1. Today’s Trading Playbook

KEY THEMES

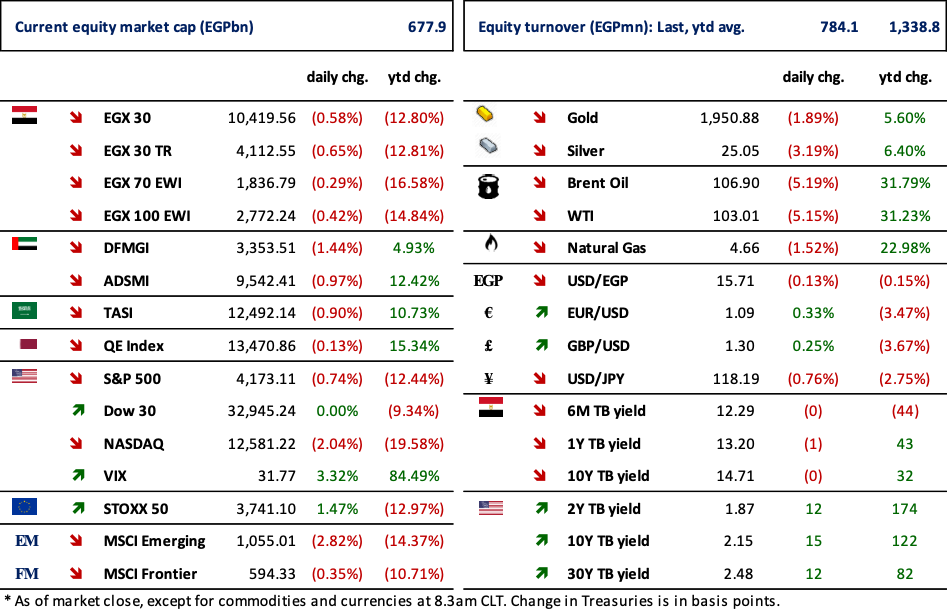

Oil prices slipped heavily, trading at its lowest levels in two weeks. Brent oil prices are now around USD101/bbl, as peace and ceasefire talks between Russia and Ukraine are challenging the notion of ultra-tight market in 2022. Meanwhile, surging COVID-19 cases in China fuelled concerns about slower demand. According to news sources, China reported 5,280 new COVID-19 cases on Tuesday, more than double the previous day’s count and the highest daily count since the start of the pandemic. As a result, Asian stocks were traded in the red territory, as sentiment for risk assets was blurred, despite weakening oil prices. We note that U.S. equities slipped moderately yesterday, ahead of the Fed most anticipated FOMC meeting. While a correction has slowed down most of the commodities on early Tuesday trading, the U.S. dollar index is now flirting with the 99.0 reading, on expectations of a hawkish fed.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Remittances from Egyptians abroad rose to record USD31.5bn in 2021 (+6.4% y/y) vs. USD29.6bn a year earlier. Meanwhile, during December 2021 alone, Remittances grew by 3.4% to record USD2.64bn. (CBE)

The government is now aiming to buy more than 6mn tons of domestic wheat this harvest season, up from its previous 5.5mn tons target. Furthermore, the government is going to pay more for the wheat it buys from domestic farmers. (Enterprise)

CORPORATE NEWS

Edita Food Industries' [EFID] achieved IFRS-based net income of EGP472mn in 2021 (+54% y/y) on higher top line of EGP5.3bn (+31% y/y). GPM, however, declined to 31.9% (-2.6pp y/y), in light of higher input prices. EFID’s strong top line growth was driven by increases in volumes and average prices across segments. EFID is currently traded at TTM P/E of 10x. (Company disclosure)

Palm Hills Developments [PHDC] BoD approved to obtain financing for the A1-1 area in Badya project, through the issuance of sukuk worth EGP3.25bn. (Arab finance)

Heliopolis Housing & Development [HELI] extended the deadline of receiving bids for leasing of the Show Land and Children Park at Merryland Park to 31 March 2022. (Arab finance)

South Cairo & Giza Flour Mills’ [SCFM] approved to continue the company for another year at its EGM held on 25 October 2021, despite reporting losses exceeding 50% of paid capital in 2020/2021. (Company disclosure)

3. Chart of the Day

Amany Shaaban | Equity Analyst

Source: CBE.

Local currency lending increased significantly as a percentage of total lending in the past four years. The weakness in USD vs. EGP affected the total amount of foreign currency loans negatively, causing local currency contribution to increase.