Today’s Top News & Analysis

Moody's downgrades Egypt's sovereign credit rating

Egypt signs an USD3bn green fuel agreement with Maersk

Egypt expects Israeli gas Imports to increase by 30%

Egyptian banks suspend debit card use in foreign currency

Egypt generates current account surplus in Q4 FY2022/2023

World bank downgrades Egypt's growth forecasts

Egypt Aluminum's 2022/23: Full year profits, yet quarterly losses

ALCN 2022/23: Simple is key

Heliopolis Housing & Development BoD approves Heliopark offer

The New Administrative capital seeks a global financial advisor for IPO

MACRO

Moody's downgrades Egypt's sovereign credit rating

Moody's has further downgraded Egypt's sovereign credit rating into junk territory from B3 to Caa1 with a stable outlook, indicating significant risk The decision was made due to Egypt's worsening debt affordability and the persistent foreign currency shortages, which affect the country's ability to meet its repayments. (Moody's)

Egypt signs an USD3bn green fuel agreement with Maersk

Egypt and "C2X," a subsidiary of the global container shipping company Maersk, have signed a new framework agreement worth up to USD3bn for the production of green fuel and its derivatives in the economic zone of the Suez Canal. The first phase of the project aims to produce 300,000 tons of green methanol annually, reaching one million tons annually upon completion of the final project stages. (Asharq Business)

Egypt expects Israeli gas Imports to increase by 30%

The Minister of Petroleum, anticipated that Egypt's imports of Israeli gas for export purposes would increase by approximately 30% in the coming period. This comes after the Egyptian-Israeli gas agreement aimed at increasing the quantities of gas imported from Israel to Egypt by about 40% since January 2021. He added that Egypt's current gas production rate is approximately 6bn CFD. (Asharq business)

Egyptian banks suspend debit card use in foreign currency

Two Egyptian banks, namely Arab African International Bank and Arab International Bank have suspended the use of EGP debit cards for FX withdrawals or payments to preserve foreign currency. (Reuters)

Egypt generates current account surplus in Q4 FY2022/2023

Egypt's Balance of Payments (BoP) has showed a current account surplus for the first time since 2014 in Q4 FY2022/2023 of USD560mn, compared to a deficit of USD3bn on Q4 FY2021/2022. This was on the back of falling imports and rising tourism and Suez Canal revenues. As for the entire fiscal year, current account deficit narrowed more than 70% to USD 4.7 bn from USD 16.6 bn in FY2021/2022. (CBE)

World bank downgrades Egypt's growth forecasts

The World Bank has downgraded its growth forecasts for the Egyptian economy to 3.7% from 4.2% in FY2022/2023 as the rising borrowing costs and heightened inflation curb economic activity. This is the second time the World Bank has cut its forecasts for Egypt this year. (Enterprise)

CORPORATE

Egypt Aluminum's 2022/23: Full year profits, yet quarterly losses

Egypt Aluminum [EGAL] results for 2022/23 show bottom line rising by 48% y/y to EGP3.7bn compared to EGP2.5bn the year before. The increase is on the back of a 52% higher revenue that recorded EGP22bn in 2022/23 and a 8pp y/y higher GPM of 32% (including SG&A expenses). Yet, EGAL recorded a net loss in Q4 of EGP225mn, on a higher effective tax rate in Q4 of 158%, or 24% in the full year, and a lower EBT margin of 5% in Q4 compared to 35% in Q3. (company disclosure)

ALCN 2022/23: Simple is key

Alexandria Container Handling Co. [ALCN] 2022/23 net profits came in at a strong EGP4.4bn (+116% y/y, +9% vs. Prime Research expectations). Revenues came at EGP4.96bn (+75% y/y, +5% vs. Prime Research expectations). GPM recorded 78.2% (+9pp y/y, inline with Prime Research expectations). This was through handling 827,176 trade containers and 4,107 transit containers. (Company disclosure)

Heliopolis Housing & Development BoD approves Heliopark offer

Heliopolis Housing & Development [HELI] BoD approved the offer to sell the Heliopark land plot from the National Organization for Social Insurance (NOSI). The deal is valued at EGP15bn before tax, paid in one payment. This implies an after tax value of EGP1,685/sqm and EGP8.7/HELI's share. (Youm7)

The New Administrative capital seeks a global financial advisor for IPO

The New Administrative Capital company in Egypt is in the initial stages of appointing a global financial advisor to launch a portion of its shares on the Egyptian Stock Exchange, as they plan to offer between 5% and 10% of its shares during H1 2024. We note that In March 2022, the company appointed the local investment bank CI Capital Holding [CICH] as an advisor for it's IPO. (Asharq Business)

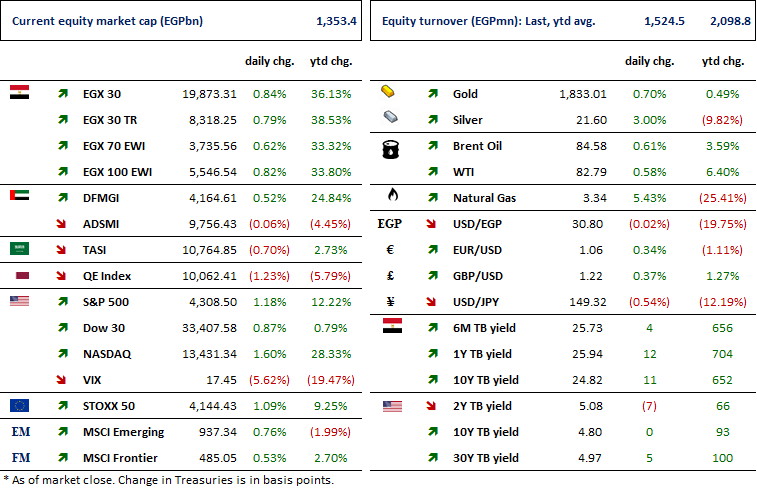

MARKETS PERFORMANCE

Key Dates

11-Oct-23

ORAS: EGM / Discussing the dividend distribution of USD0.2750/share.

EFIH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

12-Oct-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

EGCH: OGM / Approving financial statements ending 30 June 2023.

EGCH: EGM / Amending Article No. 3 & 21 of the company's bylaws.

17-Oct-23

POUL: OGM / Discussing dividends distribution.

18-Oct-23

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (3rd installment).

23-Oct-23

ABUK: Cash dividend / Deadline for eligibility for a dividend of EGP7.00/Share.

25-Oct-23

EGAL: OGM / Approving financial statements for 2022/2023.

26-Oct-23

ABUK: Cash dividend / Payment date for a dividend of EGP2.00/share (1st installment).

MNHD: Cash dividend / Payment date for a dividend of EGP0.075/share (2nd installment).

31-Oct-23

MCRO: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).