Arabian Cement: Crossing Borders

ARCC: 12MPT raised to EGP16.9/share; Overweight/High Risk maintained

Overweight/High Risk

12MPT: EGP16.9 (+66%)

In this note, we update our valuation model for Arabian Cement [ARCC] to incorporate its Q1 2024 financials released recently and now-higher FX rates.

Key Insights

Q1 2024: Higher prices, exceptionally higher volumes

Revenues increased 13% y/y (+35% q/q) to a record high of EGP1.9bn driven by higher blended volumes (+9% y/y) and blended selling prices (+9% y/y):

Export volumes (mainly clinker) surged 21% y/y, which offset a 3% decline in local sales volumes.

Overall selling prices increased, with local prices up 6% y/y and export prices up 21% y/y.

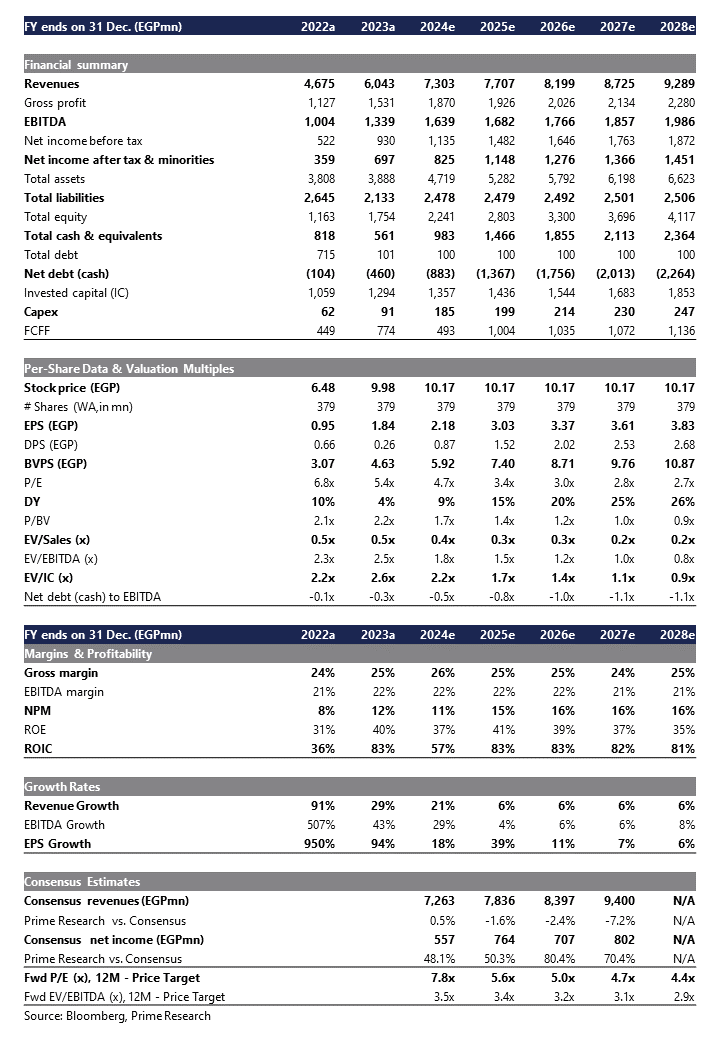

Meanwhile, cash cost per ton increased by only 4% y/y, which—combined with a lower SG&A expenses-to-revenues ratio—helped ARCC maintain stable gross profit and EBITDA margins around 33% and 27%, respectively. Still, earnings declined 37% y/y to EGP153mn, primarily due to high FX losses of EGP244mn. However, adjusting for the FX impact, normalized earnings grew 6% y/y (+67% q/q) to EGP342mn. Furthermore, net cash grew 25% to EGP575mn in Q1 2024, up from EGP460mn at the end of 2023.

Clinker exports to rise despite global competition

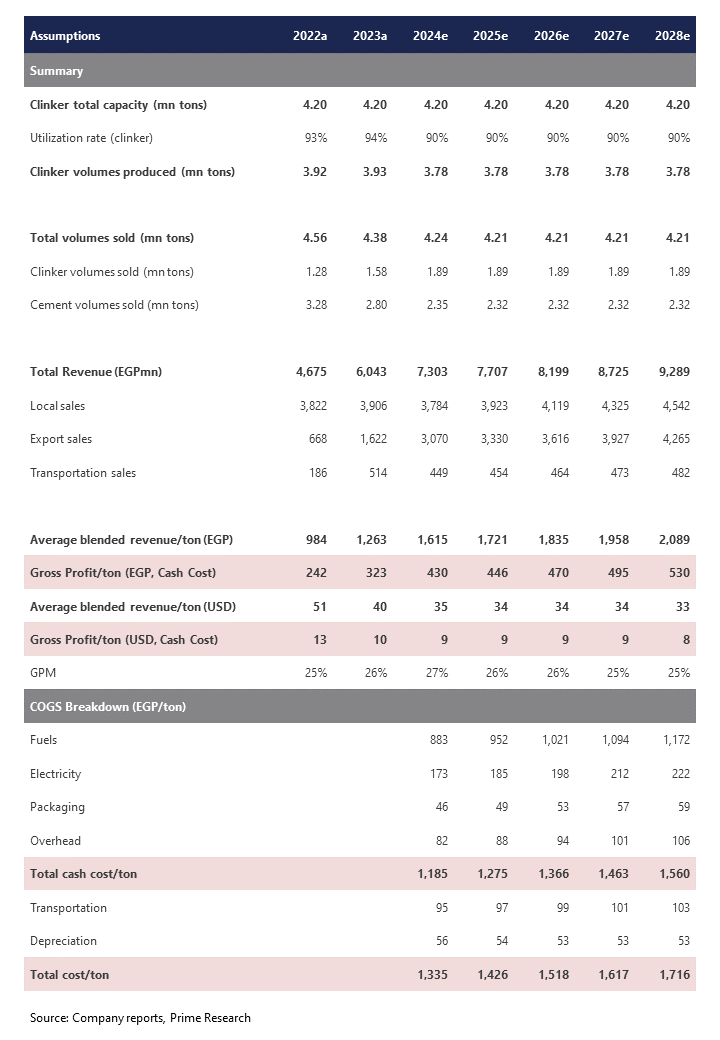

Q1 2024 was exceptional due to a shift in sales from Q4 2023, so we should expect sales volumes to normalize in the remainder of the year. ARCC, like other Egyptian cement producers, has been faced with excess supply in the local market. Also, it has seen fierce competition in the export markets, especially from Turkey and Algeria. Thus, we assumed clinker utilization rates and sales volumes will stabilize at 90% and 4.2mn tons p.a., respectively, through 2028. Recently, ARCC has been focusing on clinker exports to secure USD flows. Exports represented 40% of ARCC’s clinker production in 2023, which we expect to rise to 50% with the same clinker local/export mix as its 2023 levels.

Local blended prices to increase gradually

We expect local blended selling prices to increase gradually (a 5y CAGR of 8%) as cement producers start to pass on the increase in production costs following the EGP devaluation in March 2024. On the other hand, we assumed export prices to rise by only 2% p.a. in USD terms due to the fierce competition in the export markets. This translates into a 5y CAGR of 17% in EGP terms.

Lower coal prices to marginally improve margins

We maintained ARCC’s 2023 fuel mix with its RDF capacity limited to cover 20% of its total fuel consumption. The remaining 80% will continue be sourced from imported coal. We believe global coal prices will decline through 2028 due to the following:

China’s transition to clean energy will lead to lower coal consumption and hence oversupply.

Warmer weather reduces heating demand.

What differentiates ARCC from its peers

Experienced management.

Export-oriented (c.40% of sales volumes).

Fuel mix efficiency.

A strong balance sheet with a net cash position.

High ROIC (83%) and ROE (40%) in 2023.

Valuation, Investment Thesis, & Risks

12MPT raised, Overweight/High Risk maintained

Our updated 5y DCF model yielded a fair value of EGP12.5/share (EGP11.4 previously) and a 12MPT of EGP16.9/share (EGP15.1 previously). We now expect the FX rate to average EGP47/USD in 2024 (vs. EGP34/USD previously) before moving gradually higher to EGP63/USD by 2028 (vs. EGP42/USD in 2027 previously). Our new 12MPT implies a 2024e P/E of only 7.8x and an upside potential of 66%. Thus, we maintain our rating at Overweight/High Risk.

Investment Thesis

Lower global coal prices, gradual increase in local cement prices.

Risks

High fuel and electricity costs, stronger EGP.