Today’s Top News & Analysis

Lower budget deficit and debt rate; higher primary surplus

EGP596bn for subsidies and social support through FY25

RMDA 2023: Lower net profits on higher net finance expenses

DSCW 2023: Strong net profit growth driven by a low base year and strong operations

KABO Q2 2023/24: Strong net profits on better revenues and non-operating gains

MACRO

Lower budget deficit and debt rate; higher primary surplus

The Minister of Finance said that the government plans to reduce the budget deficit to 6% of GDP in FY25 knowing that the deficit reached 6.7% in 8M FY25 until February 2024. He added that it is expected that the budget deficit will reach 5% by June 2027. In addition, the government plans to raise the primary surplus to 3.5% and reduce the debt rate to 80%. (Asharq Business)

EGP596bn for subsidies and social support through FY25

The Minister of Finance said that the government has allocated EGP596bn for subsidies and social support through the next fiscal year, FY25, which includes:

· Commodity Subsidies: EGP134bn.

· Subsidized fuel: more than EGP147bn.

Takaful & Karama: c.EGP40bn. (Enterprise)

CORPORATE

RMDA 2023: Lower net profits on higher net finance expenses

Rameda [RMDA] posted its consolidated 2023 results with a slight decrease of 0.3% y/y in net profits to EGP245mn despite a 30% y/y increase in revenues to EGP1.9bn. The lower net profit growth is attributable to:

· Lower gross profit margin of 47% (-1.4pp y/y).

· A 272% y/y increase in net finance expenses to EGP131mn.

Regarding Q4 2023, RMDA posted only a 4% y/y increase in net profits to EGP53mn despite the higher revenues of EGP534mn (+37% y/y, -2% q/q) and the better gross profit margin of 48% (+1.3pp y/y, -1pp q/q). The net profit growth was muted by the very high growth in net finance expenses of 285% y/y to EGP30mn.

On a separate note, RMDA's BoD approved the distribution of cash dividends of EGP100mn equivalent to EGP0.067/share, implying a 2.5% yield. (Company disclosure: 1, 2)

DSCW 2023: Strong net profit growth driven by a low base year and strong operations

Dice Sport & Casual Wear [DSCW] posted its consolidated results for 2023 with a 269% y/y growth in net profits to EGP448mn on:

· Higher revenues of EGP3.4bn (+61% y/y).

· Stronger gross profit margin of 29% (+4.5pp y/y).

· Better SG&A-to-revenues ratio of 8% (+4pp y/y).

· Other income grew by 64% y/y to EGP100mn.

Regarding Q4 2023, DSCW posted a 103% y/y and an 8% q/q growth in net profits to EGP168mn on:

· Higher revenues of EGP1.2bn (+72% y/y, +39% q/q).

· Better SG&A-to-revenues ratio of 8% (+2pp y/y, +1pp q/q).

However, the gross profit margin decreased by 6pp y/y and 1pp q/q to 26%.

On a separate note, DSCW's BoD approved the distribution of cash dividends of EGP300mn equivalent to EGP0.1679/share, implying a 12% yield. (Company disclosure: 1, 2)

KABO Q2 2023/24: Strong net profits on better revenues and non-operating gains

El Nasr Clothing & Textiles Co.'s [KABO] posted its H1 2023/24 consolidated results with a 373% y/y increase in net profits to EGP71mn on:

· Higher revenues of EGP429mn (+97% y/y).

· Lower net finance expenses of EGP9mn (-6% y/y).

· Gains from assets sale of EGP8mn vs. only EGP67,334 a year earlier.

· Gains from revaluation of investments at EGP25mn vs. losses of EGP65,011 a year earlier.

· Investment gains of EGP5mn.

However, the gross profit margin dropped by 3pp y/y to 25%.

Regarding Q2 2023/24, KABO posted a 313% y/y growth in net profits to EGP45mn on:

· Higher revenues of EGP236mn (+90% y/y).

· Lower net finance expenses of EGP4mn (-20% y/y).

· Gains from assets sale of EGP8mn.

· Gains for revaluation of investments at EGP17mn vs. losses of EGP65,011.

· Investment gains of EGP5mn.

However, the gross profit margin dropped by 6pp y/y to 23%. (Company disclosure)

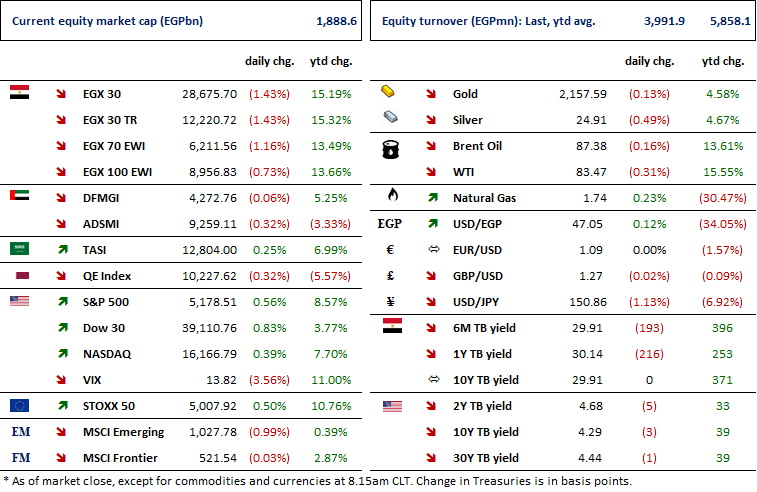

Markets Performance

Key Dates

20-Mar-24

EGCH: OGM / Approving the estimated budget of FY 2024/2025.

EGCH: EGM / Approving increasing the issued capital & amending Articles No. 6 & 4 of the company's bylaws.

21-Mar-24

ADIB: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

ADIB: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the bank's bylaws.

23-Mar-24

TMGH: OGM / Approving financial statements ending 31 Dec. 2023.

MICH: BoD meeting / Follow up on production, sales and exports.

25-Mar-24

SAUD: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

CERA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

PHDC: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

FAIT: Cash dividend / Deadline for eligibility for a dividend of EGP1.853/Share.

COMI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

COMI: EGM / Discussing agenda items.

27-Mar-24

EXPA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

GBCO: EGM / Amending Articles No. 5 of the company's bylaws.

28-Mar-24

FAIT: Cash dividend / Payment date for a dividend of EGP1.853/share.

CIEB: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MCQE: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

HDBK: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

EMFD: OGM / Approving financial statements ending 31 Dec. 2023.

ISPH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

EFID: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

30-Mar-24

PHAR: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

31-Mar-24

ARCC: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

LCSW: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

EFIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RACC: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RACC: EGM / Amending Articles No. 6 & 7 of the company's bylaws.

EKHO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.