Amr Hussein Elalfy, MBA, CFA, Head of Research | T +202 3300 5724 | aelalfy@egy.primegroup.org

Omar Roushdy | An intern on the macroeconomics team

The CBE’s main weapon of choice: Interest rates are likely to remain the Central Bank of Egypt’s (CBE) main weapon of choice to tackle the current economic challenges as we head to another MPC meeting this Thursday. The U.S. dollar (USD), the slumbering giant, has been awakened by record-breaking inflation rates, driving the Federal Reserve to hike interest rates more than initially expected and perhaps inducing a recession in the process to tame inflation. This will put more pressure on the CBE to bring interests rates up for Egypt to regain its position as an attractive destination for foreign investors looking for decent real interest rates. Compounded with the higher-than-expected April inflation reading of 13.1% y/y, this will add more steam to the higher interest rate argument for the next MPC meeting.

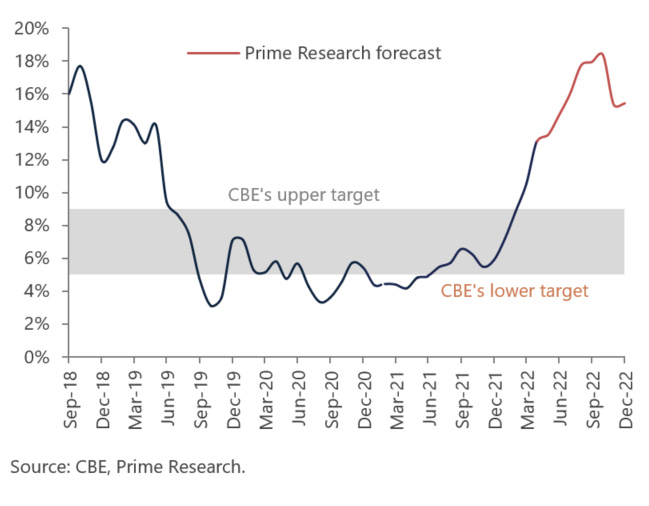

We expect a 100-150bps hike on Thursday: We expect the CBE to increase interest rates in the next MPC by 100-150bps. Through this, the CBE will be sending a strong signal to the market, underscoring its ability to (1) bring down inflation to pre-pandemic levels and (2) bring real interest rates back in the positive territory by next year to encourage investment back into the local debt market, thus boosting foreign reserves and supporting the Egyptian pound (EGP). We expect inflation to peak in October 2022 at 18.4% before cooling off afterwards. We now expect inflation to average 14.1% in 2022 (up from our previous forecast of 13.0%). As fiscal years, we expect inflation to average 8.6% in FY22 and 13.8% in FY23.

Overall, we expect a cumulative 400-450bps move in 2022: By end of 2022, we expect the CBE to have hiked interest rates by a cumulative 400-450bps for the year, including the 100-150bps we expect on 19 May 2022. This leaves a total of 200bps through yearend, which should balance out the economic cooling effects of interest rates on the investment and consumption sides of the economy with a better grip on inflation. At the end of the day, this should help bring down inflation rates, resulting in a real interest rate differential that boosts foreign investment in local debt markets and helps maintain foreign reserves.

We expect EGP to stabilize in the short term: Maintaining the current USD/EGP exchange rate should bode well for some of Egypt’s importers. Since the second half of March, the Chinese yuan (CNY) has depreciated by more than 7%. Meanwhile, the euro (EUR) is approaching parity with USD, giving hope that the recent EGP depreciation may not be as hard-hitting as it seemed in March and April. This leaves us to conclude that since most of Egypt’s trading partners have depreciated their currencies, import controls may be eased, with little EGP depreciation needed, if at all. We note that China and the Eurozone are Egypt’s main trading partners with Egyptian exports mainly spanning fertilizers, oil, and gas, all of which have been seeing massive spikes in their global demand. On the other hand, Egyptian imports continue to become cheaper as many currencies depreciate against USD, which means Egypt’s import bill will likely be lower than initially anticipated. Thus, it is too early to see how all of this will impact Egypt’s current account deficit (CAD).

Figure 1: NIR stabilized in April 2022 after falling significantly in March 2022

Figure 2: The FX position in the banking sector necessitated the EGP depreciation

Figure 3: EGP is down 52% since devaluation in November 2016 but up 2% since January 2017

Figure 4: Inflation continues to be fueled by food inflation on high global commodity prices

Figure 5: Inflation to continue rising through October 2022 before slowing down

Figure 6: Real interest rates to stay negative for the remainder of the year