Today’s Top News & Analysis

IMF review not happening in September?

Egypt’s PMI unchanged at 49.2 in August, the highest in two years

Egypt hedges 35% of its petroleum needs for FY24

CBE to issue green banking licenses

Egyptian steel exports reach USD1.4bn in 7M 2023

Egypt targets selling a stake in Banque du Caire in 2024

Egypt buys Russian wheat in a private deal

EIPCIO plans to localize APIs manufacturing in Egypt

Beltone acquires 100% of Cash

MACRO

IMF review not happening in September?

The International Monetary Fund's (IMF) scheduled September review for Egypt's development program has reportedly been pushed back again. The review will be conducted later this year, a specific date has not yet been announced. (Asharq Business)

Egypt’s PMI unchanged at 49.2 in August, the highest in two years

Egypt’s PMI continued to hover close to the 50.0 neutral threshold in August recording 49.2, the highest in two years alongside July's figure. Output and new orders fell at modest rates, while employment and inventories moved into expansion territory. The findings suggest that the sector has somewhat stabilized in recent months after a prolonged period of contraction. However, higher inflationary pressures were noticed by the August survey findings, with some firms noting that a faster increase in input costs had reduced overall activity. Comments from surveyed companies suggest that FX rate problems and cost of living pressures will need to be fully addressed before Egypt can escape the detrimental effects of inflation which currently runs at a record high. (S&P Global)

Egypt hedges 35% of its petroleum needs for FY24

Egypt reportedly secured petroleum contracts to hedge against price volatility. The contracts will cover c.35% of Egypt's total petroleum consumption in FY24 (amounting to 100mn bbl) at a price range of USD75-80/bbl. (Asharq Business)

CBE to issue green banking licences

The Central Bank of Egypt (CBE) announced that it will allow the establishment of green banks. We note that green banks provide low-cost financing solutions for renewable energy projects and eco-friendly initiatives. (Daily News Egypt)

Egyptian steel exports reach USD1.4bn in 7M 2023

Egypt's iron and steel exports increased 63% y/y to USD1.4bn in 7M 2023. The countries that imported the most steel from Egypt were:

· Spain with a value of USD266mn.

· Turkey with a value of USD197mn.

· Italy with a value of USD172mn.

· The United States with a value of USD148mn.

· Romania with a value of USD130.5mn. (Al-Mal)

Egypt targets selling a stake in Banque du Caire in 2024

CEO of Banque Misr, the state-owned bank that owns Banque du Caire [BQDC], announced that they target selling a stake in the latter ranging from 20-30% to strategic investors in 2024. (Asharq business)

Egypt buys Russian wheat in a private deal

Sources stated that Egypt bought 480,000 tons of wheat for USD270/ton on a cost & freight basis. Sources added that Egypt has shifted to direct purchasing instead of tenders, seeking lower prices. Last week Russian suppliers submitted bids with a USD270/ton set as the floor price on a Free-on-Board basis. (Reuters)

CORPORATE

EIPCIO plans to localize APIs manufacturing in Egypt

At the Pharma Conex Conference, EIPICOs' [PHAR] chairman stated the challenges that the Egyptian pharmaceutical industry faces and how PHAR contributes to overcoming them. Here are our key takeaways:

Challenges in the pharma industry:

1) Despite covering 92% of its pharma needs, Egypt imports 95% of its needs from Active Pharmaceutical Ingredients (APIs).

2) Egypt spends USD1.5bn yearly, divided into:

· USD1bn for APIs.

· USD500mn for biosimilar, oncology, and other pharma products.

3) Egypt only exports USD200-220mn of its pharma production down from USD240-250mn 3 years ago.

4) Despite having 170 manufactories with 120 production lines, Egypt mainly produces generic drugs.

PHAR will introduce a multi-purpose APIs factory targeting to cover 8-12% of Egypt's APIs needs. Here are the main information on the factory:

1) Total investments of USD100mn.

2) Located in the SC Economic Zone.

3) The factory will use key starting materials (e.g. glucose - enzymes).

4) The factory will have two blocks as follows:

· Block 1: 350 tons capacity for 7 ACA products.

· Block 2: 300 tons capacity for N-2 products.

5) The factory is 50% owned by ACDIMA while PHAR will have a 15% stake and the remaining 35% is divided between strategic investors and the SC Economic Zone.

6) It is expected to be operational through 2026, according to management. (EIPICO ,Hapi Journal)

Beltone acquires 100% of Cash

After finalizing the due diligence, Beltone Financial Holding [BTFH] announced signing an agreement to acquire 100% of Cash Micro Finance. The amount of the deal is not yet disclosed, and the acquisition will be finalized once Beltone receives FRA approval. (Company disclosure)

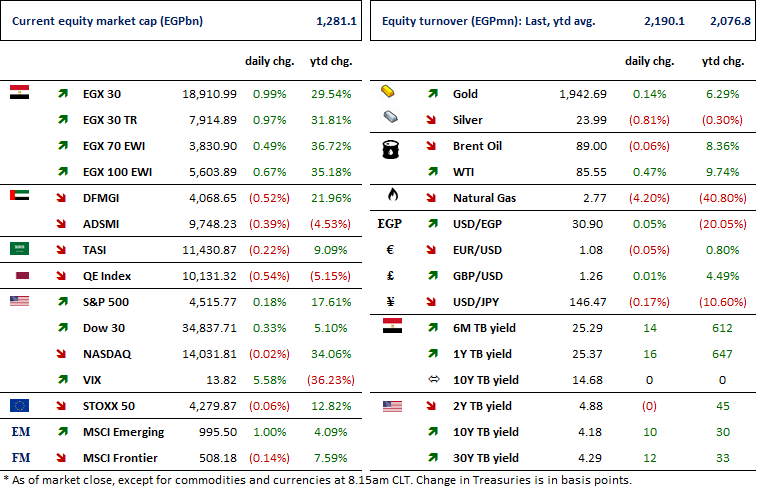

Markets Performance

Key Dates

5-Sep-23

Egypt PMI / August 2023 reading.

6-Sep-23

ELSH: OGM / Approving the decisions of the company’s board of directors in its meeting held on 15/6/2023.

ELSH: EGM / Amending some articles of the Company's bylaws.

15-Sep-23

IMF Review / Second IMF review with Egypt (end-June 2023 quantitative targets).

17-Sep-23

MCQE: Cash dividend / Deadline for eligibility for a dividend of EGP0.750/Share.

19-Sep-23

EXPA: EGM / Amending Article No. 5 of the bank's bylaws.

20-Sep-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.25/share (1st installment).

21-Sep-23

MPC Meeting / Determining the CBE's policy rate.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ODIN: OGM / Approving financial statements ending 30 June 2023.

ODIN: EGM / Amending Article No. 7 of the company's bylaws.

TAQA: OGM / A board reshuffle.

TAQA: EGM / Amending Article No. 24 of the company's bylaws.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.

AMOC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.