Heliopolis for Housing & Development [HELI] posted its Q3 2023 results recording net losses of EGP17mn vs. net profits of EGP12mn last year, despite the better revenues of EGP141mn (+133% y/y), this is attributable to:

· The gross profit margin strongly dropped to 54% vs. 99% a year earlier.

· Finance expenses grew to EGP103mn vs. EGP49mn last year. (Company disclosure)

EGAS 9M 2023: Higher investment income and FX gains save the net profits

Egypt Gas [EGAS] posted its 9M 2023 results recording a 9% y/y decrease in net profits to EGP139mn due to:

· A 29% y/y decrease in revenues to EGP3.6bn.

· Booking gross loss of EGP122mn vs. gross profit of EGP162mn a year earlier.

However, the better investment income of EGP681mn (+36% y/y) and the higher FX gains of EGP29mn vs. only EGP0.64mn last year, saved the net profits from further dropping. (Company disclosure)

EKHO Q3 2023: Weak operations drive a huge decline in net profits

Egypt Kuwait Holding Co. [EKHO] posted its 9M 2023 results recording a 34% y/y decrease in net profits to USD137mn on:

· Revenues declining by 32% y/y to USD552.9mn.

· Gross profit margin decreasing to 41.8% (-8.6pp y/y).

Regarding Q3 2023, EKHO posted a 43% y/y decrease in net profits to USD36mn on:

· Revenues declining to USD184mn (-29% y/y).

· Gross profit margin decreasing by 9.4pp to 49.1%. (Company disclosure)

MICH Q1 2023/24: Better net profits on higher revenues and investment income

Misr Chemical Industries [MICH] reported its unaudited results for Q1 2023/24 posting a 32% y/y growth in net profits to EGP137mn on:

· Higher revenues of EGP240mn (+21% y/y).

· Slightly better gross profit margin of 68.5% (+0.8pp y/y).

· Higher investment income of EGP30mn vs. only EGP10mn a year earlier. (Company disclosure)

ADIB Q3 2023: Over the top

Abu Dhabi Islamic Bank – Egypt [ADIB] announced remarkable results for Q3 2023. These are our main takeaways:

· ADIB’s net income came at EGP1.3bn (+19% q/q, +134% y/y), marking a new record for quarterly earnings.

· This was mainly due a 12% q/q increase in net interest income (NII) to EGP2.3bn (+82% y/y), which reflects the cumulative effect of the several rate hikes in 2022 and 2023.

· Accordingly, ADIB’s annualized NIM expanded a bit to 7.3% up from 7.1% last quarter. While the bank’s annualized ROAE surged to 44% from 41% last quarter.

· Also, ADIB’s other operating expenses declined by 24% q/q to EGP76mn (-39% y/y), but net trading income also declined by 67% q/q to EGP29mn.

· This has allowed the bank to maintain the high provisions booking of EGP424mn (-9% q/q, +183% y/y)

· On the balance sheet side, ADIB managed to maintain its loan book by 10% ytd to EGP65.5bn. Despite this, NPL ratio declined to 1.59% and coverage ratio increased to 367%.

· Deposits increased significantly by 18% ytd to EGP115bn, mainly derived by retail deposits with GLDR ratio down to 57%.

· Due from banks increased by 182% ytd to EGP40bn, pushing the total assets of ADIB to EGP147bn (+27% ytd) (Bank disclosure)

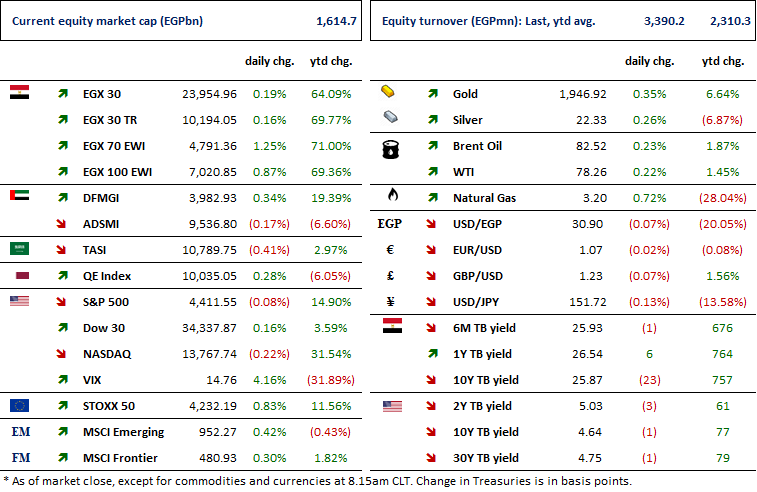

MARKETS PERFORMANCE

Key Dates

14-Nov-23

ISPH: BoD meeting / Discussing financial results.

MSCI: MSCI's November 2023 Semi-Annual Index Review Announcement.

ETEL: Conference Call / Discussing Q3 2023 financial results.

RMDA: Conference Call / Discussing Q3 2023 financial results.

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

30-Nov-23

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).