Abu Qir Fertilizers [ABUK]: The Afterparty — What's Next After an Exceptional Year?

12MPT raised to EGP60/share; Neutral / Medium Risk maintained

Neutral / Medium Risk

12MPT: EGP60/share

Abu Qir Fertilizers [ABUK] announced exceptional preliminary results for FY2022/23, achieving a new record net profit of EGP14.6bn (+61% y/y). This aligns with our previous expectations for the year's earnings at EGP14.7bn. Now that the waves of global urea price hikes have subsided significantly compared to the previous fiscal year, do we still anticipate an increase in the value of ABUK’s shares?

Firstly, we expect a rebound in global urea prices from their current levels of around USD400/ton as we approach the end of the year, for several reasons:

Russia's cancellation of the Black Sea grains agreement means Ukraine is no longer allowed to export grains and fertilizers to Europe.

Approaching winter, typically accompanied by higher natural gas prices in Europe, raises production costs and subsequently prices.

Nearing the fall’s fertilizer application season, increasing demand.

India's suspension of rice exports, boosting demand for crops and raising their prices, thus incentivizing farmers.

China's continuation of fertilizer export restrictions.

For these reasons, we anticipate an increase of around 10% from the previously projected price for FY2023/24.

Secondly, we expect further depreciation of the Egyptian pound against the U.S. dollar in FY2023/24, which will positively impact ABUK’s profits significantly as it exports nearly half of its production. In the previous fiscal year, ABUK's gains from currency fluctuations alone surpassed EGP3bn.

Thirdly, ABUK remains unburdened by any debt, whether short- or long-term, a strength point in times of rising interest rates. In fact, the company possesses a substantial cash position that generates income from bank deposits.

Fourthly, ABUK holds stakes in other fertilizer companies, including Alexandria Fertilizers (Alex Fert) and Helwan Fertilizers. As the profits of these companies increase, the value of ABUK's stakes rises, thereby increasing its valuation.

Fifthly, we expect a generous dividend distribution for FY2022/23, potentially reaching EGP6.5/share, a 13% yield.

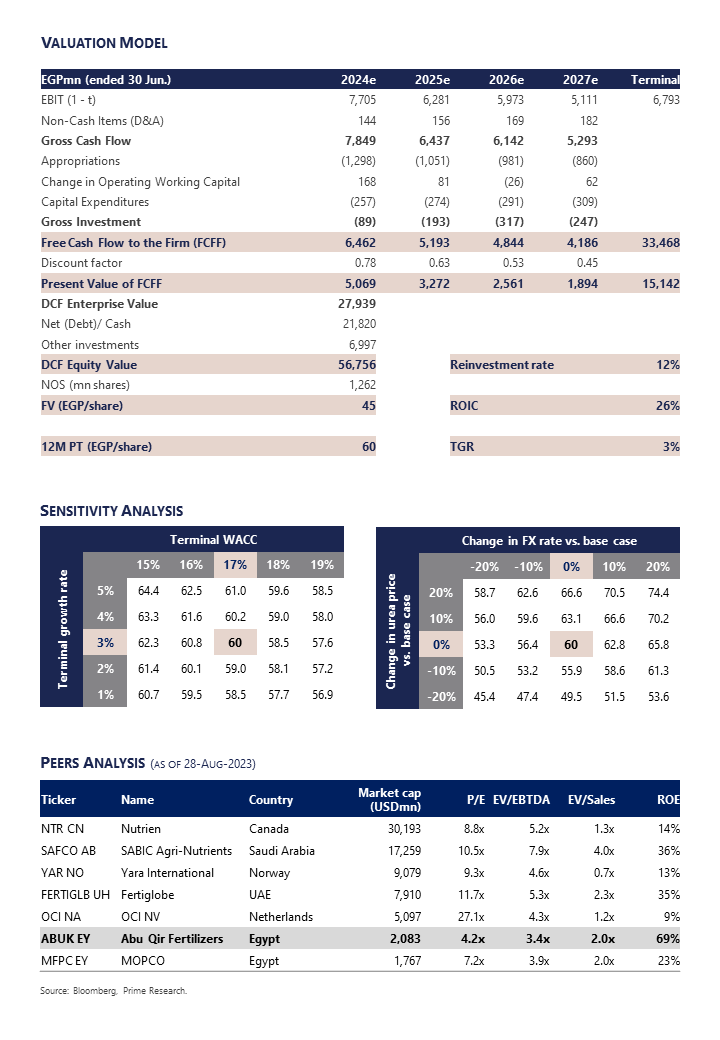

12MPT raised to EGP60/share, with our Neutral / Medium Risk rating maintained: After reviewing these assumptions and penciling them into the company's financial model, using a discounted cash flow model, assuming a WACC of 17% and a long-term growth rate of 3%, we raise our 12-month price target by 14% to EGP60/share from EGP52.8/share, while maintaining our Neutral / Medium Risk rating, with an 18% upside potential. Notably, our valuation depends heavily on natural gas costs as well as urea prices and FX rate fluctuations. Our new 12MPT implies a 6x P/E ratio and a 2.8x EV/EBITDA ratio for FY2023/24.