Today’s Top News & Analysis

The Fed raises interest rates to a 22-year high; GCC central banks follow suit

EGX50 EWI index to be discontinued

Egypt discussing free trade agreement with Serbia

A ship transporting 3,000 cars to Egypt catches on fire

Fertilizers producers reportedly face temporary gas cuts

TSFE signs MoU with Indorama

Fuel subsidies hit EGP58bn in FY23

Egypt denies the existence of any problems in the Zohr gas field

Egypt to offer new industrial lands to investors within a month

Egypt receives USD59mn in H1 2023 from Sukari gold mine

What else has the hot weather caused?

Renewable energy for aluminum producers

OLFI Q2 2023: Higher net profits on higher revenues with improved volumes and prices

MOPCO's BoD approves contributing to the new green hydrogen plant

Fawry negotiates potential expansion plans into KSA

SPMD 2022: Net loss on weaker revenues

MACRO

The Fed raises interest rates to a 22-year high; GCC central banks follow suit

The U.S. Federal Reserve raised its benchmark interest rate by 25bps to a range of 5.25-5.50%. The Fed chair did not rule out the possibility of another rate hike. Meanwhile, several central banks of the GCC states that peg their currencies to the USD also raised interest rates by 25bps, as follows:

· The Central Bank of Kuwait raised the discount rate to 4.25%.

· The Central Bank of the U.A.E. raised the benchmark overnight deposit rate to 5.40%.

· The Saudi Central Bank raised the repurchase agreement (Repo) rate to 6% and the reverse repo rate to 5.50%.

· The Qatar Central Bank raised the lending rate to 6.25% and the deposit rate to 5.75%.

· The Central Bank of Bahrain raised the benchmark interest rate for one-week deposits to 6.25% and overnight deposits to 6%. (Financial Times, Asharq Business)

EGX50 EWI index to be discontinued

The Egyptian Exchange (EGX) decided to discontinue its EGX50 EWI index effective 1 August 2023. The decision came after conducting a survey with 17 firms in the finance industry, which revealed that 94% of the participants do not use the EGX50 EWI at all. (EGX disclosure)

Egypt discussing free trade agreement with Serbia

Egypt and Serbia are negotiating the implementation of a free trade agreement. The most important goods traded between them include fertilizers, tobacco, phosphates, and machinery. In 2022, trade between the two countries increased by 42% y/y to USD113.6mn. (Economy Plus)

A ship transporting 3,000 cars to Egypt catches on fire

A cargo ship carrying 3,000 cars from Germany to Egypt caught fire off the Dutch coast yesterday. The reason for the fire is yet to be determined. Currently, measures are being taken to prevent the ship from sinking to avoid causing an environmental disaster. Among the 3,000 cars, approximately 350 were Mercedes-Benz vehicles, while the make and model of the other cars remain unknown. (Reuters)

Fertilizers producers reportedly face temporary gas cuts

Egypt’s urea producers were reportedly facing a 20% cut in gas supply from the government starting the mid of this week amidst the heat wave. (Asharq Business)

TSFE signs MoU with Indorama

The Sovereign Fund of Egypt (TSFE) signed an MoU with the Singapore-based Indorama Corporation to explore investment opportunities in various sectors, including mining, industrials, fertilizers, phosphate extraction, and medical fibers. The agreement also involves participation in Egypt's privatization efforts. (Cabinet Statement)

Fuel subsidies hit EGP58bn in FY23

Egypt’s fuel subsidies decreased to EGP58bn in FY23 vs. EGP59bn in FY22 (-2% y/y) but was 107% above its budget target of EGP28bn. (Asharq Business)

Egypt denies the existence of any problems in the Zohr gas field

The Egyptian Cabinet denied the existence of any issues in the Zohr field, and the Minister of Petroleum & Mineral Resources confirmed that the field is operating at its full capacity, producing an average of approximately 2.3bn cubic feet of natural gas daily. Meanwhile, the twentieth well is currently being drilled at a cost of USD70mn. Total investments in the field are valued at USD12bn, with a target to reach USD15bn within three years. (Asharq Business)

Egypt to offer new industrial lands to investors within a month

Egypt intends to offer new land for industrial development to investors within a month in the cities of October, El-Fayoum, Beni Suef, Al-Sadat City, the Tenth of Ramadan City, and some governorates of Upper Egypt. Meanwhile, the issuance of new factory operating licenses across various sectors increased 57% y/y to 6,400 licenses in FY23. (Asharq Business)

Egypt receives USD59mn in H1 2023 from Sukari gold mine

In H1 2023, Egypt’s profit share from the Sukari gold mine reached USD46mn (+114% y/y) while royalties amounted to USD13mn (+11% y/y). Gold production from the mine increased 8% y/y to 220,560 ounces in H1 2023. Meanwhile, the Central Bank of Egypt reduced its purchases of purified gold by 53% y/y to USD13mn for 6,752 ounces in H1 2023. (Al-Borsa)

What else has the hot weather caused?

Egypt has recently been witnessing some electricity disruptions due to overconsumption resulting from above-average hot weather. Even though Egypt produces 20,000 MW of surplus electricity, electricity stations reportedly need more amounts of fuel to offset the overload. The fuel currently in use is only able to cover 32,000 MW of electricity, while consumption exceeds 35,000 MW. The electric grid needs 135mn cubic meters of natural gas and 10,000 tonnes of diesel daily to avoid power outages. In addition to power outages and natural gas cuts for fertilizer producers, the intense heat has had other effects, such as:

· Egypt consuming all the natural gas it produces (Egypt’s total natural gas production is between 6.5-6.8bn cubic feet per day).

· Natural gas exports decreased from 406,000 tonnes in May to 0 tonnes in June, while only one shipment has been exported so far in July (Egypt plans to resume natural gas exports in the fall).

· Exports of natural gas decreased by more than 27% y/y in H1 2023.

· Importing diesel worth EGP2bn to replenish our consumed reserves. (Asharq Business: 1, 2, 3, Economy Plus)

Renewable energy for aluminum producers

The Egyptian government is looking to build solar power plants for aluminum production with a consortium of Orascom Construction [ORAS] and Engie. The talks included building a solar plant for Egypt Aluminum’s [EGAL] factory in Nagaa Hammadi and for a new aluminum factory to be located in Safaga. (Al-Mal)

CORPORATE

OLFI Q2 2023: Higher net profits on higher revenues with improved volumes and prices

Obour Land Food Industries [OLFI] reported Q2 2023 net profits of EGP97mn (+22% y/y) on higher revenues of EGP1.5bn (+70% y/y). The higher revenues are attributable to an improvement of 8% y/y in white cheese volumes to 26,900 tons, besides an increase in white cheese average prices to EGP55.2/kg vs. EGP35/kg last year. However, the gross profit margin declined by 3pp y/y to 20% due to the higher costs of raw materials.

We note that the growth in OLFI's net profits was partially subdued by the following:

· Provision for potential claims of EGP19mn.

· Higher net finance expense of EGP37mn vs. only EGP8mn last year.

Based on H1 2023, the stock is currently trading at:

· A TTM P/E of 7.9x, which is lower than its historical average.

· A TTM EV/EBITDA of 4.7x, which is also lower than its historical average.

Based on our expectations for 2023e, the stock is currently trading at:

· A P/E of 5.8x.

· An EV/EBITDA of 4.4x.

Based on our expectations for 2023e, we note that our 12MPT of EGP11.8/share implies:

· A P/E of 7x.

· An EV/EBITDA of 4.8x. (Company disclosure: 1, 2)

MOPCO's BoD approves contributing to the new green hydrogen plant

The board of Misr Fertilizers Production (MOPCO) [MFPC] approved contributing to the new green hydrogen plant in cooperation with the Egyptian Petrochemicals Holding Co. (ECHEM) and the Norwegian SCATEC. The percentage and amount of MOPCO’s contribution is yet to be determined. (Company disclosure)

Fawry negotiates potential expansion plans into KSA

Fawry [FWRY] said it is currently in negotiations with Saudi Payments, a subsidiary of the Saudi Central Bank, to enter the Saudi market. This also comes at a time when FWRY is evaluating a potential application for a digital banking license in Egypt. (Company disclosure)

SPMD 2022: Net loss on weaker revenues

Speed Medical [SPMD] reported a consolidated 2022 net loss of EGP146mn compared to a net profit of EGP136mn in 2021 due to:

· Lower revenues of EGP120mn (-67% y/y).

· Provisions and other operating expenses of EGP61mn.

SPMD recorded a gross loss of EGP3mn vs. a gross profit of EGP206mn in 2021. (Company disclosure)

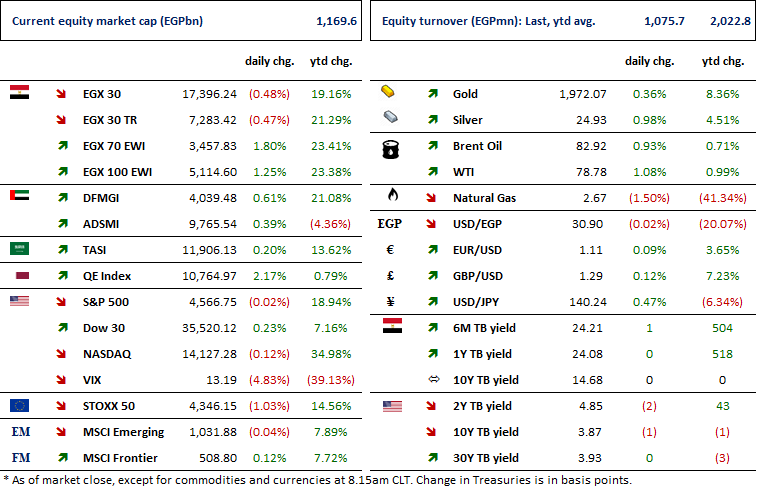

Markets Performance

Key Dates

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

MICH: BoD meeting / Follow up on production, sales and exports.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).