Today’s Top News & Analysis

Transferring Misr Insurance to TSFE could take up to a year

World Bank supports 27 projects in Egypt for USD0.5bn

ESRS intends to buy the government’s share in EZDK

EGBE preliminary Q1 2023: Improved profitability

JUFO’s OGM approves distributing cash dividends

MTIE’s OGM approves distributing a 25% stock dividend

MACRO

Transferring Misr Insurance to TSFE could take up to a year

Reportedly, the transfer of the full ownership of Misr Insurance Holding Company to The Sovereign Fund of Egypt (TSFE) could take up to one year given the large number of subsidiaries of the holding company and the required processing. A presidential decree was issued last March to transfer Misr Insurance Holding's ownership from the Ministry of Public Business Sector to TSFE. (Al-Borsa)

World Bank supports 27 projects in Egypt for USD0.5bn

According to an official's statement, The World Bank is focused on increasing its presence in Egypt through various investments, and that the bank is supporting around 27 projects in Egypt with a total investment of USD0.5bn. (Al-Borsa)

Corporate

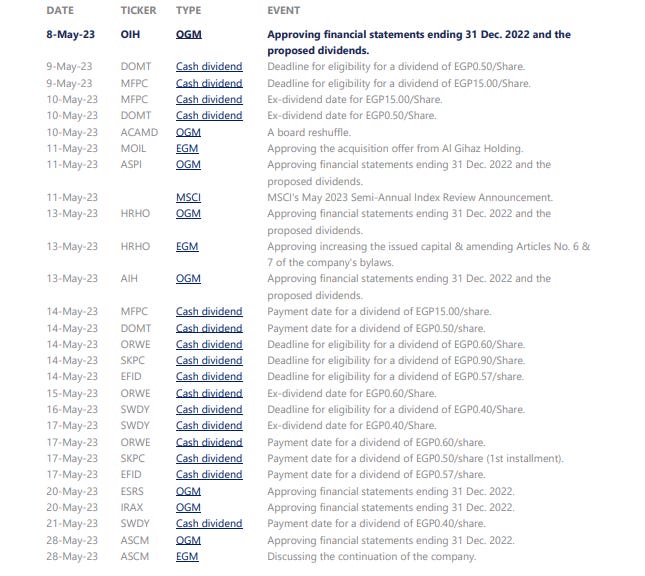

ESRS intends to buy the government’s share in EZDK

Ezz Steel Co. [ESRS] is reportedly interested in purchasing the Egyptian government’s stake in its subsidiary Al Ezz Dekheila Steel Co. (EZDK) [IRAX]. The government owns a 13.93% stake in EZDK through National Investment Bank (8.15%) and National Bank of Egypt (5.78%). Both sides are currently negotiating the fair value of the acquisition, which will reportedly be completed by the end of this month. (Asharq Business)

EGBE preliminary Q1 2023: Improved profitability

Egyptian Gulf Bank [EGBE] preliminary stand-alone results for Q1 2023 showed the bank managed to grow its net income by 60% y/y to EGP316mn, partially on the back of:

(1) a 36% y/y increase in net interest income to EGP923mn.

(2) a significant decrease in the bank's effective tax rate to 42%, down from 49% in 2022.

Meanwhile, the bank’s deposits grew by 11% ytd to EGP80bn, while loans grew by 9% ytd to EGP29bn. EGBE's annualized ROE is now up at 22%, and the bank is currently traded at an annualized P/E of 5.4x and a P/BV of 1.2x. (Bank disclosure)

JUFO’s OGM approves distributing cash dividends

Juhayna Food Industries’ [JUFO] OGM approved distributing cash dividends of EGP0.15/share, implying a 1% yield. (Company disclosure)

MTIE’s OGM approves distributing a 25% stock dividend

MM Group for Industry & International Trade [MTIE] approved to distribute a 25% stock dividend worth EGP150mn at a par value of EGP0.62/share, raising MTIE’s paid-in capital to EGP749mn. (Company disclosure)