Today’s Top News & Analysis

CBE keeps key policy rates unchanged, in line with Prime Research expectations

Egypt looking to issue green bonds

A Saudi company to invest in Egypt’s pharmaceutical distribution industry

The government’s offerings program targets are all made

MSCI may reclassify Egypt’s index

Indian automotive companies are interested in investing in SCZone

Emirati investors are interested in EAST

ABUK’s BoD announced KPIs of its 2023/24 budget

MOIL Q1 2023: Narrower net losses

Egypt to partner up with four companies

MACRO

CBE keeps key policy rates unchanged, in line with Prime Research expectations

On Thursday, the Central Bank of Egypt’s Monetary Policy Committee (MPC) decided in its fourth meeting of the year to maintain the overnight deposit rate, the overnight lending rate, and the rate of the main operation at 18.25%, 19.25 %, and 18.75%, respectively. This is in line with our expectations at Prime Research. (CBE)

Egypt looking to issue green bonds

Egypt seeks having a guarantee from the Asian Infrastructure Investment Bank to issue green bonds, which will increase Egypt’s exposure to capital markets and decrease its borrowing costs. Egypt first issued green bonds in 2020. (Asharq Business)

A Saudi company to invest in Egypt’s pharmaceutical distribution industry

Nahdi Medical Co., a Saudi-based company, is interested in tapping the Egyptian pharmaceutical distribution industry by investing in one of the pharmaceutical distributors, which is rumored to be Ibnsina Pharma [ISPH], according to sources. However, ISPH’s management said that there is no acquisition offers received yet. (Al-Mal)

The government’s offerings program targets are all made

Egypt’s Minister of Planning said that targets of the government’s offerings program are all achieved with transactions already done but will be announced after Eid. (Enterprise)

MSCI may reclassify Egypt’s index

MSCI announced in its annual market classification review that it may reclassify Egypt’s index from “emerging” to “frontier” or “standalone” status on the back of the USD shortage that makes the Egyptian market less accessible to foreign investors. (MSCI)

Indian automotive companies are interested in investing in SCZone

In light of a meeting in Mumbai between the Suez Canal Economic Zone (SCZone) head and Indian investors, automotive companies expressed an interest in investing in SCZone, including Bajaj Auto which has a collaboration with GB Corp [GBCO] to manufacture motorbikes and tuk tuk. (Enterprise)

CORPORATE

Emirati investors are interested in EAST

Emirati investors are reportedly back in talks to acquire 25-30% of Eastern Company [EAST] which denied receiving any official offers. In addition, EAST's management added that the discussions should be done with the Ministry of Public Enterprise and its subsidiary. News also circulated that the ministry's subsidiary will likely sell a part of its stake in EAST, which is 50%, while the acquisition may be finalized in a few days. (Al-Mal)

ABUK’s BoD announced KPIs of its 2023/24 budget

In a meeting held on 21 June 2023, Abu Qir Fertilizers’ [ABUK] BoD announced the KPIs of its FY2023/24 budget. Revenues are expected to reach EGP13.9bn, while total expenses are expected to reach EGP9.7bn. (Company disclosure)

MOIL Q1 2023: Narrower net losses

Maridive & Oil Services [MOIL] reported its Q1 2023 preliminary standalone results, recording a net loss of USD0.5mn (vs. a net loss of USD5.1mn in Q1 2022 and a net loss of USD77mn in Q4 2022) on revenues of USD14.6mn (+31% y/y, -44% q/q) and a GPM of 38% (vs. a gross loss of USD2mn in Q1 2022). Meanwhile, MOIL’s BoD approved several decisions in its recent meeting, including:

· Selling vessels MD-510 and MD-35 to fund operating expenses or outstanding bank debts.

· A capex charge to purchase the MD-602 crane ship for USD2.15mn.

· The MoU pertaining to the establishment of a JV in Libya with a 49% stake worth USD102,000. (Company disclosure)

Egypt to partner up with four companies

The Egyptian government will partner up with four private-sector companies as follows:

· Cadence Energy, in partnership with Egyptian Chemical Industries (Kima) [EGCH] and the Holding Co. for Chemical Industries: Establishing a holding company called Pure Dive to build chlorine pellets factory.

· Global Steel: Creating a company called EgyDrew for PC wire.

· A consortium of Gulf Cryo and Emex Engineering & Construction: Establishing a hydrogen processing unit.

Wadi El Neel Life Science: Operating a factory for kidney dialyzers. (Enterprise)

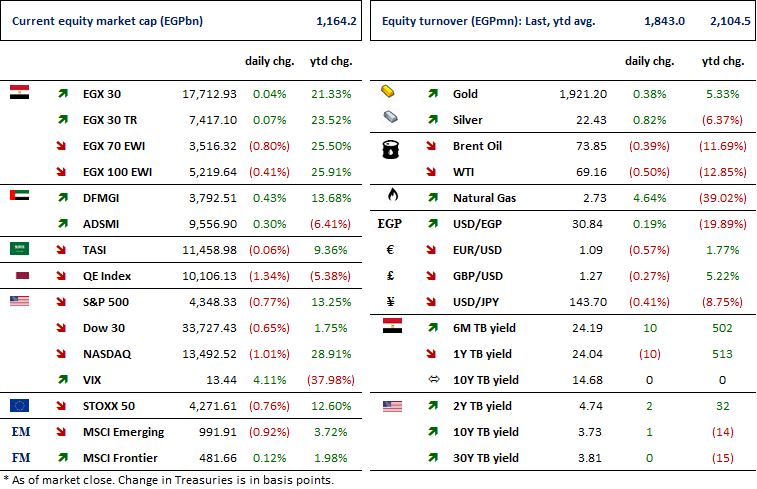

Markets Performance

Key Dates

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Last day of trading the rights issue.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

11-Jul-23

BTFH: Capital increase / Capital increase subscription closing date.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).