Today’s Trading Playbook

Amany Shaaban | Equity Analyst

KEY THEMES

Yesterday, the management of Commercial International Bank [COMI] held their Q1 2022 a conference where they discussed the results. Below are our key highlights from the call:

Q1 witnessed some one-offs: COMI achieved its highest quarter ever in terms of net earnings, while reporting a number of one-offs, such as:

(1) Considerable contingent provisions booked due to certain exposure to Russian banks in the form of counter guarantees. With the new “C” credit rating for Russian banks, COMI had to book higher provisions, just in case. The possibility of this taking place in the future depends on Russian banks’ credit rating stability; further deterioration would require more provisions to be booked.

(2) FX gains arising from COMI’s long USD position, coupled with gains realized on sale of financial investments through comprehensive income.

Despite tightening measures, loan book outlook remains robust: Lending growth target for the year remains around 20%, even with the interest rate outlook, as corporates still need to borrow in order to sustain their businesses and imports. Meanwhile, management projects that for each 100bps hike in interest rate, the bank’s NIM widens by 20-35bps.

How will the new high-yield CDs play out? The 18% p.a. high-yield one-year CDs offered by state-owned banks are very costly, effectively costing the banks 21% after accounting for the 14% required reserve ratio. On the other hand, it’s impossible for private banks to follow suit. Around 80% of the EGP500bn proceeds flowing to these CDs have in fact mostly cannibalized on the balance sheets of the two main state-owned banks themselves, namely National Bank of Egypt and Banque Misr. On the other hand, only 20% came from the rest of the market. For COMI itself, only around EGP11bn shifted to the 18% CDs (i.e. 2.6% of deposits). COMI might consider increasing its rates depending on upcoming inflation readings.

The reason behind the improving credit quality: The decrease in the NPL ratio was in light of loan write-offs. Management targets credit provisions in 2022 of c.EGP1bn, excluding any unusual items, like the contingent provisions mentioned above.

The status quo of asset allocation in 2022: As for Treasury yields, management expects a 250bps rate hike within the upcoming two months. Accordingly, the bank will be more inclined to utilize its funding sources in Treasury investments.

Gauging the impact of the recent EGP depreciation: The EGP depreciation had no sizeable effect on COMI’s foreign currency portfolio. Going forward, management does not expect any further weakness in EGP. With a foreign-currency NIM between 1.4-1.5%, COMI expects mid-single-digit organic growth in foreign-currency loans of around 4-7%, in addition to the impact of a weaker EGP.

Shedding light on new import procedures: According to management, the new letters of credit (LC) regulations by the CBE place an obligation on banks more than importers, as banks will need to guarantee payments as opposed to incoming documents for collection (IDC). Banks also have to give facility limits to companies that otherwise wouldn’t have had limits under the old regime. However, management stated that the new treatment should not have any negative impact either on imports or foreign currency balance. Also, if there are any delays, it’s only due to adjusting to new procedures.

Finally, management expectations for net earnings in 2022 remain the same at EGP15.5bn. This implies that COMI is currently traded at 2022e P/E of 5.3x. COMI is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an Overweight rating on COMI, with our 12MPT of EGP72/share (ETR +72%)

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The International Monetary Fund chief said that the upcoming IMF loan program to Egypt aims to support the country's social protection system amid rising food and energy prices against the backdrop of the Russian war in Ukraine. (Economy Plus)

Suez Canal revenues jumped last March to USD601.7mn, an increase of 36% y/y compared to its counterpart in 2021, which amounted to USD439.4mn. (Economy Plus)

CORPORATE NEWS

Ezz Steel [ESRS] OGM has approved dividends distribution of EGP0.8/share, implying 6% in yield. (Company disclosure)

Al Ezz Dekheila Steel - Alexandria [IRAX] OGM has approved dividends distribution of EGP60.0/share, implying 11% in yield. (Company disclosure)

Al-Ezz for Ceramics and Porcelain [ECAP] OGM has approved dividends distribution of EGP0.55/share, implying 6% in yield. (Company disclosure)

Egyptian Chemical Industries (KIMA) [EGCH] is seeking to generate EGP4.291bn in revenue during the 2022/2023. Meanwhile, EGCH is targeting a distributable bottom line of EGP426.4mn in 2022/2023. (Arab Finance)

MM Group for Industry & International Trade [MTIE] obtained the Financial Regulatory Authority (FRA) approval add the activity of establishing specialized service centers for maintenance, installation and repair work to serve the activity of air conditioners and the activity of electrical and non-electric household appliances. (FRA)

Palm Hills Developments [PHDC] has raised its stake in International Company for Leasing [ICLE] to 18.2% from 15.3% by purchasing around 576,000 shares with a total value of c.EGP23.6mn at an average price of EGP41/share. (Mubasher)

Orascom Development [ORHD] plans to launch three new projects in El Gouna in 2022, including a hotel and real estate. (Arab finance)

GLOBAL NEWS

A prolonged slowdown in China would have substantial global spillovers, IMF Managing Director Kristalina Georgieva said on Thursday, but added that Beijing has room to adjust policy to provide support. (Reuters)

Refiners are planning to spend the summer increasing jet fuel and diesel production instead of gasoline, traders and analysts said, favoring what have historically been the least profitable parts of the barrel instead of the most profitable. (Reuters)

Germany will stop importing oil from Russia by the end of the year, said German Foreign Minister Annalena Baerbock after a meeting with her Baltic counterparts on Wednesday.(Reuters)

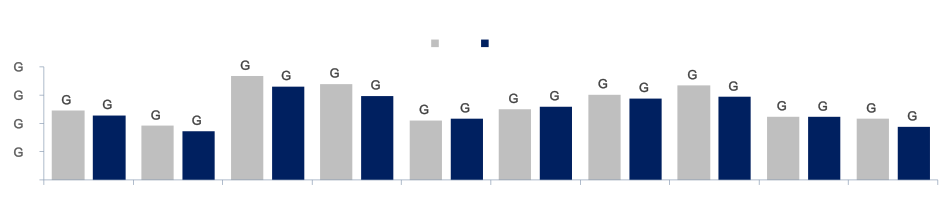

3. Chart of the Day

Amany Shaaban | Equity Analyst

Source: Banks' Financials, Prime Research.

Net interest margin (NIM) has declined across all banks in 2021 as the effect of the interest rate cut in 2020 materialized. It’s expected for the NIM to stabilize in 2022, or even improve for some banks on the back of the expected hiking cycle.