Today’s Top News & Analysis

Eni on the verge of discovering a huge natural gas field

Palliser Capital successfully blocks Capricorn and NewMed merger

Egypt to offer bids for obsolete energy sites for the first time

Chevron wants to use Egyptian natural gas processing facility to export Cypriot gas

SFE reportedly eyes a stake in El Ezaby Pharmacy

Egyptian Government cancels rice subsidies; three companies to supply rice

Al Baraka Bank 2022: A reformative year

A new General Manager for SODIC

Egyptian Satellites' 2022 results: a 27% growth in net income

EIPICO changes its capital increase terms

Talaat Moustafa Group distributes dividends

MACRO

Eni on the verge of discovering a huge natural gas field

Italian energy giant Eni is reportedly close to discovering a huge natural gas field in its Thuraya concession located north of Arish in the Mediterranean. According to sources, drilling started two months ago and investments in the site amount to USD90mn. Official announcements have not yet been made as Eni is waiting to confirm the size of the well and its susceptibility to extraction. (Al-Mal)

Palliser Capital successfully blocks Capricorn and NewMed merger

We had reported on 16 January that Palliser Capital was attempting to block Israeli NewMed Energy’s acquisition of LSE-listed Capricorn Energy. Palliser Capital, Capricorn’s third largest shareholder, has succeeded in blocking the acquisition. The general meeting that took place 1 February removed seven board members, replaced them with six independent candidates, and rescheduled the merger vote from 1 February to 22 February. With the impending vote likely to go against NewMed’s favor, Capricorn and NewMed announced the mutual termination of the merger agreement with immediate effect. If the merger would have gone through, the merged entity NewMed would have assumed control of Capricorn’s oil and gas operations in Egypt’s Western Desert. (Offshore Energy)

Egypt to offer bids for obsolete energy sites for the first time

Egypt is set to announce details of the first-ever bid for obsolete energy fields by the end of February. The aim is to extract the quantities available in the sites using unconventional means and specialized technology. (Zawya)

Chevron wants to use Egyptian natural gas processing facility to export Cypriot gas

Chevron has formally requested to use Shell’s underutilized West Delta Deep Marine facilities on Egypt’s Mediterranean coast to process gas from Cyprus’ Aphrodite field. Chevron has reportedly already gained approval from Egyptian officials and are just waiting on final approval from Shell. The agreement with Egyptian authorities will allow Chevron to export 50% of its planned LNG output with the rest being allocated to the Egyptian market. (Mees)

SFE reportedly eyes a stake in El Ezaby Pharmacy

The Sovereign Fund of Egypt (TSFE) is interested in having a minority stake in El Ezaby Pharmacy in partnership with a local investment company. (Enterprise)

Egyptian Government cancels rice subsidies; three companies to supply rice

The Egyptian Government will cancel the rice subsidies starting from 25 February 2023. Meanwhile, the General Authority for Supply Commodities (GASC) will value the offers submitted by three companies to supply Indian rice. (Al-Borsa)

CORPORATE

Al Baraka Bank 2022: A reformative year

Al Baraka Bank – Egypt [SAUD] announced 2022 full results. Below are our main takeaways:

· Unlike last year, 2022’s net income showed positive y/y growth of 55% to EGP1.8bn. This was on the back of:

(1) 25% y/y higher net interest income of EGP3.4bn.

(2) 38% y/y lower provisions of EGP344mn on high base year.

(3) 77% y/y higher net trading income of EGP104mn.

(4) Other operating income of EGP49mn against other operating expenses of EGP9mn the year before due to reversal of contingent provisions.

· This pushed SAUD’s ROAE up to 26% against 21% last year. While NIM increased by 30bps to 4.76%.

· SAUD’s loan book increased significantly by 46% ytd to EGP35bn, attributable to corporate local currency loans. NPL ratio increased so slightly to 4.7% with a lower- yet still suitable- coverage ratio of 144%.

· The bank increased it’s financial investments allocation by 83% ytd to EGP31.8bn, representing 37% of total assets.

· While deposits increased by only 3% ytd to EGP74bn on foreign currency deposits, which in turn upped the bank’s GLDR by 15pp to 48%.

· SAUD’s CAR dropped by 3 pp to 17.7% on EGP devaluation, however still above CBE’s threshold of 12.5%.

· BoD has suggested distributing cash dividends of EGP1.03/share, which implies a dividends yield of 11% and payout ratio of 42%.

· SAUD is currently traded at a P/E of 3.8x and a P/BV of 0.8x. (Bank disclosures: 1, 2)

A new General Manager for SODIC

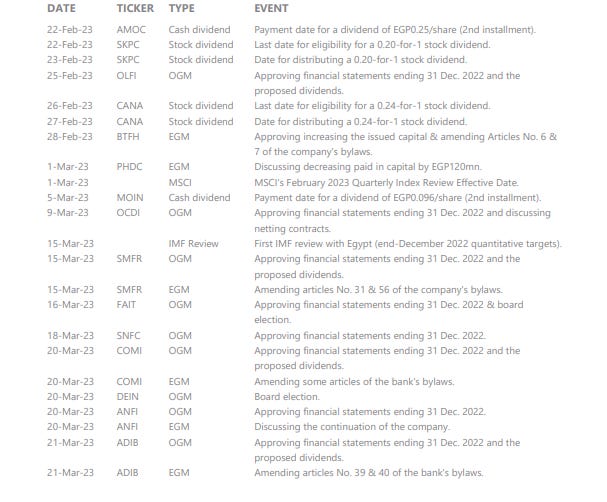

SODIC's [OCDI] BoD appointed Eng. Ayman Amer as General Manager for the company effective 15 Feb. 2023, after Eng. Magued Sherif stepped down from his role as OCDI's Managing Director. (Company disclosure)

Egyptian Satellites' 2022 results: a 27% growth in net income

Egyptian Satellites' Co. [EGSA] 2022 results show net income increasing by 26.7% y/y to USD39mn on USD99.9mn in revenues (-10.7% y/y). Meanwhile, GPM jumped 25pp y/y to 45.5% due to a 55% lower cost of satellite channel allocation expenses. This is due to the renewal of only 6 Eutelsat transponders out of a total of 35 and ending the allocation of 29. (Company disclosure)

EIPICO changes its capital increase terms

EIPICO's [PHAR] shareholders proposed a capital increase by 50% instead of 15%, to be EGP1.49bn with an increase of EGP496mn. The increase will take place through a rights issue, offering 49,585,250 new shares at a par value of EGP10/share without an issuance premium. In light of the general meeting's proposal, PHAR's BoD approved the changes in the capital increase. It is worth mentioning that in January 2023, PHAR's BoD initially approved to increase the paid-in capital by EGP148mn (+15%) at a par value of EGP10/share + issuance premium of EGP44.72/share. (Company disclosure)

Talaat Moustafa Group distributes dividends

Talaat Moustafa Group Holding [TMGH] BoD approved paying EGP400mn or EGP0.193/share cash dividend, implying a dividend yield of 1.96%. The distribution will be split into two payments worth EGP0.096/share each. (Al-Mal)