TODAY’S TOP NEWS & ANALYSIS

Egypt and Qatar sign a double taxation agreement

Credit Agricole 2022: Remarkable operating performance

ORWE’s 2022: Strong earnings growth

Edita to acquire 100% stake in a company in food industries

E-Finance plans to invest EGP2.5bn within three years

ISPH clarifies misinterpreted news regarding their 2023 investments

MACRO

Egypt and Qatar sign a double taxation agreement

Egypt and Qatar sign a double taxation agreement An agreement to eliminate double taxation and tackle tax evasion was reached between Egypt and Qatar. The agreement includes capital gains, income, corporate profit, interest and dividends. (Enterprise)

CORPORATE

Credit Agricole 2022: Remarkable operating performance

Credit Agricole - Egypt [CIEB] announced strong financial results for 2022. CIEB’s net income increased 52% y/y to EGP2.4bn (+39% higher than our estimates). This was on the back of:

1) A stronger than expected growth in net interest income of 30% tp EGP3.8bn mainly on income from loans that grew 27% y/y.

2) 40% y/y lower provisions of EGP193mn where CoR decreased to 0.6%.

3) 45% increase in net fees and commissions income to EGP828mn.

4) 36% increase in other operating income to EGP113mn.

• On the balance sheet side, CIEB’s loan book increased by 13% ytd to EGP34.4bn, attributable to corporate loans. With a decreased NPL ratio of 2.9% and a stable coverage ratio at 150%.

• While deposits grew by 25% ytd to EGP60bn with an equal contribution to growth from local and foreign currency deposits.

• Total financial investments grew significantly ytd by 62% to EGP13bn which is a new approach for CIEB. This has caused GLDR to drop from 63% to 57%. Now treasuries represent 17% of CIEB’s total assets against 13% last year.

• Interbank assets saw huge growth as well to EGP20.7bn, almost double its balance last year.

• Given this huge growth in interest earning assets, CIEB’s NIM remained flat at 6.6% in 2022, while ROAE expanded 6 pp y/y to 26%.

• CIEB’s positive assets repricing gap widened to 30% of total assets, which makes the bank a strong beneficiary of interest rate increases.

• While the positive foreign currency net position still makes the bank make good use of any further devaluations.

• BoD suggested distributing a DPS of EGP1.55/share which implies a payout ratio of 80% and a dividends yield of 15%.

• The bank is currently traded at a P/E of 5.3x and a P/BV of 1.3x (Bank disclosures: 1, 2)

CIEB — Rating: OW / M, 12MPT: EGP8.30/share. FV EGP11/share (22-Aug-2022)

ORWE’s 2022: Strong earnings growth

Oriental Weavers Carpet [ORWE] reported Q4 2022 consolidated net profits of EGP316mn (+39% y/y) on higher revenues of EGP3.8bn (+25% y/y). Revenue growth was driven by prices rather than volumes which decreased 20% y/y to 28.1mn sqm. Still, the Egypt-based woven segment was the highest revenue contributor with 65% or EGP2.5bn (+35% y/y). However, gross profit and EBITDA margins decreased to 7% (-7pp y/y) and 11% (3pp y/y), respectively. The BoD proposed distributing a cash dividend of EGP0.6/share, implying a 5% yield. (Company disclosure)

Edita to acquire 100% stake in a company in food industries

Edita Food Industries’ [EFID] BoD approved the acquisition of 100% stake in a company specialized in food industries but not listed on the EGX. (Company disclosure)

E-Finance plans to invest EGP2.5bn within three years

E-Finance [EFIH] intends to invest up to EGP2.5bn within the next three years to 2025, targeting EGP0.9-1.2bn within 2023. The investments are earmarked for the evolution of EFIH's infrastructure base and the acquisition of fintech startups. (Al-Mal)

[ISPH] clarified misinterpreted news published recently which cited EGP200mn investments in 2023.

The company said that this was within the context of a response to an inquiry regarding the company's average investments over the last few years, which amounted to less than EGP200mn annually with no specific figures disclosed. (Company disclosure)

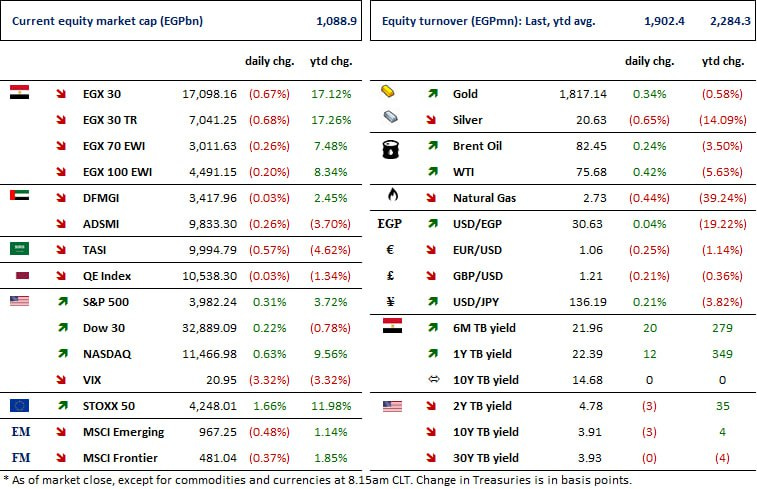

MARKETS PERFORMANCE

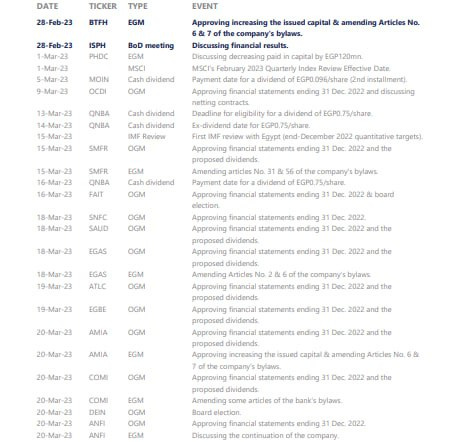

KEY DATES

LATEST RESEARCH