1. Today’s Trading Playbook

KEY THEMES

Inflation drivers continued to mount after the government hiked butane gas cylinder prices by 6.7%, reaching EGP75 for household cylinders and EGP150 for commercial consumption. Such inflationary pressure is predicted to be met with a tight monetary action by the CBE this week. We initially thought that we do not think the CBE will begin its tightening cycle with aggressive rate hikes, as uncertainty remains high, and a de-escalation of the conflict will have a significant impact on global commodity markets. However, this takes nothing from our predictions that at least interest rates will be hiked by 200-300bps in 2022, the first of which we think will occur at the March 24 meeting this week. As a reflection on the market, such policy response should favor companies with resilient balance sheets, while denting the profitability of high-leveraged names.

Elsewhere, U.S. equities rose notably last Friday, after talks between U.S. President Joe Biden and Chinese President Xi Jinping over the Ukraine crisis ended without big surprises. Meanwhile, Brent oil prices settled above the USD105/bbl level, after a volatile week of trading above and below USD100/bbl. Moreover, the greenback remained elevated with the U.S. dollar index inching above the 98.0 reading yet gold prices went down.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt is in talks with the IMF on possible support that could include a loan, as shockwaves from the war in Ukraine add pressure on the country’s economy. (Bloomberg)

Expect the price cap on unsubsidized baladi bread to be announced within the next 48 hours, head of internal trade at the Supply Ministry, said in a televised interview. (Enterprise)

Egypt is hoping to lure tourists from several European countries and the United States to our beach resorts with a new promotional campaign that’s hoped to help fill the gap left by the loss of Russian and Ukrainian tourists. Meanwhile, The UK and Canada has lifted all COVID-19 related travel restrictions. (Enterprise)

Prime minister hiked butane gas cylinder prices by 6.7%, reaching EGP75 for household cylinders (from EGP70) and EGP150 (from EGP140) for commercial consumption. (Masrawy)

CORPORATE NEWS

Qatar National Bank Al Ahli’s [QNBA] BoD has approved the adjustment of its DPS suggestion for the year 2021 to EGP0.75 from EGP1.30. The new DPS will imply 4.4% in yield, and a 21% payout ratio, pending shareholders’ approval. (Company disclosure)

Orascom Development Egypt’s [ORHD] net profit in 2021 surged to EGP1.3bn (+130%y/y) where revenue jumped to EGP7.1bn (+41%y/y). Meanwhile, ORHD’s GPM increased to 34% (+6pp) and is currently trading at a 2021 P/E of 3.2x. (Company disclosure)

e-Finance’s [EFIH] BoD held on 17 March 2022 has agreed to invest USD10mn in a startup fund concerning the financial services, to be launched today. Furthermore, the BoD agreed to buy a land plot in new administrative capital, in a collaboration with a sister company. (Company disclosure)

Ajwa’ Group for food industries [AJWA] has reported its standalone figures, reporting an 83% y/y decrease in bottom line losses, coming in with EGP5.3mn of net loss in 2021 compared to EGP30.4mn in 2020. (Mubasher)

Tenth of Ramadan for Pharmaceutical Industries and Diagnostic Reagents –Rameda- [RMDA] has bought treasury shares during 17 March 2022 session up to 2.3mn shareswithin the context of RMDA’s share buyback program. (Company disclosure)

Moon Capital has raised its stake in EK Holding [EKHO] from 2.8% to 4.5% through buying 19.6mn shares at an average share price of EGP21/share. (Company disclosure)

Rolako Investment has raised its stake in MM Group [MTIE] from 11.99% to 12.06%through buying 0.725mn shares at an average share price of EGP5.10/share. (Company disclosure)

GLOBAL NEWS

Two of the Federal Reserve's most hawkish policymakers on Friday said the central bank needs to take more aggressive steps to combat inflation, and two others said they would be open to it – one of whom just six months ago envisioned a 2022 with no rate increases at all. (Reuters)

The Bank of England raised interest rates again on Thursday in a bid to stop fast-rising inflation becoming entrenched, but it softened its language on the need for more increases as households face a huge hit from soaring energy bills. (Reuters)

3. Chart of the Day

Research Team

Source: Al-Mal.

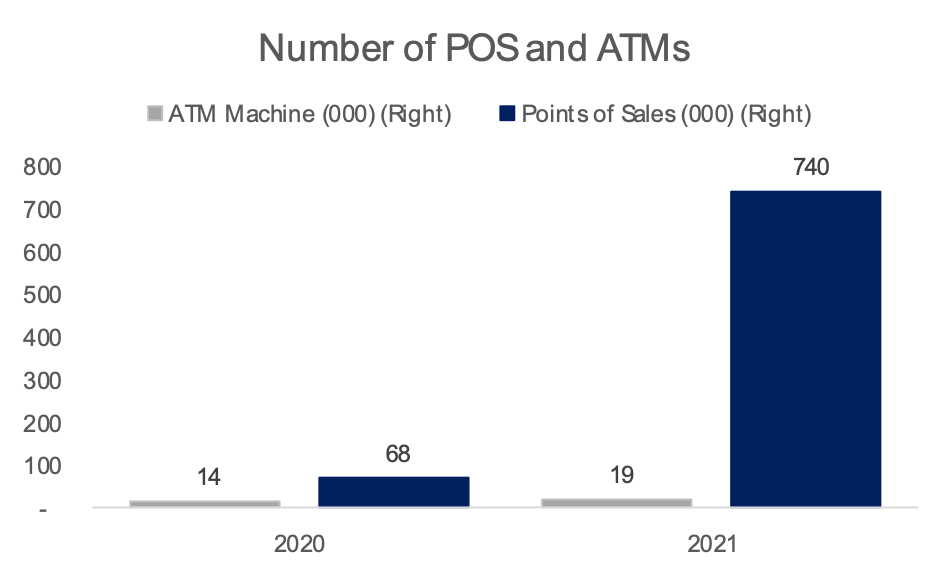

The number of Egypt ATM Machine has surged 37% to 19,000, while the number of POS has leaped to 740,000, from 68,000 a year earlier.