Fundamental Thoughts

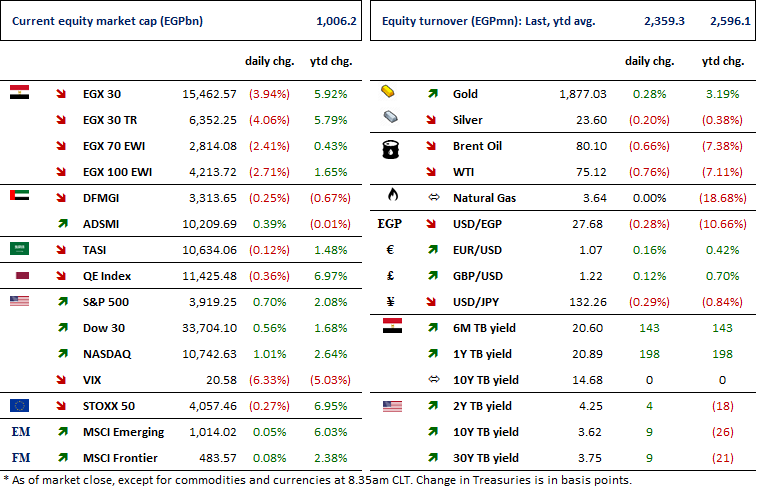

It was an ugly trading session yesterday, with both EGX 30 (-3.9%) and EGX 70 EWI (-2.4%) mimicking the same performance from start to finish. It looked like the mounting pressure we referred to yesterday was released in the form of a profit-taking wave. Egyptian institutions were net sellers for the day, probably taking some profits off the table, while foreign investors fell back to their usual status as net sellers.

The trigger? We can only guess that a higher-than-expected December 2022 inflation reading may have led investors to think of further tightening by the Central Bank of Egypt (CBE) when it meets in three weeks. This alone can push valuations lower, especially when the USD only inched higher yesterday to EGP27.65. Indeed, EGX 30 USD closed yesterday down 4.2%, extending its ytd loss to 5.3%.

That said, we think this is a good opportunity for those who missed the early rally at the start of the year to breathe the pressure and jump back in at current levels.

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Key points from IMF's press release regarding Egypt's Extended Fund Facility

Egypt’s core inflation rise to 24.4% in December 2022

ExxonMobil obtains Exploration Rights in Nile Delta

AD Ports interested in Suez Port (Port Tawfiq)

CIB reportedly issues new 22.5% 18-months CDs

Egyptian steel companies hike their prices

Telecom Egypt to obtain new frequencies soon

Contact Financial Holding aims to expand its portfolio

EFID to sell used equipment to its plant in Morocco

B.Tech closes its first securitized bonds issuance

AMN for Industrial Investment ups its stake in PACHIN

MACRO

Key points from IMF's press release regarding Egypt's Extended Fund Facility

The International Monetary Fund (IMF) published yesterday a press release with some details about Egypt’s Extended Fund Facility (EFF), some key points of which we highlight below:

· The CBE will commit to a durably flexible exchange rate that should conform to the dynamics of the country’s balance of payments (BoP), preventing the imbalances to resurface in the future and in turn furtherly improving its export competitiveness.

· Mounting inflationary pressures require a tighter CBE monetary policy.

· The CBE will consult with IMF staff when headline inflation comes outside an inflation target of the 5%-9% range and consult with the Executive Board if inflation falls outside the outer bands of 3%-18% in December 2022, 3%-16% in March 2023, and 3%-15% in June 2023.

· The CBE will stop providing governmental entities with foreign currency liquidity out of the reserves in order to fund their imports.

· Foreign reserves growth outside the scope of borrowing is a major target of the IMF program. Accordingly, the IMF target a cumulative increase in reserves of USD6bn during FY23 and USD10.1bn in FY24.

· The CBE will apply, in a more decisive manner, restrictions on net foreign currency position for banks in order to put a lid on extremely negative net foreign assets (NFAs). Hence, the CBE will monitor individual banks’ net open positions, NFAs, and foreign exchange transactions on the interbank market, and it will consult with IMF staff if aggregate banks’ NFAs show a cumulative decline of USD2bn over a three-month period.

· Egypt’s financing gap for FY23 is estimated at USD5bn, which is to be closed from the IMF and different lenders, including The World Bank, the China Development Bank, the Asian Infrastructure Investment Bank, the Arab Monetary Fund, and the African Development Bank. Throughout 2023, Egypt will receive USD700mn from the IMF, with two USD347mn tranches scheduled for March and September. The Egyptian government will receive also USD2bn from committed purchases of public sector assets, including from partners in the GCC. The remaining USD2bn from the IMF will be across six USD 347 tranches through September 2026, with two disbursements scheduled for March and September each year.

· Egypt’s financing gap is estimated at USD17bn over the next four years or so. The USD3bn IMF program will only account for less than 20% of that amount, with the remainder expected to be filled by other multilateral and bilateral creditors.

· Egypt secured assurances from GCC partners that the USD28bn in official deposits from GCC members at the CBE (at end-September 2022) will not mature until after the completion of the 4y EFF in September 2026 and will not be used for the purchase of equities or debt.

· Egypt will carry out an ambitious privatization plan where certain purchases of equity stakes in state-owned assets with proceeds going towards increasing international reserves, closing the financing gap, further strengthening the country’s fiscal position, and reducing government debt.

· Egypt will publish a comprehensive annual tax expenditure report, detailing tax exemptions and tax breaks provided to companies operating in free economic zones and to all state-owned enterprises (including public sector companies, public business sector companies, military-owned companies, economic authorities, and joint ventures and partnerships).

Egypt’s core inflation rise to 24.4% in December 2022

Similar to headline inflation, Egypt’s core inflation rose to 24.4% in December 2022 compared to 21.5% in November 2022, while m/m inflation was 2.6% in December vs. 2.7% in November. (Economy Plus)

ExxonMobil obtains Exploration Rights in Nile Delta

ExxonMobil has been granted exploration rights to two offshore drilling blocks, covering a combined area of over 11,000 sq. km. Both sites are located in the outer Nile Delta region and ExxonMobil Egypt will begin operations this year, following final approval from the Egyptian government. (Reuters)

AD Ports interested in Suez Port (Port Tawfiq)

Abu Dhabi Ports (AD Ports) is reportedly in negotiations with the Egyptian government to develop and manage the Suez Port (Port Tawfiq) on a right-of-use basis contract. AD Ports currently operates Ain Sokhna Port and a multi-purpose terminal in Safaga Port in Egypt. Last September, AD Ports acquired a 70% stake in two Egyptian logistics companies, Transmar and Transcargo International, for USD140mn. (Asharq Business)

CORPORATE

CIB reportedly issues new 22.5% 18-months CDs

Commercial International Bank - Egypt [COMI] has reportedly issued new high-yield 18-month CDs, a 20% p.a. paid monthly and a 22.5% p.a. paid as a lump sum at maturity. (Al-Masry Al-Youm)

Egyptian steel companies hike their prices

Beshay Steel increased its rebar prices by 14% to EGP27,360/ton compared to EGP24,000/ton in mid-December. The Arab Iron & Steel Union (AISU) reported that average international rebar prices reached USD700/ton in the first week of 2023, up from USD680/ton in the last week of 2022. Rising billet prices (USD550/ton vs. USD530/ton) are to blame for the price increase. Beshay’s new price is equivalent to almost USD1,000/ton, which is USD300 higher than the average international price. Ezz Steel [ESRS] is also set to raise its price today for both long and flat steel to EGP25,985/ton compared to EGP23,450/ton in mid-December. (Al-Borsa)

Telecom Egypt to obtain new frequencies soon

Telecom Egypt’s [ETEL] mobile operator, WE, will soon obtain new additional frequencies to improve the quality of its service. The cost of these frequencies is said to be USD125mn and will be funded through loans. WE has managed to add on 12mn mobile subs in five years despite a saturated market with penetration rate of 110%. (Economy Plus)

Contact Financial Holding aims to expand its portfolio

Contact Financial Holding [CNFN] is aiming to expand its current outstanding portfolio by 70% to EGP19bn in 2023, targeting Saudi Arabia and the UAE. CNFN’s portfolio grew 62% to EGP11.4bn in 2022, driven in part by expansion into the African market. (Al-Borsa)

EFID to sell used equipment to its plant in Morocco

Edita Food Industries’ [EFID] BoD approved selling 825 Twinkies molds to its plant in Morocco for a total of EUR83,500 which is equivalent to EGP2.4mn. (Company disclosure)

B.Tech closes its first securitized bonds issuance

B.Tech has reportedly finalized a securitization bond issuance worth EGP1bn over three tranches with a credit rating of P1. The issuance is the first of an EGP5.0bn approved bond program that should be finalized within two years. (Arab Finance)

AMN for Industrial Investment ups its stake in PACHIN

AMN for Industrial Investment upped its stake in Paints & Chemical Industries (PACHIN) [PACH] from 9.937% to 10.604% after buying 160,205 shares at an average price of EGP28.99/share. (Company disclosure)