Today’s Trading Playbook

KEY THEMES

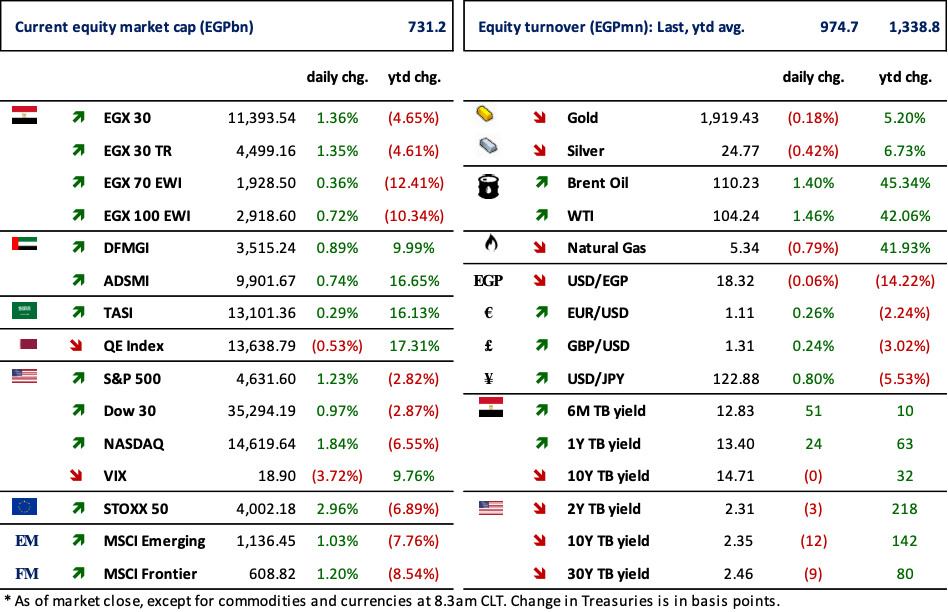

U.S. equities surged on Tuesday, with Asia shares joining the rally on early Wednesday on hopes that a diplomatic solution will end the Ukraine-Russia conflict. Meanwhile, Brent oil prices were below the USD110/bbl mark. We note that the US dollar index (DXY) came very close to breaching the 100 mark, before sliding downward to 98.0. Despite the optimism in the equity market, the spread between the 10-year and 2-year U.S. Treasury is at only 13bps, making many investors cautious about the prospect of yield curve inversion.

Here at home, the market rebounded after yesterday’s choppy trading after a three days of consecutive losses. We think Tuesday’s rebound made sense, given what we said yesterday’s Trading Playbook, indicating that we were at our lowest levels in USD terms since March 2020. We reiterate that the EGX30 is now trading at 2023e P/E of 5.7x, implying an earnings yield of c.17%.

Now, on to the top news and analysis for the day.

Top News & Analysis

MACRO NEWS

Qatar has agreed to invest USD5bn in Egypt “in the coming period,” according to the Cabinet statement. The statement didn’t disclose where the money would be invested or when the transactions would be closed. (Cabinet statement, Bloomberg)

The Suez Canal Authority recorded revenues of USD1.6bn in Q1 2022, growing by 18.5% y/y. (Economy Plus)

Egypt’s wheat imports in 2022-2023 are expected to drop to their lowest in nine years as the Russia-Ukraine war cuts two of our biggest suppliers off from the export market. (Enterprise)

CORPORATE NEWS

MM Group [MTIE] net earnings in 2021 grew marginally to EGP375mn (+1.3% y/y) in view of achieving top line of EGP9bn (+4% y/y). MTIE is currently traded at 2021 P/E of 11x. (Company disclosure)

Elsewedy Electric’s [SWDY] OGM has approved not to distribute cash dividends from 2021 achieved net earnings. (Mubasher)

Emaar Misr for Development [EMFD] has announced the launch of Uptown Club in Uptown Cairo. The club will provide luxurious and modern spaces for various sports and art forms. (Arab finance)

Pioneers Properties [PRDC] result showed a consolidated net profit of EGP298mn from the start of its establishment in October 2021 to the end of 2021, where revenue amounted to EGP1.6bn. (Mubasher)

Arab Cotton Ginning Co.’s [ACGC] H1 2021/22 KPIs showed net income of EGP26mn vs. EGP0.7mn a year ago on higher gross profit margin of 22% vs. 10% a year earlier.Revenues, however, dropped to EGP534mn (-5% y/y) during the same period. (Company disclosure)

Nile Pharmaceuticals [NIPH] net earnings in 8M 2021/22 were up 10% y/y to EGP77mn.(Mubasher)

Egyptian Financial and Industrial [EFIC] shareholders have approved dividend distribution of EGP2/share, implying 12.0% in dividend yield. (Mubasher)

Kafr El Zayat Pesticides [KZPC] shareholders have approved a dividend distribution of EGP4/share, implying 12.3% in dividend yield. (Mubasher)

Egypt Aluminum [EGAL] is targeting net earnings in 2022/23 of EGP1.6bn, implying forward P/E of 6x. (Company disclosure)

GLOBAL NEWS

Oil prices clawed back heavy losses on Wednesday, amid tight supply and growing prospects of new Western sanctions against Russia even as signs of progress emerged from peace talks between Moscow and Kyiv. (Reuters)

Russia has offered to buy back dollar bonds maturing next week in roubles in a move seen by analysts as helping local holders of the USD2bn sovereign issue receive payment, while also easing the country's hard-currency repayment burden. (Reuters)

The energy ministers of Saudi Arabia and the United Arab Emirates, key members of OPEC+, said on Tuesday the producers' group should not engage in politics as pressure mounted on them to take action against Russia over its invasion of Ukraine. (Reuters)

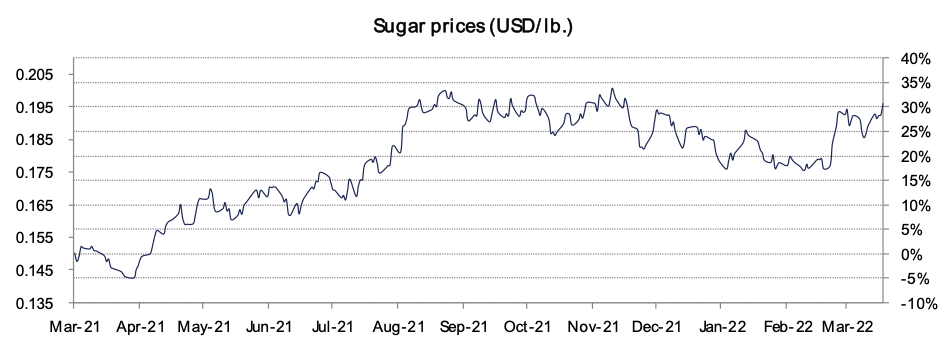

3. Chart of the Day

Source: TradingEconomics.com.

Sugar futures on ICE rose to USD0.196 per pound (lb.) by end of March, a three-week high, tracking higher oil prices on expectations of lower supply. It is now up 31% y/y.