Today’s Top News & Analysis

EFID Q2 2024: Declined GPM and net interest expenses drive a decline in net profit

RMDA Q2 2024: Better revenues reflect in net profits

ETEL Q2 2024: A decline in net profits despite revenue growth

ARCC Q2 2024: Better operations drive the net profits growth

SUGR Q2 2024: Lower net profits on weaker operations

CORPORATE

EFID Q2 2024: Declined GPM and net interest expenses drive a decline in net profit

Edita Food Industries [EFID] posted an 18% y/y decline in net profits to EGP313mn in Q2 2024, despite a 42% y/y growth in revenues to EGP4.1bn mainly driven by a 33% y/y increase in overall average prices to EGP3.96/pack. However, the gross profit margin declined by 3pp y/y to 29%.

Despite the strong growth in revenues, the net profits mainly declined due to recording net interest expenses of EGP79mn vs. net income interest of EGP10mn last year. (Company disclosure: 1, 2)

RMDA Q2 2024: Better revenues reflect in net profits

Rameda [RMDA] posted a 26% y/y growth in net profits to EGP62mn in Q2 2024, due to:

· Higher revenues of EGP565mn (+25% y/y).

· Better gross profit margin of 48% (+2pp y/y).

· Recording FX gains of EGP7mn vs. FX losses of EGP560,905 last year. (Company disclosure)

ETEL Q2 2024: A decline in net profits despite revenue growth

Telecom Egypt [ETEL] posted a 9% y/y decline in net profits to EGP2.6bn in Q2 2024 despite a 44% y/y growth in revenues to EGP20bn. The decline in net profits is attributable to a 1.3pp y/y decline in EBITDA margin to 40% and a 255% y/y increase in net finance cost to EGP3.5bn. (Company disclosure: 1, 2)

ARCC Q2 2024: Better operations drive the net profits growth

Arabian Cement [ARCC] posted a 103% y/y growth in net profits to EGP194mn in Q2 2024, due to:

· Higher revenues of EGP2bn (+36% y/y).

· Improved gross profit margin of 16% (+3pp y/y).

· Lower net interest expenses of only EGP3mn vs. EGP21mn last year. (Company disclosure)

SUGR Q2 2024: Lower net profits on weaker operations

Delta Sugar [SUGR] posted a 5% y/y decline in net profits to EGP723mn in Q2 2024, due to the lower revenues of EGP1.7bn (-51% y/y) and the lower gross profit margin of 35% (-5pp y/y). (Company disclosure)

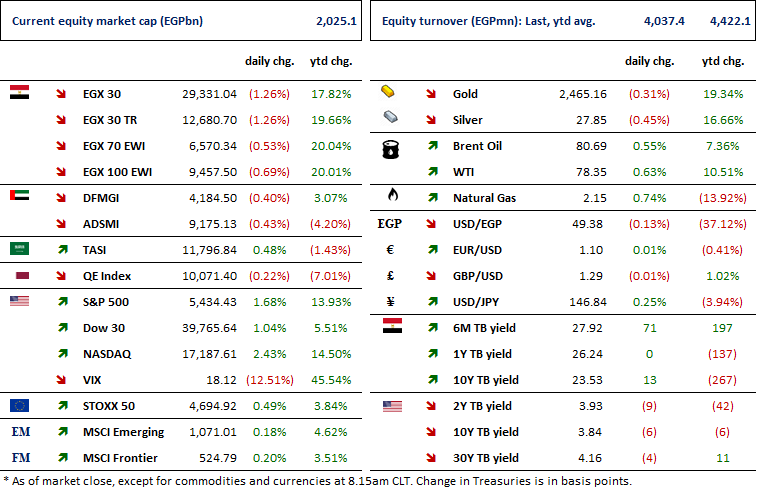

MARKETS PERFORMANCE

Key Dates

14-Aug-24

ICLE: EGM / Amending Article No. 3 of the company's bylaws.

ETEL: Earnings Announcement / Announcing Q2 2024 financial results.

ORAS: Cash dividend / Deadline for eligibility for a dividend of EGP9.69/Share.

17-Aug-24

MFPC: OGM / Considering distributing cash dividends.

18-Aug-24

OFH: OGM / A board reshuffle.

20-Aug-24

ACGC: EGM / Amending some Articles of the company's bylaws.

21-Aug-24

ORAS: Cash dividend / Payment date for a dividend of EGP9.69/Share.

EXPA: Stock dividend / Last date for eligibility for a 0.33-for-1 stock dividend.

22-Aug-24

EXPA: Stock dividend / Date for distributing a 0.33 for-1 stock dividend.

26-Aug-24

BINV: Cash dividend / Deadline for eligibility for a dividend of USD 0.020/Share.

28-Aug-24

TANM: Stock dividend / Last date for eligibility for a 0.2-for-1 stock dividend.

29-Aug-24

TANM: Stock dividend / Date for distributing a 0.2 for-1 stock dividend.

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/Share (2nd installment)

CCAP: OGM / Discussing appointing an additional auditor for the company’s accounts for the current year ending 31 Dec. ,2024.

CCAP: EGM / Discussing the continuation of the company.

SKPC: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

BINV: Cash dividend / Payment date for a dividend of USD 0.020/Share.