Today’s Top News & Analysis

Details of ADQ’s acquisition of EDC

Details of ADQ's acquisition of ELAB

Russia withdraws from the Black Sea Grains Agreement

Fawry plans to enter Saudi Arabia; considers applying for a digital banking license in 2023

e-Finance considers applying for a digital banking license

Sidpec’s BoD approves ETHYDCO acquisition

TALM Q3 2022/23: Strong q/q performance but slow y/y growth

MM Group to acquire a stake in B Pharma Holding

ADIB signs a USD50mn financing agreement with IFC

MACRO

Details of ADQ’s acquisition of EDC

Details of ADQ Holding’s acquisition of the Egyptian Drilling Co. (EDC) were reported as follows:

· ADQ acquired a 25% stake worth c.USD350mn, putting EDC’s valuation at USD1.4bn.

· Enppi, Petrojet, and the South Valley Egyptian Petroleum Holding Co. (GANOPE) divested their complete stakes following the acquisition.

· EDC’s new shareholder structure includes the Egyptian General Petroleum Corporation (EGPC) (a 60% stake), the Egyptian Natural Gas Holding Co. (EGAS) (a 5% stake), and the Egyptian-Jordanian Fajr Natural Gas Co. (a 10% stake). (Al-Mal)

Details of ADQ's acquisition of ELAB

ADQ Holding acquired 24% of the Egyptian Linear Alkylbenzene Co. (ELAB) worth c.USD170mn, putting ELAB's valuation at USD708mn. EGPC and the Ministry of Finance divested their complete stakes following the acquisition. (Al-Bosra)

Russia withdraws from the Black Sea Grains Agreement

Russia announced it would withdraw from the Black Sea Grains Agreement with Ukraine. As a result of Russia’s withdrawal, wheat prices may start to rise again. (Enterprise)

CORPORATE

Fawry plans to enter Saudi Arabia; considers applying for a digital banking license in 2023

Fawry’s [FWRY] CEO said his company is planning to expand its operations to many countries, including Saudi Arabia where expansion could start next year. He also added that FWRY is currently considering applying for a digital banking license. (Asharq Business)

e-Finance considers applying for a digital banking license

e-Finance Investment Group’s [EFIH] CEO said his company is considering applying for a digital banking license to make better use of its fintech and lending experience. (Al-Shorouk)

Sidpec’s BoD approves ETHYDCO acquisition

Sidi Kerir Petrochemicals' (Sidpec) [SKPC] BoD approved the acquisition of Egyptian Ethylene Production Co. (ETHYDCO) through a share swap. The board approved allocating 876,905,118 shares for the acquisition through a capital increase. This will put the share swap ratio at 79.1 SKPC shares for every ETHYDCO share. ADQ Holding had reportedly acquired a 27% stake in ETHYDCO worth USD290mn from the shares belonging to the National Investment Bank (NIB) and GASCO. ADQ's stake in ETHYDCO would translate into an 18% stake in SKPC following the acquisition. SKPC’s remaining shareholders following the share swap will include:

· Egyptian Petrochemicals Holding Co. (ECHEM) (a 23% stake).

· Al Ahly Capital Holding Co. (a 17% stake).

· Social Insurance Fund for Government Workers (a 10% stake).

· Insurance Fund for Workers in the Public & Private Business Sectors (a 6% stake).

· Egyptian Petrochemicals Co. (EPC) (a 3% stake).

· NIB (a 3% stake).

· Others (a 20% stake). (Company disclosure, Al-Borsa)

TALM Q3 2022/23: Strong q/q performance but slow y/y growth

Taaleem Management Services [TALM] reported consolidated 9M 2022/23 net profits of EGP342mn (+24% y/y) on higher revenues of EGP718mn (+20% y/y). Moreover, gross profit margin improved to 76% (+1.3pp y/y), while the EBITDA margin slightly decreased by 0.7pp y/y to 66%.

Regarding Q3 2022/23, TALM's net profits grew by 11% y/y to EGP151mn with a strong q/q growth of 80% due to higher revenues of EGP290mn (+10% y/y, +46% q/q). Gross profit margin decreased slightly y/y by only 0.2pp, but it improved strongly by 9pp q/q to 79%. Meanwhile, EBITDA margin declined by 2pp y/y to 71% but grew by 13pp q/q. The strong growth in TALM's q/q figures can be attributable to:

· A low-base quarter.

· 48% q/q higher tuition revenues of EGP281mn (+9% y/y). (Company disclosure)

MM Group to acquire a stake in B Pharma Holding

MM Group’s [MTIE] BoD approved acquiring a 40% stake in B Pharma Holding for up to EGP205mn. B Pharma Holding is a company specializing in pharmaceutical distribution in partnership with B Investments Holding [BINV]. (Company disclosure)

ADIB signs a USD50mn financing agreement with IFC

Abu Dhabi Islamic Bank - Egypt [ADIB] signed a 5-year financing agreement with the International Finance Corporation (IFC) for USD50mn which is to be included in ADIB's Tier 2 capital base. (Bank disclosure)

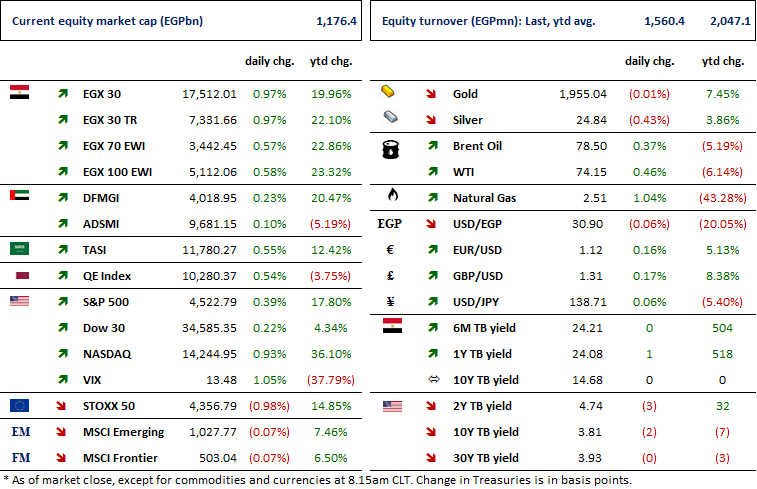

Markets Performance

Key Dates

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.