Today’s Top News & Analysis

Net Foreign reserves hit USD40.36bn on Ras El-Hekma deal

Ministry of Planning adjusts private investment calculations

Change drug prices would take 4-6 months

An LNG shipment to avoid fuel shortages; blackouts may continue after Eid

MACRO

Net Foreign reserves hit USD40.36bn on Ras El-Hekma deal

Net Foreign reserves in the Central Bank of Egypt (CBE) expanded in March 2024 to USD40.36bn (+14.3% m/m), thanks in part to the inflows from Ras El-Hekma deal followed by the special MPC meeting that concluded a 6% raise in interest rates and a free exchange rate. (Enterprise)

Ministry of Planning adjusts private investment calculations

The Ministry of Planning adjusted its calculation methods for the private sector investments through FY23 leading to valuing the private sector's contribution to the overall economy at 36.4% instead of 25.5% (EGP499bn vs. EGP299bn). Consequently, the private sector's forecasts through Q1 FY24 have also been adjusted to EGP154bn vs. EGP114bn in a previous forecast, raising the overall forecast of the year to EGP600bn. (Ministry statement)

Change drug prices would take 4-6 months

The Egyptian Drug Authority (EDA) told the Federation of Egyptian Chambers of Commerce’s pharma division that raising the drug prices would take at least 4-6 months to be applied. The federation's head said that this timeline would be 2 months for the EDA to study all price proposals and another 2-4 months for the cabinet to approve. Sources said that there are three scenarios of proposed prices as follows:

(1) All drug prices to be raised by 30-40% at four stages timeline through a year (25% of drugs per quarter).

(2) Only 3,000 drug prices to be raised between 30-80% while fixing the prices of other drugs.

(3) 1,500 drug prices to be raised at three stages timeline by 25-30% (500 drugs per stage).

Meanwhile, the federation's head expected that the price changes would only be applied to 10% of the total drug market, while a 10% price increase would be applied to the total market without an actual announcement. (Alarabiya)

An LNG shipment to avoid fuel shortages; blackouts may continue after Eid

It is said that the Egyptian government bought an LNG shipment through its holding company, the Egyptian Natural Gas Holding Co. (EGAS) in a move aiming to avoid fuel shortages. We note that a source said that the electricity blackouts may start again after Eid in response to the increased costs after the MPC decisions to keep a free exchange rate. This aims to overcome the summer's high demand for energy and save the country's natural gas reserves. (Asharq Business, Enterprise)

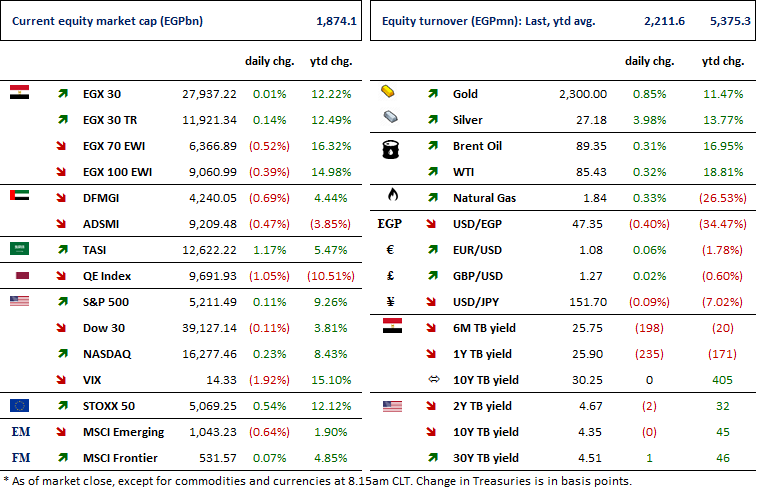

Markets Performance

Key Dates

6-Apr-24

OLFI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

7-Apr-24

FWRY: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MFPC: Cash dividend / Payment date for a dividend of EGP2.00/share.

14-Apr-24

DOMT: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

16-Apr-24

ORHD: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

17-Apr-24

MASR: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

18-Apr-24

SWDY: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

SWDY: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

CLHO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

CICH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

CICH: EGM / Amending some Articles of the company's bylaws.

20-Apr-24

DSCW: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

DSCW: EGM / Amending Articles No. 3, 4 & 7 of the company's bylaws.

21-Apr-24

CIEB: Cash dividend / Deadline for eligibility for a dividend of EGP1.145/Share.

24-Apr-24

CIEB: Cash dividend / Payment date for a dividend of EGP1.145/share.

29-Apr-24

RMDA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.