Today’s Top News & Analysis

Another decline in Egypt’s PMI

Highest Net Foreign Reserves in four years

MSCI Index Review: Egypt will no longer have special treatment

CCAP 2023: Earnings y/y growth driven by non-operational items

CCAP: Debt settlement and restructuring followed by a capital increase

CIRA: SEIC to submit an MTO to acquire it

SCFM 9M 2024: Earnings increased 75% y/y

CEFM 9M 2024: Earnings increased 5% y/y

AXPH 9M 2024: Earnings soared 77% y/y

MACRO

Another decline in Egypt’s PMI

Egypt’s Purchasing Manager’s Index (PMI) for the non-oil private sector saw its reading in April 2024 drawing into the contraction territory at 47.2 vs. 47.6 in March. (S&P Global)

Highest Net Foreign Reserves in four years

Net Foreign Reserves in the Central Bank of Egypt (CBE) expanded in April 2024 to USD41.1bn vs. USD40.36bn a month earlier, hitting its highest level in four years. Still, this comes as a result of the Ras El-Hekma deal. (Enterprise)

MSCI Index Review: Egypt will no longer have special treatment

MSCI will announce the results of the May 2024 Index Review for the MSCI Equity Indexes on May 14, 2024. In addition, special treatment for MSCI Egypt and MSCI Kenya Indexes will no longer be applied as liquidity and capital repatriation on the Egyptian and Kenyan foreign exchange markets have improved. (MSCI)

CORPORATE

CCAP 2023: Earnings y/y growth driven by non-operational items

Qalaa Holdings [CCAP] reported strong financial results in Q4 2023, where net income after minority interest increased significantly to EGP4.8bn compared to EGP409mn in Q4 2022. However, recurring EBITDA fell from EGP9.7bn in Q4 2022 to EGP5.9bn in Q4 2023. Consolidated revenue showed a 9% y/y growth, reaching EGP26.4bn in Q4 2023.

For the full year 2023, CCAP’s net income stood at EGP6.5bn, a substantial 419% y/y increase from EGP1.3bn in 2022. On the other hand, recurring EBITDA decreased from EGP29.6bn in 2022 to EGP22.7bn in 2023. Revenues for the year reached EGP 97.1bn, showing a 17% y/y growth. Revenue growth for both the three- and twelve-month periods was primarily driven by the contribution of Egyptian Refining Company (ERC).

The significant growth in the bottom line was driven by gains from the sale of APM Investment Holdings Limited's Ethiopian mine in Q3 2023 (EGP2.6bn) as well as gains from the divestment of shares associated with TAQA Arabia [TAQA] (EGP5bn). (Company disclosure)

CCAP: Debt settlement and restructuring followed by a capital increase

Qalaa Holdings [CCAP] received a debt purchase offer from Qalaa Holding Restructuring I Ltd (QHRI) to purchase the outstanding debt of USD325mn from CCAPs’ lenders under the Syndicated Loan Agreement, for an amount equivalent to 20% of the principal outstanding balance of the Syndicated Loan. Then QHRI will participate in CCAP’s capital increase and transfer a number of capital increase shares of CCAP to each shareholder who participated in the purchase of debt. (Company disclosure)

CIRA: SEIC to submit an MTO to acquire it

Social Impact Capital Ltd, the majority owner of CIRA Education [CIRA] with a 51.21% stake, has recently received a mandatory tender offer from the Saudi Egyptian Investment Company (SEIC). The offer outlines the intention to acquire a minimum of 75% and up to 100% of CIRA shares at a price of EGP14/share. (Company disclosure)

SCFM 9M 2024: Earnings increased 75% y/y

South Cairo & Giza Mills [SCFM] reported a 75% y/y increase in earnings to EGP33.4mn in 9M 2024. (Company disclosure)

CEFM 9M 2024: Earnings increased 5% y/y

Middle Egypt Mills [CEFM] reported a 5% y/y increase in earnings to EGP84mn in 9M 2024. (Company disclosure)

AXPH 9M 2024: Earnings soared 77% y/y

Alexandria Pharmaceuticals & Chemicals Industries [AXPH] reported a 77% y/y increase in earnings to EGP192mn on higher gross profit margin of 22.5% vs. 17.9% in the comparable period and a 27% YoY increase in revenues to EGP1.51bn in 9M 2024. (Company disclosure)

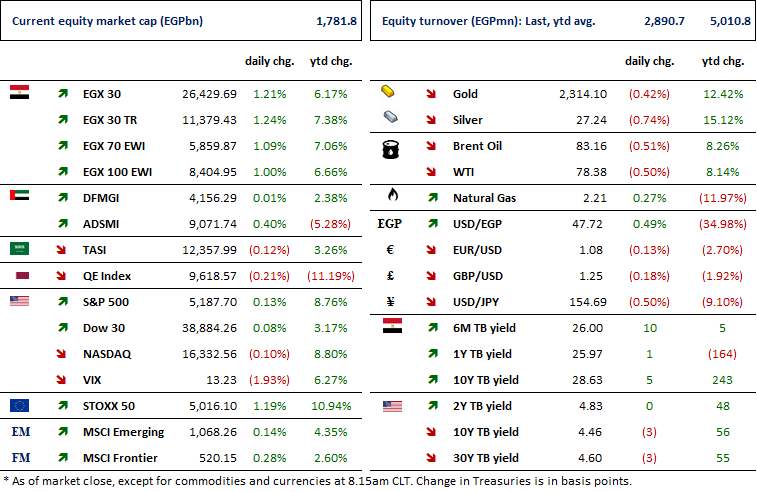

Markets Performance

Key Dates

8-May-24

Egypt PMI / April 2024 reading.

ELSH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

ELSH: EGM / Amending Article No. 7 of the company's bylaws.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

9-May-24

JUFO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

OLFI: Cash dividend / Payment date for a dividend of EGP0.950/share.

12-May-24

RAYA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RAYA: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

13-May-24

EFIH: OGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

DOMT: Cash dividend / Payment date for a dividend of EGP0.50/Share.

18-May-24

HRHO: OGM / Approving financial statements ending 31 Dec. 2023.

20-May-24

ORAS: OGM / Approvig financial statements ending 31 Dec. 2023 and the proposed dividends.

23-May-24

HELI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

26-May-24

OIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

SKPC: Cash dividend / Deadline for eligibility for a dividend of EGP1.25/Share.

OFH: OGM / Approving financial statements ending 31 Dec. 2023.

MCRO: OGM / Approving financial statements ending 31 Dec. 2023.

29-May-24

SKPC: Cash dividend / Payment date for a dividend of EGP0.75/Share (1st installment)

30-May-24

CCAP: OGM / Discussing agenda items.