Today’s Trading Playbook

KEY THEMES

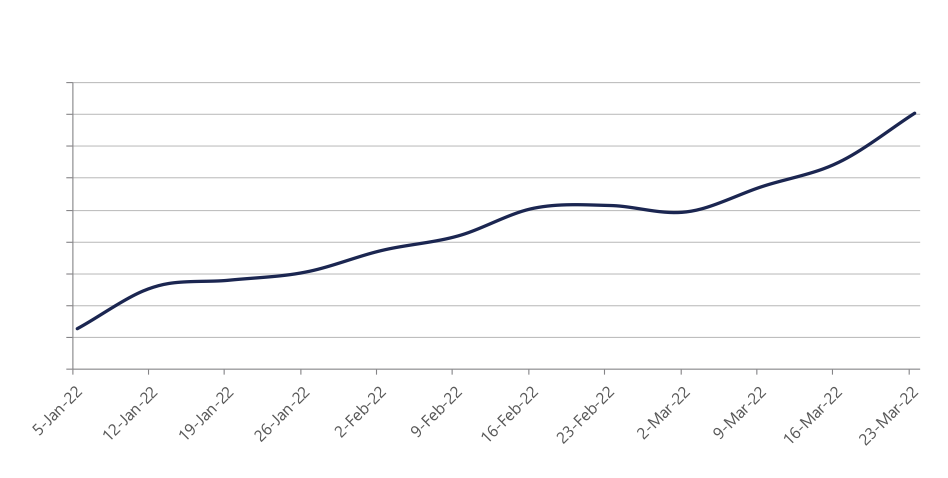

Yesterday, the market slipped in a loud fashion, with EGX30 dropping by 2.64%, completing a 3-day losing streak. As usual, post considerable movements in FX rate, a look at the index in USD terms is always useful. Despite being still above the 11,000 mark, we are at our lowest levels since March 2020 as the chart below shows. To put it into perspective, March 2020 was the month where the market endured the heavy losses when the pandemic first broke loose. Meanwhile, the EGX30 in USD terms is now only 5% above its November 2016 levels. We note that the index is now trading at 2023e P/E of 5.6x, implying an earnings yield of c.18%.

Source: EGX

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The government is now reviewing its public offerings program in light of the recent developments resulting from the Russian-Ukrainian war. Minister of Planning, said that the program for offering 10 companies is being studied with consultants, aiming to offer four to five companies during 2022 in sectors of Energy, insurance and the financials. (Economy Plus)

The monthly fuel import bill was close to USD1.05bn per month, compared to about USD790mn per month before the outbreak of the Russian-Ukrainian war, which caused oil prices to ignite, especially with Egypt covering 25% of its needs from global markets. (Economy Plus)

Egypt signed a loan agreement with the French government for EUR776.9mn to fund the 55 new trains for Cairo Metro Line 1 being supplied by French manufacturer Alstom. (Cabinet statement)

CORPORATE NEWS

Commercial International Bank’s [COMI] OGM approved a DPS EGP1.35 implying a 3% yield. (Company disclosure)

Speed Medical [SPMD] BoD agreed to cooperate with a specialized company in research and marketing to support its marketing & sales plans. (Mubasher)

Arabian Food Industries [DOMT] upped its selling price for its bakery segment by 20% to reach EGP6.0/piece. (Al-Mal)

Ibnsina Pharma [ISPH] approved the gradual sale of its treasury shares bought previously within its share buyback program amounting to 4mn shares. (Company disclosure)

Sidi Kerir Petrochemicals [SKPC] EGM has approved a 20% bonus share distribution.(Company disclosure)

GLOBAL NEWS

Japan and the United States agreed to closely communicate on currency issues, Japan's top currency diplomat said on Tuesday in the wake of the yen's decline to six-year lows against the dollar. (Reuters)

Oil prices dropped on Tuesday, extending losses from the previous day as Ukraine and Russia headed for peace talks and on fears of a drop in fuel demand in China after the financial hub of Shanghai shut down to curb a surge in COVID-19 cases. (Reuters)

U.S. new vehicle sales could fall to the lowest first-quarter volume in the past decade as chip shortages and the Ukraine crisis squeeze inventories and rising prices push less affluent buyers out of the market. (Reuters)

3. Chart of the Day

Research Team

Source: Bloomberg.

The price of skimmed milk powder (SMP) surged 18% ytd to USD4,505/ton.