Today’s Top News & Analysis

Relations with India upgraded to strategic

Electronic invoices will be mandatory for importing and exporting

Eni acquires Neptune Energy

Afreximbank renews an USD600mn facility to The United Bank

KABO Q3 2022/23: Extraordinary results

MICH finalizes TCCA project and hydrogen unit contract

Dice to increase exports capacity through a new factory

MTS added to the pre-IPO fund

MACRO

Relations with India upgraded to strategic

The President of Egypt signed a joint declaration with the Prime Minister of India to upgrade relations between the two countries to the level of strategic partnership. Thus, we can expect a greater trade flow between the two countries, more investments, and an exchange of knowledge and expertise. (Egyptian presidency)

Electronic invoices will be mandatory for importing and exporting

The Egyptian Tax Authority will not allow any company to import, export, or deal with customs if they do not possess an electronic tax invoice starting from 1 July 2023. The authority also stated that only electronic invoices will be accepted when proving deductible expenses or refunding value-added taxes. (Economy Plus)

Eni acquires Neptune Energy

Italy-based Eni and its Norwegian subsidiary Vår Energi have jointly acquired Neptune Energy for USD4.9bn. Neptune is an exploration and production oil and gas company with operations worldwide. In Egypt, the company has interests in an oil and gas field in the Western Desert and an operated offshore concession in the Gulf of Suez. (Asharq business)

Afreximbank renews an USD600mn facility to The United Bank

African Export-Import Bank (Afreximbank) has renewed an USD600mn facility to TheUnited Bank to be lent to small- and medium-sized enterprises (SMEs). (Al-Mal)

CORPORATE

KABO Q3 2022/23: Extraordinary results

El Nasr Clothing & Textiles Co. [KABO] reported Q3 2022/23 consolidated net profits of EGP31mn vs. EGP4mn only last year, due to:

· Higher revenues of EGP178mn (+95% y/y, +44% q/q).

· A higher gross profit margin of 36% (+10pp y/y, 9pp q/q).

· Income from selling assets increased to EGP11mn vs. EGP4.9mn last year.

· Financial investments through P&L of EGP4.4mn. (Company disclosure)

MICH finalizes TCCA project and hydrogen unit contract

Misr Chemical Industries Co. [MICH] released the final details of its JV trichloroisocyanuric acid (TCCA) 90% granular project. MICH and its majority shareholder, the Chemical Industries Holding Co., will each have a 12% stake, while Cadence Energy & Engineering Construction Co. will have a 76% stake. The details of the project are as follows:

· Establishment of a new company, Pure Dive, to manage and operate the TCCA plant.

· An investment cost of EGP1.3bn.

· Average expected annual revenues and profits of EGP990mn and EGP145mn, respectively.

· Expected breakeven period of 5 years and 3 months.

· Net present value of EGP74mn and an internal rate of return of 13.9%.

· Expected to be completed within 18-24 months.

· Will be built on 15,000 sqm of land provided by MICH in exchange for an annual rent.

· Market research has shown that this project will help bridge the supply gap as domestic demand is currently being met by the importation of the TCCA granular, along with there being a domestic off-take offer to purchase all the volumes produced.

· There still is no deal in place with a bank to fund the project.

Meanwhile, MICH also announced the signing of the hydrogen unit tender with Gulf Cryo and EMCCES. The agreement entails MICH supplying the hydrogen gas while Gulf Cryo and EMCCES will be responsible for building the hydrogen unit and marketing/selling the hydrogen gas both inside and outside Egypt. The project is expected to be completed and begin production within a year and is expected to add c.EGP33mn to MICH’s yearly revenues. (Company disclosures: 1, 2)

Dice to increase exports capacity through a new factory

Dice Sport & Casual Wear’s [DSCW] BoD approved leasing a 45,000 sqm factory from Misr Helwan Spinning & Weaving for nine years. The factory is expected to increase DSCW's capacity by 30% and it will be dedicated to increasing the company's exports. (Company disclosure)

MTS added to the pre-IPO fund

TheSovereign Fund of Egypt (TSFE) reportedly added Misr Technology Services (MTS) to the pre-IPO fund where the goal is to offer a stake to strategic investors before next year where the company is supposed to be offered in an IPO. The government owns 80% of the company, and the company’s shareholders include the Ministry of Finance, E-Finance For Digital and Financial Investments [EFIH], National Investment Bank, the Egyptian Co. for Investment Projects, and Admiral Management Corporation. (Al-Borsa)

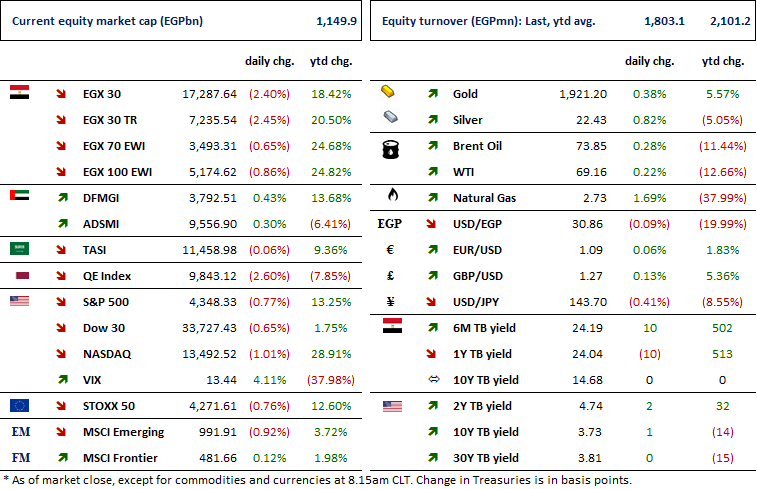

Markets Performance

Key Dates

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Last day of trading the rights issue.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

11-Jul-23

BTFH: Capital increase / Capital increase subscription closing date.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).