Today’s Trading Playbook

KEY THEMES

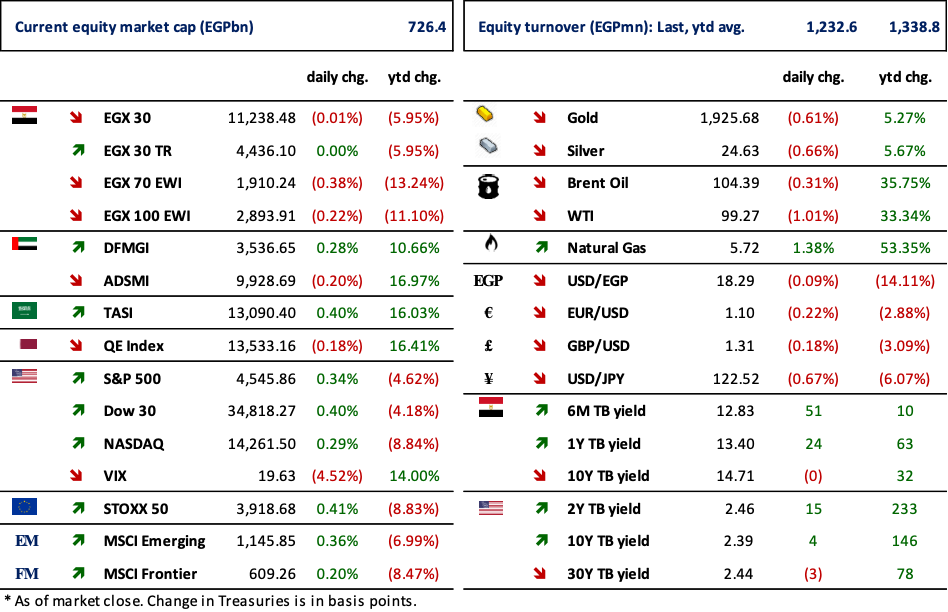

U.S. equities upped moderately last Friday, after data released on Friday showed employers added 431,000 jobs in March and the unemployment rate fell to 3.6%. Meanwhile, U.S. Treasury yields went up, leading to an inversion of the yield curve, where the 10-2-year Treasury yield spread is now at negative 7.5bps. Furthermore, oil prices dropped on the back of the International Energy Agency countries agreed to a new release of oil from emergency reserves in response to the current imbalance.

Elsewhere, Misr Chemical Industries [MICH] 8M 2021/22 net earnings grew to EGP125mn, which represents an annual growth rate of 23% y/y. We note that MICH’s 8M 2021/22 implies a bottom line for February 2022 alone of EGP13mn. Such strong earnings growth is primarily the reason of robust caustic soda market during the entirety of 2021/22 so far. MICH stock price dropped recently to EGP10.0/share, which we believe it is very attractive given the prospect of strong double-digit earnings growth in 2021/22. We remind you that MICH is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. MICH is currently traded at 2021/22e P/E of only 4x. We have an Overweight recommendation on MICH, with our 12MPT of EGP13.90/share (ETR +39%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Minister of Finance, revealed that Egypt is preparing to issue the first sovereign sukuk offering before the end of the current fiscal year, to attract a new segment of foreign investors, especially from the Middle East, North Africa and Asia, who prefer financial transactions in accordance with the principles of Islamic Sharia. (Economy plus)

The Deputy of Finance Minister said that Egypt is considering setting the oil price between USD80/bbl and USD85/bbl in the draft budget for FY23. (Economy Plus)

The European Bank for Reconstruction and Development (EBRD) has downgraded Egypt’s 2022 growth outlook due to rising food and energy price inflation caused by the conflict in Ukraine. The lender expects the economy to grow at a 3.1% clip this year, down from the 5.0% it had penciled in last November. (Enterprise)

The Trade Ministry has banned the export of salvaged and scrap metals for six months in a bid to help manufacturers struggling with price hikes and shortages of raw materials. (Ministry of trade)

The Trade Ministry announced changes to streamline its import registration procedures in a bid to make it easier for overseas companies to export goods to Egypt. This came after The EU last year filed a case at the World Trade Organization (WTO) against Egypt’s “arbitrary” registration requirements, alleging that they violate trade rules and are responsible for a 40% fall in European exports to Egypt. (Ministry of Trade)

CORPORATE NEWS

The government is reportedly studying the revision of natural gas prices to the industrial sector during April using a pricing formula. (Masrawy)

Orascom Investments Holding [OIH] EPS in 2021 upped to EGP0.1/share vs. an EPS of EGP0.010/share a year earlier. Despite operational losses, net income came in light of gains from discontinued operations related to the sale of its Brazilian assets, amounting to EGP650mn. OIH is currently traded at 2021 P/E of 2.2x. (Company disclosure)

Macro Group Pharmaceuticals’ [MCRO] OGM approved a dividend distribution of EGP0.069/share, implying a dividend yield of 2%. (Company disclosure)

Housing & Development Bank's [HDBK] OGM approved a DPS EGP2.50, implying a dividend payout ratio of 20% and a yield of 6%. (Company disclosure)

Telecom Egypt’s [ETEL] OGM approved a dividend distribution of EGP1.0/share, implying a 6% yield. (Company disclosure)

Delta Sugar’s [SUGR] shareholders have approved dividend distribution of EGP0.5/share, implying 4% in dividend yield. (Mubasher)

National Bank of Egypt has upped its stake in Fawry [FWRY] to 12.54% from 6.54% previously. (Mubasher)

Passenger car sales rose more than 20% y/y in February2022, according to industry figures from the Automotive Information Council (AMIC), which showed that around 19,700 cars were sold during the month, up from 13,300 in February last year. (Enterprise)

GLOBAL NEWS

The Federal Reserve needs to move monetary policy towards a more neutral stance, but the pace at which it tightens credit will depend on how the economy reacts, New York Fed President said Saturday. (Reuters)

The European Central Bank plans to raise interest rates sometime after winding down its bond purchase program in the third quarter of this year, ECB board member Isabel Schnabel said on Saturday. (Reuters)

U.S. employers maintained a brisk pace of hiring in March, driving the unemployment rate to a new two-year low of 3.6% while also boosting wages, resulting in a further tightening of labor market conditions and opening the door to a hefty 50bps interest rate hike from the Federal Reserve in May. (Reuters)

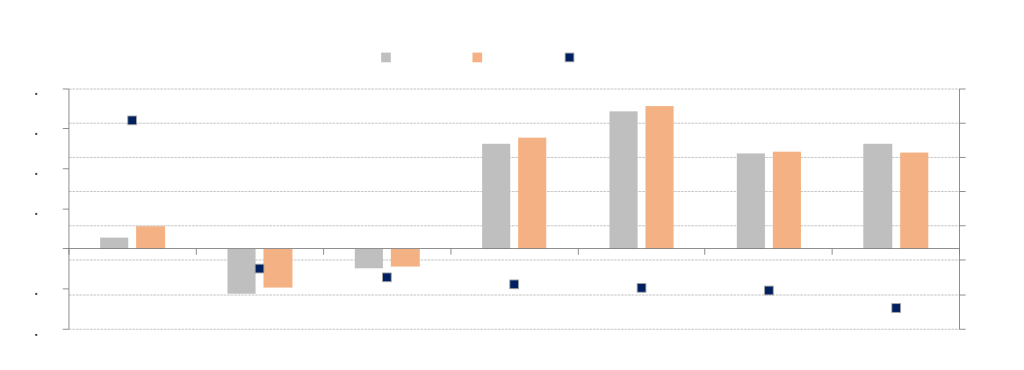

3. Chart of the Day

Amr Abdelrazek | Equity Analyst

aabdelrazek@egy.primegroup.org

Source: Company's reports, Prime Research.

In absolute terms, Middle & West Delta Flour Mills [WCDF] reported the highest net income of EGP71.4mn in H1 FY22 among state-owned listed mills. In relative terms, Alexandria Flour Mills [AFMC] reported highest y/y improvement in net income (+102%) to EGP11.2mn in H1 FY22.