Today’s Top News & Analysis

PIF talks to acquire TUB are reportedly advancing

ACTA wins a franchise right to operate in the New Administrative Capital

National Investment Bank reduces its stake in ADIB

Valu closes its third securitization issuance

Elsewedy Electric writes off treasury shares

MACRO

PIF talks to acquire TUB are reportedly advancing

Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia, is reportedly continuing advanced talks to acquire The United Bank (TUB). The CBE owned bank could be worth about USD600mn according to circulating news. Worth to note that the due diligence was reportedly completed last August, according to unofficial sources. (Asharq business)

ACTA wins a franchise right to operate in the New Administrative Capital

ACTA wins the franchise rights to operate smart buses and electric taxi in the New Administrative Capital with an expected investment of EGP1bn for the first phase. (Economy Plus)

CORPORATE

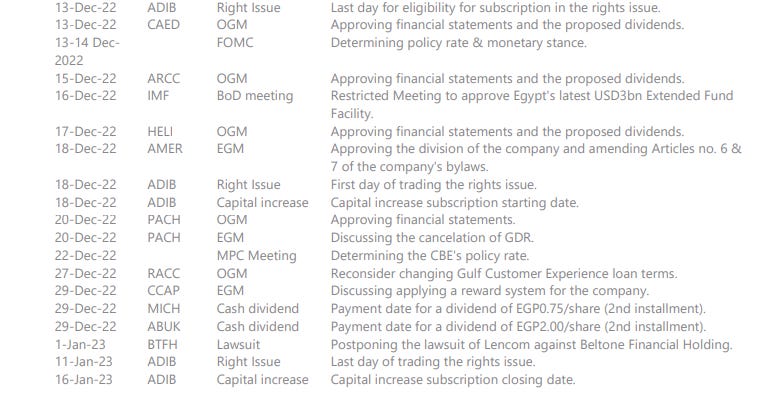

National Investment Bank reduces its stake in ADIB

National Investment Bank (NIB) reduced its stake in Abu Dhabi Islamic Bank - Egypt [ADIB] through a block trade by 30.4mn shares from 10% to 2.4% at an average price of EGP17.8/share. This comes a day before the last date for rights issue eligibility. (Company disclosure)

Valu closes its third securitization issuance

Valu, the consumer finance arm of EFG Hermes Holding [HRHO], has closed its third securitization bond worth EGP855mn, which is part of a EGP2bn program. The securitization issuance is comprised of a single tranche with a tenor of 12 months. (Company disclosure)

Elsewedy Electric writes off treasury shares

The EGX agreed to list Elsewedy Electric's [SWDY] paid capital decrease from EGP2.184bn to EGP2.171bn by writing off 13.4mn treasury shares. (Arab Finance)