Today’s Top News & Analysis

Egypt to receive a USD820mn this week

EU to give Egypt a EUR1bn emergency fund

Egypt to receive Ras El-Hekma dues in May 2024

Lower interest rates at the last T-bills auction

SCZone approves new projects

MACRO

Egypt to receive a USD820mn this week

On Friday, the International Monetary Fund (IMF) approved raising Egypt's extended fund facility from USD5bn to USD8bn. The fund also approved an immediate withdrawal of USD820mn that is expected to be received this week as per the PM’s talks yesterday. (Enterprise)

EU to give Egypt a EUR1bn emergency fund

The European Union (EU) will apply an emergency funding mechanism to accelerate lending Egypt a EUR1bn macro-financial assistance fund. This should bypass the EU's parliament approval and the evaluation of the funding's effect. We note that the EUR1bn fund is a part of EU's EUR7.4bn that was approved recently. (Enterprise)

Egypt to receive Ras El-Hekma dues in May 2024

The Egyptian PM said that the government will receive the second tranch of Ras El-Hekma dues by the beginning of May 2024. We note that Egypt already received USD10bn as a first tranch. (Enterprise)

Lower interest rates at the last T-bills auction

On Thursday, the Ministry of Finance raised 1-year and 6-month t-bills worth EGP25bn and EGP35bn, respectively. For the third time this month, the average yield dropped to 25.9% vs. 32.3% and 25.75% vs. 31.84% on 7 March 2024. However, the demand is still high, where the 1-year t-bills received offers 4x higher than the original ask and the 6-month t-bills received 2x more. (Enterprise)

SCZone approves new projects

The General Authority of the SCZone approved the start of the following projects:

Orascom Industrial Parks, a subsidiary of Orascom Construction [ORAS], to develop an EGP13bn industrial complex in the Sokhna Industrial Zone.

Turkey's DNM Textile for Spinning, Weaving, & Dyeing will develop a USD40mn denim factory in Qantara West Industrial Zone in addition to an industrial complex for cloth production.

SCZone will be a route of green fuel exportation to Europe.

The Norwegian Jotun factory has started operations in the Tenth of Ramadan Industrial Zone, the factory is worth USD100mn. (enterprise)

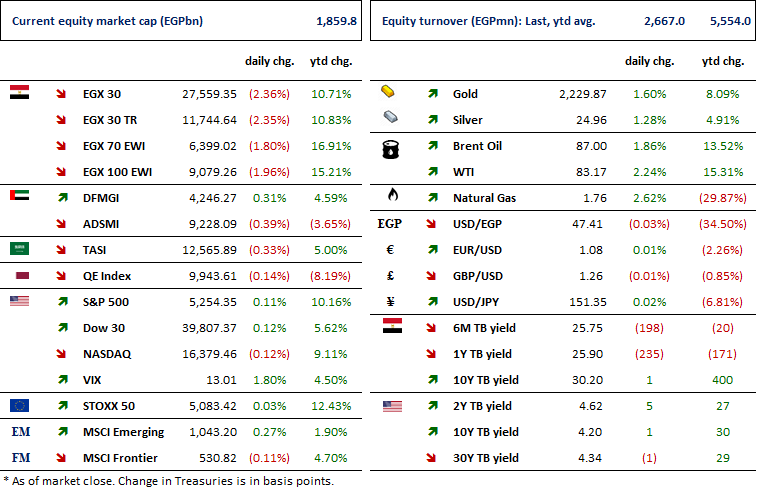

Markets Performance

Key Dates

31-Mar-24

ARCC: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

LCSW: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

EFIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RACC: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RACC: EGM / Amending Articles No. 6 & 7 of the company's bylaws.

EKHO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

2-Apr-24

ORWE: EGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

ORWE: OGM / Amending some Articles of the company's bylaws.

MFPC: Cash dividend / Deadline for eligibility for a dividend of EGP2.00/Share.

3-Apr-24

Egypt PMI / March 2023 reading.

6-Apr-24

OLFI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

7-Apr-24

FWRY: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MFPC: Cash dividend / Payment date for a dividend of EGP2.00/share.