Today’s Top News & Analysis

CBE maintains interest rates—as expected

UAE companies interested in Safi and Wataniya stakes

EFIH Q1 2023: Up in the “Cloud”

FWRY Q1 2023: Profits more than quadrupled y/y

CLHO successfully concludes its share buyback program

MPRC preliminary Q1 2023: Strong profitability and wider margins

SPMD preliminary 2022: Net loss on weaker revenues

TAQA begins EGX listing procedures

MACRO

CBE maintains interest rates—as expected

In line with our expectations at PRIMEResearch, the Monetary Policy Committee (MPC) at the Central Bank of Egypt (CBE) decided in its third meeting of the year to maintain the overnight deposit rate, the overnight lending rate, and the rate of the main operation at 18.25%, 19.25 %, and 18.75%, respectively. The discount rate was also maintained at 18.75%. The MPC cited that prices of international commodity prices and global inflationary pressures have eased. Moreover, forecasts for economic growth have broadly stabilized, while volatility in financial conditions of key advanced economies has eased compared to the previous MPC meeting. Domestically, Egypt's real GDP growth rate eased to 3.9% during Q4 2022 compared to 4.4% in Q3 2022, primarily driven by an improvement in tourism, agriculture, and trade. Meanwhile, broad money (M2) and its local currency components grew at a slower pace in March 2023. (CBE)

UAE companies interested in Safi and Wataniya stakes

Agthia a subsidiary of ADQ Holding, is reportedly interested in buying a stake in National Co. for Natural Water (Safi). Also, Abu Dubai National Oil Co. (ADNOC) is interested in buying a stake in National Petroleum Co. (Wataniya). UAE-based companies are eying around 20-25% stakes. (Asharq Bloomberg)

Corporate

EFIH Q1 2023: Up in the “Cloud”

E-Finance [EFIH] announced Q1 2023 results, where net profit grew by 41% y/y to EGP282mn. This was on the back of:

· Strong y/y growth in top line of 37% to EGP768mn. This growth was—in order—driven by:

(1) Strong y/y growth of 42% in e-finance Digital Operations revenues of EGP715mn on cloud hosting and transaction-based revenues.

(2) Significant increase in eAswaaq’s revenues to EGP6.2mn from EGP0.6mn in Q1 2022.

(3) A 22% y/y increase in eKhales revenues to EGP11mn. Which all offset the 29% decline in eCards’ revenues to EGP25mn.

· A 39% y/y increase in net financing income to EGP96mn.

Earnings growth came despite:

· A 14% y/y increase in SG&A to EGP85mn.

· FX losses of EFP35.5mn on the back of the EGP devaluation.

· A 51% y/y decrease in investment income to EGP19mn on delayed profit distribution. (Company disclosure)

FWRY Q1 2023: Profits more than quadrupled y/y

Fawry [FWRY] announced strong Q1 2023 results, where net income grew by 338% y/y to EGP123mn. Meanwhile, revenues grew by 40% y/y to EGP676mn on the back of strong growth in FWRY’s banking services segment which contributed 50% to the y/y growth. This brought the GPM up to 62% from 57.7% in Q1 2022. Besides revenues, the following items contributed to earnings growth:

· A 130% y/y increase in credit interest to EGP88mn on yield from Treasury bills.

· A 39% y/y decline in financing cost to EGP8.9mn.

· FX gains of EGP12mn (+177% y/y) on the back of the EGP devaluation. (Company disclosure)

CLHO successfully concludes its share buyback program

Cleopatra Hospitals Group [CLHO] successfully concluded its share buyback program after buying back as much as 9.9% if outstanding share capital. As a result, CLHO cancelled 154mn shares or 9.67% of its paid-in capital, resulting in an 11% accretion to its earnings per share (EPS). Going forward, CLHO’s BoD may consider another share buyback program. (Company disclosure)

MPRC preliminary Q1 2023: Strong profitability and wider margins

Egyptian Media Production City [MPRC] reported its consolidated Q1 2023 net profit of EGP166mn (+229% y/y) on higher revenues of EGP233mn (+64% y/y). Meanwhile, GPM expanded by 16pp y/y to 69%. (Company disclosure)

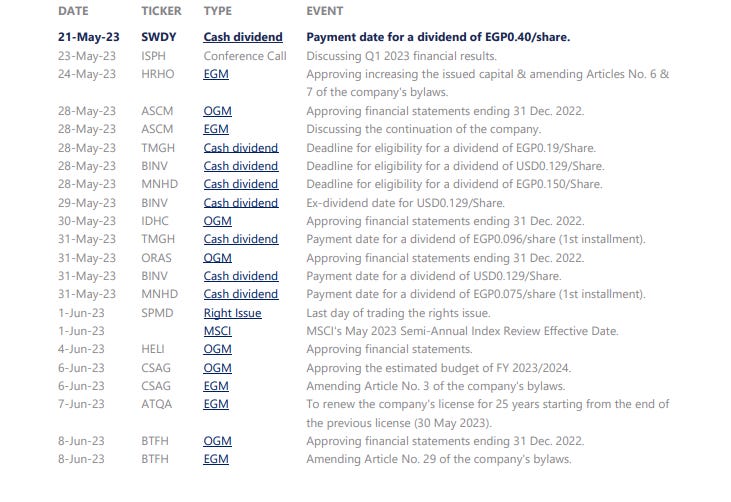

SPMD preliminary 2022: Net loss on weaker revenues

Speed Medical [SPMD] reported a standalone 2022 net loss of EGP140mn compared to a net profit of EGP137mn in 2021 due to:

· Lower revenues of EGP117mn (-68% y/y) due to the gradual phase-out of COVID-19.

· A gross loss of EGP6mn vs. a gross profit of EGP213mn in 2021.

· Provisions and other operating expenses of EGP64.4mn. (Company disclosure)

TAQA begins EGX listing procedures

TAQA Arabia, Qalaa Holding’s [CCAP] subsidiary (a 55.3% stake), announced that it has started procedures to list the company on the EGX. The company is considering whether to float existing shares or issue new shares. (Al-Mal)