New Research

Alexandria Containers Handling [ALCN] – Breaking Higher Waves

On 20 November 2022, we published a Core Coverage report on Alexandria Containers & Cargo Handling Co. [ALCN] with an Overweight rating and a 12MPT of EGP16.9/share. The stock price has exceeded that 12MPT, having rallied 39% since then from EGP13.05/share. The USD has also strengthened against the EGP, which in consequence led to a higher revenue per container in H1 2022/23 (+73% y/y). Hence, we updated our model for ALCN, which resulted in a higher 12MPT of EGP27.5/share, thanks to the stronger USD, offering a 52% upside. Thus, we maintain our Overweight/Medium Risk rating.

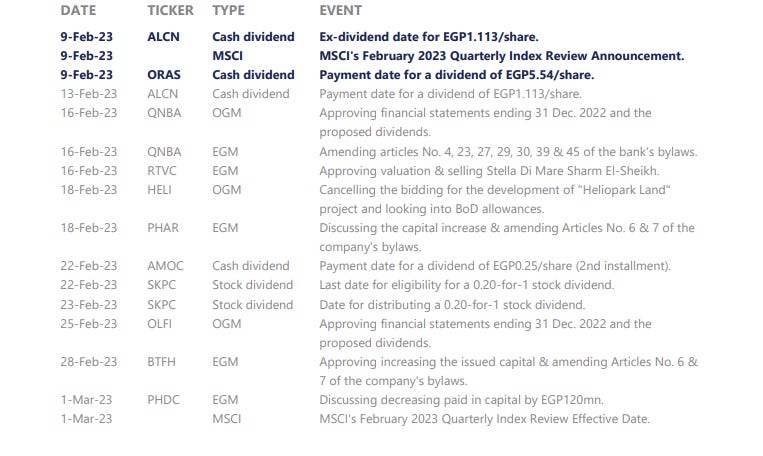

We also note that today, 9 February 2023, is the ex-dividend date for ALCN's EGP1.11/share dividend payment. Thus, we adjust our 12MPT down to EGP26.1/share, still implying an upside of 57% (based on yesterday’s DPS-adjusted closing price).

For the full Core Coverage update, please click here.

Today’s Top News & Analysis

Egypt to sell stakes in 32 state companies within a year through March 2024

Inflation in Egypt jumps to the highest level in more than 5 years

Egypt’s government studies creating electricity pricing committee every 3 or 6 months

Egypt negotiates to import Serbian wheat; finance wheat & grain silos

CI Capital Holding closes a securitization bond for Aman

Export Development Bank of Egypt's OGM approves 2023 budget

Contact Financial Holding and Global Auto partnered to form a firm

Overcrowding of export containers in Alexandria Container Handling Co.’s terminal

MACRO

Egypt to sell stakes in 32 state companies within a year through March 2024

Following Wednesday’s Cabinet meeting, the Prime Minister announced that:

· 32 companies will be offered for sale either through IPOs on the EGX or by selling stakes to strategic investors.

· The companies are distributed over 18 sectors, including three banks namely, Banque du Caire [BQDC], Arab African International Bank (AAIB), and The United Bank. Meanwhile, National Co. for Natural Water (Safi) and National Petroleum Co. (Wataniya), two military-owned companies, are also included.

· The offering will take place within a year, and at least 25% of the companies will be offered during H1 2023. (Asharq Business)

Inflation in Egypt jumps to the highest level in more than 5 years

The increase in food prices and the EGP devaluation prompted an acceleration of inflation in Egypt during January, reaching its highest level in more than 5 years, to record 25.8% in January 2023 y/y, compared to 21.3% in December 2022, according to CAPMAS. The inflation exceeded Prime Research's expectation of 23.8%. (Asharq business)

Egypt’s government studies creating electricity pricing committee every 3 or 6 months

The Egyptian government suggested creating an electricity pricing committee that meets every 3 or 6 months, similar to the fuel pricing committee. This is due to the EGP devaluation and the increased prices of oil and gas. Currently, electricity prices are based on the exchange rate of EGP18/USD. Therefore, the government plans to increase electricity prices by July 2023. (Asharq Business)

Egypt negotiates to import Serbian wheat; finance wheat & grain silos

The Minister of Supply announced that there are:

· Negotiations with the Serbian side to import up to 1mn tons of wheat through Constanta port.

· Discussions with the European Investment bank to finance silos for storing wheat and grains in Damietta port, with a capacity of 200,000 tons, in addition to other 5 silos with a capacity of 5,000 tons each. (CNBC Arabia)

CORPORATE

CI Capital Holding closes a securitization bond for Aman

CI Capital Holding [CICH] closed an EGP403mn securitization bond for Aman, a Raya Holding [RAYA] subsidiary, as part of an EGP5bn program. The bond is comprised of three tiers (13, 37, and 56 months). (Mubasher)

Export Development Bank of Egypt's OGM approves 2023 budget

Export Development Bank of Egypt's [EXPA] OGM approved the bank's budget for 2023. The budget targets a 21% growth in loans to EGP52bn, with focus on retail loans to represent 15% of total loan book in 2023 against 12% in 2022. Meanwhile, a 12% growth is targeted for deposits to EGP82.7bn, with focus on local-currency deposits. The bank also targets total assets growth of 12% to EGP101bn and growth in net fees and commissions of 25% to EGP624mn. (Bank disclosure)

Contact Financial Holding and Global Auto partnered to form a firm

Contact Financial Holding [CNFN] and Global Auto will establish a consumer finance arm to finance the latter’s services. CNFN will also provide its insurance services to Global Auto's clients. (Mubasher)

Overcrowding of export containers in Alexandria Container Handling Co.’s terminal

There has reportedly been overcrowding of export containers currently in Alexandria Container Handling [ALCN] terminal in Alexandria port, which is due to insufficient space for storing containers in the terminal. This might affect the flow of exports temporarily. (Al-Mal)