Fundamental Thoughts

Today, the Central Bank of Egypt’s Monetary Policy Committee (MPC) meets for the sixth time this year, leaving two more meetings in November and December before calling it a year. But the question remains: Will the outcome of the meeting really matter?

So far, the CBE has raised interest rates by 300bps ytd and a cumulative 1,100bps since March 2022. In its last meeting, the MPC cited “the balance of risks surrounding the inflation outlook” and “contain[ing] the inflationary pressures”, and “anchor[ing] inflation expectations around the CBE’s targets”.

With the August inflation print hitting yet another all-time high of 37.4%, rising from 36.5% in July, we note that the monthly acceleration slowed. Indeed, monthly urban inflation seems to have subsided (1.6% m/m in August vs. 1.9% m/m in July), and monthly core inflation also slowed down (0.3% m/m in August vs. 1.3% m/m in July). However, core inflation is still at elevated levels, albeit it marginally lower at 40.4% in August vs. 40.7% in July.

With interest rates now at 19.25%/20.25% for overnight deposit/lending rates, we think keeping rates unchanged or hiking them by 100bps will not do the trick when it comes to “containing” inflation. This was also our view on 3 August. After all, a 100bps hike is only less than 5% of the current lending rate, so the impact on the market will be marginal. But if we take the MPC’s word for it, an all-time inflation reading necessitates keeping the hiking momentum it resumed in the last meeting. For this, we think a 100bps hike will not necessarily be momentous, but it will sure send a consistent message to the IMF that the CBE is sticking to its orthodox monetary policy tools.

But the question still remains: Does it really matter?

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Egypt to build EUR1bn tire factory

New Golden licenses for two industrial firms

Cabinet approves new renewable energy projects

NUCA to partner with a foreign investor on a 100acre project in Cairo

Russia withdraws from the Wheat deal; Egypt to find an alternate

Shell sells a 40% stake of the Mediterranean block to a Kuwaiti company

Egypt raises GDP growth targets for the current and following fiscal years

MACRO

Egypt to build EUR1bn tire factory

The Cabinet has announced signing a contract with Rolling Plus Chemical Industries, whose shareholders include Egyptian, Saudi, and Cypriot companies, to establish a EUR1bn worth tire factory in the Ain Sokhna industrial zone. The factory has a capacity to produce 7mn tires per year and could create as many as 1k direct and indirect jobs. (Cabinet)

New Golden licenses for two industrial firms

The Cabinet has approved granting the golden license for: (1) Egyptian Natural Gas Company (GASCO) for its USD380mn project to expand its gas complex in Alexandria by adding a fourth production line with a capacity of 600mn CFT/day. (2) EgyptSat Auto for its planned EGP300mn electric mobility and components factory in the Tenth of Ramadan industrial zone. (Cabinet)

Cabinet approves new renewable energy projects

In a meeting held yesterday, the Cabinet approved an offer submitted by UAE-based AMEA Power to expand the production capacity of the 1.8GW Benban solar park in Aswan by 1GW, and to set up a 500MW wind farm in Ras Ghareb. (Cabinet)

NUCA to partner with a foreign investor on a 100acre project in Cairo

A foreign investor is looking to partner with the New Urban Communities Authority (NUCA) to develop a 100-acre land plot in the greater Cairo area. The full amount of the land value is to be paid in USD. NUCA has reported that it has sold c.USD3bn of land plots in foreign currency until August. (Al-Mal)

Russia withdraws from the Wheat deal; Egypt to find an alternate

Sources said that Russia is not accepting the pre-stated price for the private wheat deal with Egypt announced on 5 September 2023. The deal specified that Egypt would buy 480,000 tons of wheat for USD270/ton on a cost & freight basis. However, Egypt is trying to secure new deals with France and Bulgaria, but no details are announced yet. (Asharq Business)

Shell sells a 40% stake of the Mediterranean block to a Kuwaiti company

BG International, a subsidiary of Shell plc, signed a Farm Out Agreement (FOA) with Kuwait Foreign Petroleum Exploration Company (KUFPEC), under which KUFPEC will acquire a 40% stake in Block 3 (NorthEast El-Amriya) in the Egyptian Mediterranean Sea. The agreement is still subject to government and regulatory approvals, and Shell will remain to be the operator in Block 3. (KUFPEC)

Egypt raises GDP growth targets for the current and following fiscal years

The head of the General Authority for Investment announced that the Egyptian government raised its GDP growth target for the current fiscal year to 4.4% after previously lowering them to 4.1%. He also added that the targets for GDP growth for the next fiscal year are set at 5%, increasing from the previous estimate of 4.7%. He pointed out that this growth is supported by the real estate and infrastructure sectors. (Asharq Business)

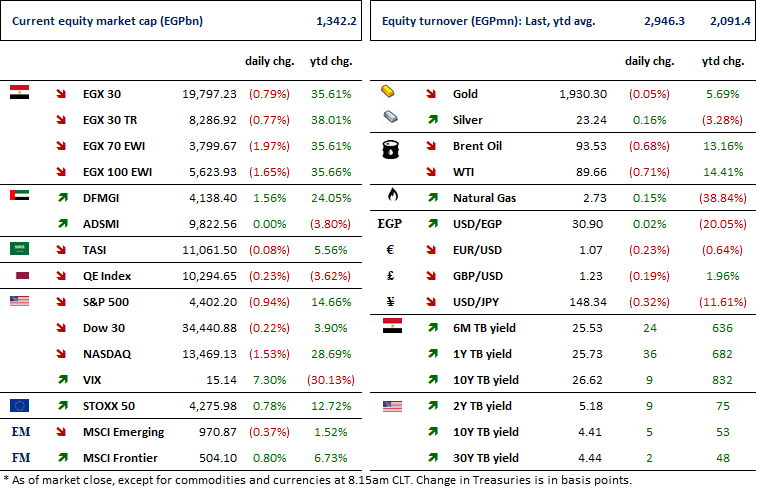

MARKETS PERFORMANCE

Key Dates

21-Sep-23

RMDA: Stock dividend / Date for distributing a 0.52 for-1 stock dividend.

MPC Meeting / Determining the CBE's policy rate.

25-Sep-23

IRAX: Voluntary delisting / Voluntary delisting ending date.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ODIN: OGM / Approving financial statements ending 30 June 2023.

ODIN: EGM / Amending Article No. 7 of the company's bylaws.

TAQA: OGM / A board reshuffle.

TAQA: EGM / Amending Article No. 24 of the company's bylaws.

27-Sep-23

BTFH: OGM / Discussing netting contracts.

28-Sep-23

EAST: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.

AMOC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

IFAP: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

1-Oct-23

CIRA: OGM / Discussing dividends distribution.

3-Oct-23

Egypt PMI / September 2023 reading.

4-Oct-23

SKPC: Cash dividend / Payment date for a dividend of EGP0.40/share (2nd installment).

11-Oct-23

ORAS: EGM / Discussing the dividend distribution of USD0.2750/share.

EFIH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

12-Oct-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.