Today’s Top News & Analysis

Egypt to study localizing the auto industry

Egypt studies barter trading

Kuwait renews a USD4bn deposit in the CBE

SUGR 9M 2023: Strong net profits on strong revenues, investment income, and other revenues

ORHD Q3 2023: Higher net profits on growing revenues and other income

MACRO

Egypt to study localizing the auto industry

The Egyptian government will start a feasibility study to establish the East Port Said Automotive Zone (EPAZ) in partnership with the German-based Volkswagen. The EPAZ is aimed to localize the auto industry with an initial investment of USD240mn. Volkswagen should provide technical assistance to the General Authority of Suez Canal (SCZone), The Sovereign Fund of Egypt (TSFE), and EPAZ. (Enterprise)

Egypt studies barter trading

Egypt studies with Russia, Turkey, and some African countries to start commercial trade through bartering in order to loosen the pressure on FX. (Asharq Business)

Kuwait renews a USD4bn deposit in the CBE

Kuwait renewed an equally divided two-tranche USD4bn deposit in the Central Bank of Egypt (CBE), the first tranche to end by April 2024 while the second ends by September 2024. (Asharq Business)

CORPORATE

SUGR 9M 2023: Strong net profits on strong revenues, investment income, and other revenues

Delta Sugar [SUGR] reported its 9M 2023 results posting 91% y/y growth in net profits to EGP1.4bn on:

· Strong revenues of EGP6.4bn (+105% y/y).

· Higher investment income of EGP179mn vs. only EGP72mn last year.

· Other revenues growing to EGP90mn (+54% y/y).

We note that the net profit growth is slightly muted by:

· Gross profit margin witnessing a 1.6pp y/y decrease to 31.5%.

· Recording higher other expenses of EGP28mn vs. only EGP7mn last year. (Company disclosure)

ORHD Q3 2023: Higher net profits on growing revenues and other income

Orascom Development [ORHD] reported its 9M 2023 results posting a 30% y/y growth in net profits to EGP1.8bn on a 55% y/y growth in revenues to EGP10.4bn, while the gross profit margin was flat at 36.5% (+0.4pp y/y). However, the net profit growth was muted by the extraordinary other expenses growing to EGP385mn vs. EGP124mn a year earlier.

Regarding Q3 2023, ORHD had a strong performance posting a 45% y/y growth in net profits to EGP929mn on:

· Higher revenues of EGP4.2bn (+56% y/y).

· Better gross profit margin of 39.3% (+1pp y/y).

Booking other income of EGP66mn vs. other loss of EGP3mn last year. (Company disclosure)

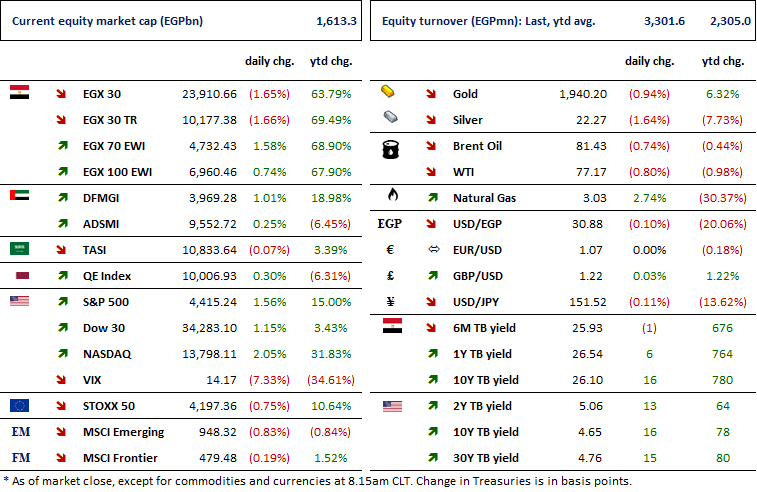

MARKETS PERFORMANCE

Key Dates

13-Nov-23

UASG: BoD meeting / Discussing financial results.

14-Nov-23

ISPH: BoD meeting / Discussing financial results.

MSCI: MSCI's November 2023 Semi-Annual Index Review Announcement.

ETEL: Conference Call / Discussing Q3 2023 financial results.

RMDA: Conference Call / Discussing Q3 2023 financial results.

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

30-Nov-23

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).