1. Today’s Trading Playbook

KEY THEMES

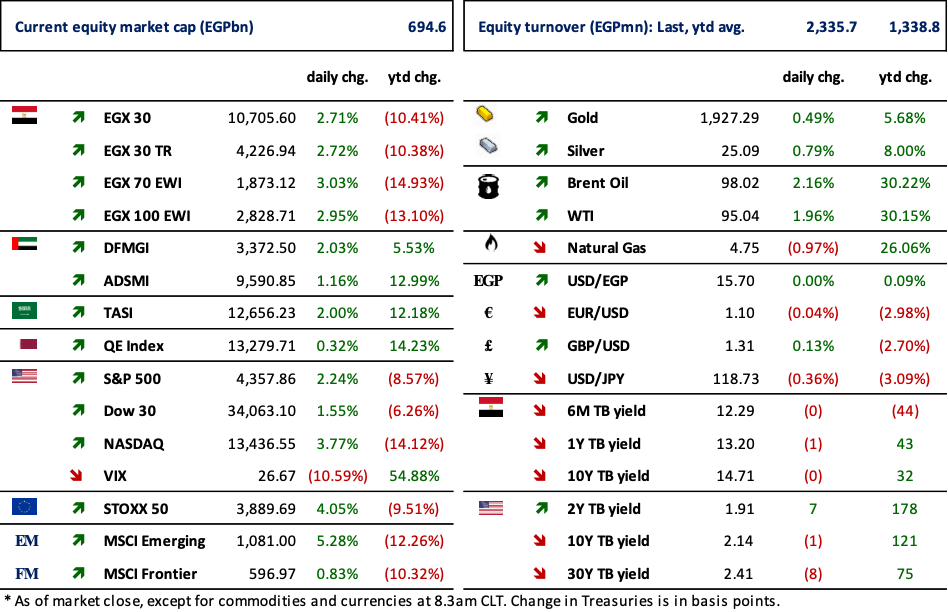

Global equities went through a synchronized pickup post the Fed’s decision to hike interest rates for the first time since the year 2018. U.S. equity indices bounced back after briefly trading in the red territory yesterday, with indices gaining between 1.5% and 3.7%. U.S. Fed Chair signaled the massive uncertainty the economy faces from the war between Russia and Ukraine and the ongoing COVID-19 crisis, yet he said "ongoing increases" in the target federal funds rate "will be appropriate" to curb the highest inflation the country has witnessed in 40 years. Asian shares rose in response to the overall sentiment improvement for risk assets, as peace talks between Russia and Ukraine haven’t failed yet. Moreover, the promise of more economic stimulus from China has calmed investors’ worries regarding a slowdown in China. On the other hand, Brent oil prices slipped below the USD100/bbl mark, as ongoing peace talks between Russia and Ukraine have relatively soothed supply tightness fears, given the growing possibility of the returning Iranian output to the market.

Here at home, the market retaliated yesterday, with notable single-day gains seen by the EGX30. The majority of large caps have witnessed a rebound yesterday, as panic waves from global spillovers started to lose some steam. However, it was very interesting to see foreigners being considerably net sellers in yesterday’s session, as opposed to massive buying activities from local institutions.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Farmers will receive between EGP865/ardeb and EGP885/ardeb of wheat that they sell to the state, up 8% from the price set in November. (Enterprise)

CORPORATE NEWS

Orascom Financial Holding [OFH] net losses registered EGP102mn between 10 December 2020 and 31 December 2021. Net losses occurred due to high credit provisions coupled with higher salaries expenses, which were unmatched by OFH top line of EGP522mn. (Company disclosure)

Housing & Development Bank’s [HDBK] BoD has ratified the bank’s budget for 2022. HDBK targets standalone bottom line of EGP2bn, up 9% from 2021’s net earnings. We note that the bank targeted ROE is 20%, whereas forward P/E according to management target is 3x. (Company disclosure)

Tenth of Ramadan for Pharmaceutical Industries and Diagnostic Reagents –Rameda- [RMDA] has bought treasury shares during yesterday’s session up to 1.0mn shares within the context of RMDA’s share buyback program. (Company disclosure)

Raya Contact Center [RACC] has bought treasury shares during yesterday’s session up to 0.4mn shares within the context of RACC’s share buyback program. (Company disclosure)

Egyptian Transport and Commercial Services [ETRS] EGM approved reducing the par value and decreasing the authorized capital by EGP0.25bn to EGP0.75bn. (Company disclosure)

State-owned Misr Insurance Holding (MIH) is targeting to float 25% of its life Insurance subsidiary on the EGX next October. (Enterprise)

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: Prime Research.

Emaar Misr for Development [EMFD] reported the highest NPM compared to its peers in 2021.