New Research

Arabian Cement Co. [ARCC]: Survival of the Fittest

Playing in the big league: Powered by two production lines producing 4.2mn tons of clinker (the equivalent of 5mn tons of cement), Arabian Cement Co. [ARCC] is the sixth largest cement producer in Egypt’s cement industry. ARCC produces and sells clinker and cement in both the local and the export markets, with a total of c.4.5mn tons of clinker and cement sold in 2022. ARCC also offers transportation services, which contributed c.4% to revenues in 2022.

Overweight / High Risk, 12MPT EGP15.1/share (+96%): Despite the tough years the Egyptian cement industry faced between 2019-2021, ARCC’s focus on efficiency to streamline its cost structure, alongside strong sales volumes and shrewd management team, makes ARCC a good investment option, in our view. In addition, ARCC boasts a generous dividend yield of c.15%, with a dividend payout ratio expected to stabilize over our forecast horizon. We valued ARCC using a five-year discounted cash flow (DCF) model, which produced a fair value of EGP11.4/share and a 12-month price target (12MPT) of EGP15.1/share (an 96% upside), hence our Overweight rating. Our 12MPT implies a conservative 2023e P/E of 7.5x and an undemanding 2023e EV/EBITDA of 4.2x. Currently, ARCC is trading at an EV/ton of EGP666 (USD21.6), an 8% discount to a peers' average of EGP727 (USD23.5).

For the full report, please click here.

Today’s Top News & Analysis

The CBE canceled the 11% initiative for the tourism sector

Japanese Yazaki to start its factory construction in Fayoum

A block trade on TAQA Arabia shares

Beltone to buy an office building from SODIC

Qalaa Holding, ECARU, and Axens to produce bioethanol

MACRO

The CBE canceled the 11% initiative for the tourism sector

The Central Bank of Egypt (CBE) announced canceling the 11% initiative for the tourism sector, adding that there will be no new loans granted under the 11% initiative. However, there will be a new initiative to be announced later, in co-operation between the Ministries of Finance and Tourism. (Al-Borsa)

Japanese Yazaki to start its factory construction in Fayoum

The Japan-based Yazaki, an auto parts manufacturer, has been given the green light to start construction of its EUR30mn factory in the Fayoum Free Zone after signing the land contracts with authorities. (Enterprise)

CORPORATE

A block trade on TAQA Arabia shares

Yesterday, a block trade was executed on a 20% stake (270mn shares) of TAQA Arabia’s [TAQA] shares worth EGP1.6bn. The trade was intended to close one of TAQA’s debts by transferring its processes to one of the creditors. (EGX)

Beltone to buy an office building from SODIC

SODIC's [OCDI] shareholders approved the sale of a 6,900 sqm office building in Eastown project to Beltone Financial Holding [BTFH] for EGP1.1bn. BTFH will pay 20% up front with the rest of the amount to be paid each quarter over the coming 4.5 years. (Enterprise)

Qalaa Holding, ECARU, and Axens to produce bioethanol

ECARU, Qalaa Holding [CCAP], and French Axens will carry out joint research into producing green fuel in Egypt. The three companies will conduct technical and economic studies on the production of advanced bioethanol and sustainable aviation fuel, with plans to export bioethanol. (Enterprise)

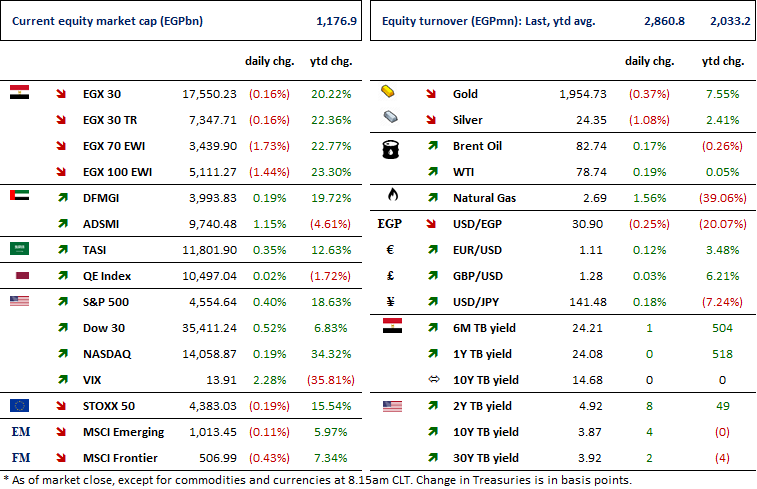

Markets Performance

Key Dates

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).