Today’s Top News & Analysis

FY25 budget forecasts submitted to the House of Representatives

Egypt plans to raise oil production by 9% y/y in FY25

TALM Q2 2023/24: Strong net profits driven by operations and net finance income

MACRO

FY25 budget forecasts submitted to the House of Representatives

Yesterday, the Ministry of Finance submitted its budget forecasts for FY25 to the House of Representatives for approval. The forecasts include a 4.2% economic growth which is 0.2pp higher than the preliminary forecasts released last week. Meanwhile, the headline average inflation is targeted at 17.9% vs. 18.1% in the last forecast, and the 35.7% projected for FY24. The forecasts highlighted also:

· Brent crude prices are planned to average at USD82/ barrel vs. USD85/barrel in FY24.

· Wheat prices remain at an average of USD280/ton.

· Taxes expected to reach EGP2tn contributing by 77% of total revenues of EGP2.6tn with an 8.5% y/y growth.

· Spendings are expected to rise to EGP3.9tn vs. EGP3tn this year.

· The debt-to-GDP ratio is expected to be 88.2% vs. a targeted 89% in FY24. (Enterprise)

Egypt plans to raise oil production by 9% y/y in FY25

The Egyptian government plans to increase its oil production by 9% y/y in FY25 to 637 barrels/day. This comes in response to the operations of several oil fields. (Asharq Business)

CORPORATE

TALM Q2 2023/24: Strong net profits driven by operations and net finance income

Taaleem Management Services [TALM] posted its Q2 2023/24 results with a 63% y/y growth in net profits to EGP137mn on:

· Higher revenues of EGP298mn (+50% y/y).

· Better gross profit margin of 75% (+5pp y/y).

· Stronger net finance income of EGP15mn (+74% y/y).

Regarding H1 2023/24, TALM had an 86% y/y growth in net profits to EGP358mn on:

· Higher revenues of EGP690mn (+61% y/y).

· Better gross profit margin of 79% (+6pp y/y).

· A 135% y/y increase in net finance income to EGP29mn. (Company disclosure)

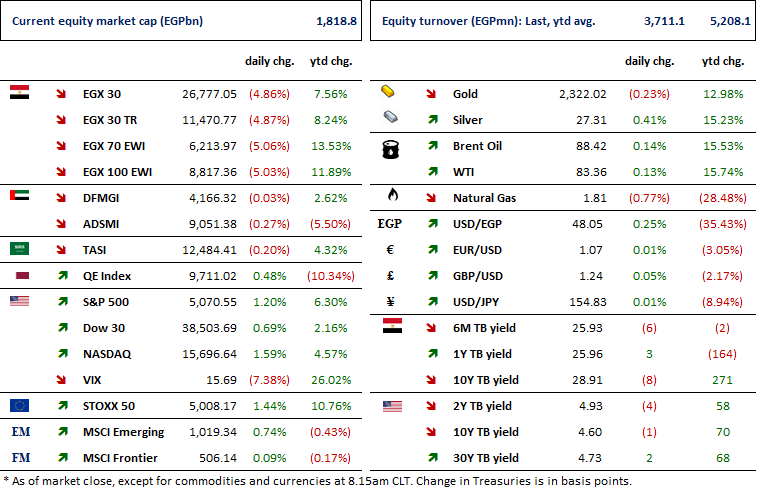

Markets Performance

Key Dates

27-Apr-24

MICH: BoD meeting / Follow up on production, sales and exports.

28-Apr-24

AMIA: Cash dividend / Payment date for a dividend of EGP0.050/share.

29-Apr-24

RMDA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BTFH: OGM / Approving financial statements ending 31 Dec. 2023.

30-Apr-24

EGAL: OGM / Approving the estimated budget of FY 2024/2025.

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (1st installment).

ORWE: Cash dividend / Payment date for a dividend of EGP1.25/share.

EFIH: Cash dividend / Payment date for a dividend of EGP0.187/share.

EFIC: Cash dividend / Payment date for a dividend of EGP2.00/Share (1st installment).

PRCL: OGM / Considering renting a ceramic factory.

PRCL: EGM / Amending some Articles of the company's bylaws.

1-May-24

AIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

2-May-24

OLFI: Cash dividend / Deadline for eligibility for a dividend of EGP0.950/Share.

8-May-24

Egypt PMI / April 2024 reading.

ELSH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

ELSH: EGM / Amending Article No. 7 of the company's bylaws.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

9-May-24

JUFO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

OLFI: Cash dividend / Payment date for a dividend of EGP0.950/share.

12-May-24

RAYA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RAYA: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

13-May-24

EFIH: OGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

DOMT: Cash dividend / Payment date for a dividend of EGP0.50/Share.

18-May-24

HRHO: OGM / Approving financial statements ending 31 Dec. 2023.