Fundamental Thoughts

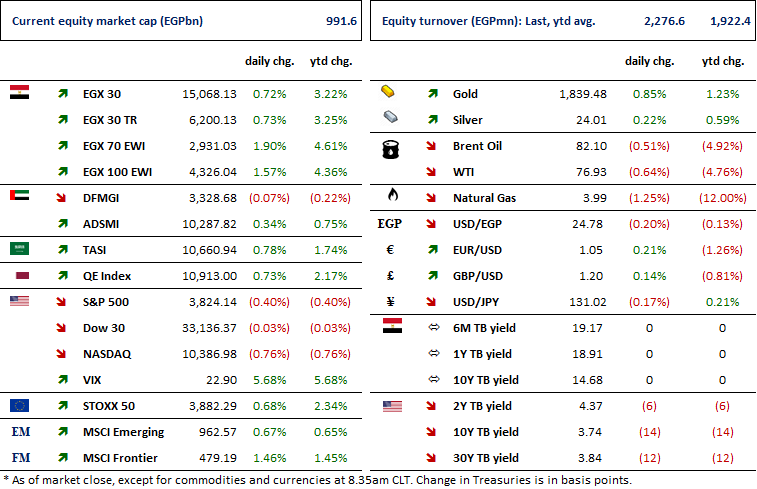

The market was up again yesterday, with both EGX 30 (+0.7%) and EGX 70 EWI (+1.9%) ending the day higher. Foreign investors were still net sellers, whereas Egyptian and Arab investors were net buyers. What is interesting is that Egyptian institutions are buying into the market. Sounds like a broken record? Well, it does because this is exactly what happened on Monday—but a good broken record overall. For EGX 30, this is the second positive performance in a row so far in 2023 and the fourth overall. The last time the EGX 30 made that record was exactly one month ago. Cruising above the 15,000 again, the last time the index closed above that level was on 15 December 2022. For EGX 70 EWI, this is also the second positive performance in a row so far in 2023 and the sixth overall. The last time the EGX 70 EWI was only three weeks ago. Although still below the 3,000 mark (a level it last hit in early September 2021), the index is just a tad below its 52-week high reached intraday on 15 December 2022.

Well, it looks like 15 December 2022 is a key reference date to keep track of. Speaking of dates, Egypt PMI December’s data published earlier today showed yet another contraction, albeit a reading slightly higher m/m, extending to sub-50 sequence for more than two years. Yet, this is not surprising, given the huge pile-up of goods at Egyptian ports, waiting to be released from customs due to a shortage of US dollars, which may also explain the slight rise in net foreign reserves by end of December. On the positive side, however, we think the recent easing of the stock of goods should reflect positively on January’s reading but may not be enough to nudge it past that 50 mark. Also today, Canal Shipping & Handling [CSAG] goes ex-dividend for its EGP0.7858 DPS.

Last but not least, media reports of a potential sale of Ramses Hilton, a prominent hotel in downtown, suggests a price per room of USD0.4mn, which—if confirmed—should reflect positively on two listed names, Misr Hotels [MHOT] and Pyramisa Hotels [PTHV]. Both stocks have already risen quite a lot recently, mostly in the latter half of 2022. However, the Ramses Hotel valuation could mean there could be further for the recent rally seen in the two stocks. Just as a reminder, we first eyed MHOT as a potential stock pick from a contrarian point of view on 26 July 2020, almost 2.5 years ago. Since then, the stock has delivered an outstanding 487% (yes this is correct!), from EGP9.6 all the way to EGP56.36 a share yesterday, and we could think of another double from here in view of the above Ramses Hilton deal.

Today’s Top News & Analysis

Egypt PMI reading rises to 47.2 in December 2022

Egypt's net foreign reserves inch higher in December

Egypt’s primary surplus reaches 2.3% in H1 FY23

The Ministry of Agriculture releases amounts of corn and soybeans

The Manufacturing & Extractive Industries index slipped 3% m/m in October 2022

Four companies ready to be floated on the EGX

Alkuwari International Group reportedly proposes to buy Ramses Hilton

GlobalCorp closes its third securitization bond

A block trade on HDBK's shares

MACRO

Egypt PMI reading rises to 47.2 in December 2022

Egypt PMI rose m/m from 45.4 in November to 47.2 in December 2022, still below the 50 mark for the 25th consecutive month, driven by weak demand conditions and higher input costs in view of a weaker EGP. (PMI)

Egypt's net foreign reserves inch higher in December

Egypt's net foreign reserves inched higher from USD33.5bn in November to USD34bn in December, the fourth in a row since September. (CBE)

Egypt’s primary surplus reaches 2.3% in H1 FY23

Egypt's net foreign reserves inched higher from USD33. (Al-Borsa)

The Ministry of Agriculture releases amounts of corn and soybeans

The Ministry of Agriculture has released from customs 212,000 tons of corn worth USD84mn and 75,000 tons of soybeans worth USD57mn, in addition to fodder worth USD2mn during last week. (Al-Mal)

The Manufacturing & Extractive Industries index slipped 3% m/m in October 2022

Egypt’s Manufacturing & Extractive Industries Index (excluding crude oil and petroleum products) declined 3.0% m/m in October 2022 although it rose 3.1% y/y. The m/m drop was driven in part by electronic appliances (-7.1% m/m) due to limited imports and vehicles (-16.7% m/m) due to lower demand. (CAPMAS)

CORPORATE

Four companies ready to be floated on the EGX

The head of the Egyptian Exchange (EGX) revealed that four state-owned companies are ready to be floated on the EGX, namely Banque du Caire [BQDC], Misr Life Insurance, Egyptian Drilling Co., and Egyptian Linear Alkylbenzene Co. (ELAB), but fell short of disclosing an expected timeline for the offerings. (Ashraq Business)

Alkuwari International Group reportedly proposes to buy Ramses Hilton

Alkuwari International Group, a Qatari company, reportedly proposed an offer to Ekuity Holding to buy Ramses Hilton for USD320mn. (Asharq Business)

GlobalCorp closes its third securitization bond

GlobalCorp closed the third issuance of a securitized bond worth EGP1.1bn, as a part of its EGP5bn securitization program. The bond was comprised of three tranches, all of which have credit ratings of A+. (Hapi Journal)

A block trade on HDBK's shares

During Tuesday's session, a block trade of 2.6mn shares were executed on Housing & Development Bank [HDBK] at an average price of EGP20.2/share, worth EGP52.5mn. (Company disclosure)