Today’s Top News & Analysis

Three GCC strategic investors bid for Wataniya

Maersk offers to acquire Zaafarana Wind Farm

Egypt signs gold exploration contracts

Misr Pharmacies to float on the EGX

FAIT Q2 2023 preliminary: No more FX gains

EKHO’s Sprea Misr opens a new factory and reveals expansion plan

Qalaa Holdings’ National Printing to list on the EGX

Palm Hills Developments plans to securitize EGP5bn

MACRO

Three GCC strategic investors bid for Wataniya

The Sovereign Fund of Egypt (TSFE) received three offers from Abu Dubai National Oil (ADNOC), Emirates National Oil Company Group (ENOC), and Saudi Arabia’s Petromin to acquire the state-owned National Petroleum Co. (Wataniya). (Al-Borsa)

Maersk offers to acquire Zaafarana Wind Farm

Maersk, the Danish shipping and logistics giant, made an offer to the Egyptian government to acquire the state-owned 545MW Zaafarana wind farm. The farm was originally included in The Sovereign fund of Egypt's (TSFE) list of 32 companies for privatization. (Al-Mal)

Egypt signs gold exploration contracts

The Egyptian government will sign seven gold exploration contracts with Australia’s Centamin and Canada’s Barrick Gold after long negotiations. The contracts state that the government receives 50% of net income of any discoveries. (Asharq Business)

Misr Pharmacies to float on the EGX

Misr Pharmacies, whose paid-in capital is EGP250mn, is looking to offer 20-30% of its shares on the Egyptian Exchange. (Amwal Alghad)

CORPORATE

FAIT Q2 2023 preliminary: No more FX gains

Faisal Islamic Bank of Egypt [FAIT] announced its preliminary results for Q2 2023, where net income dropped by 74% q/q to EGP556mn. We believe this was mainly due to having recorded no FX gains in Q2 2023 vs. EGP1.6bn in Q1 2023. Net interest income, however, remained almost flat (-1.7% q/q) at EGP1.4bn. FAIT’s annualized ROE has now declined to 9% vs. 38% in Q1 2023. The bank is traded at an annualized P/E of 7x and a P/BV of 0.6x. (Bank disclosure)

EKHO’s Sprea Misr opens a new factory and reveals expansion plan

Egypt Kuwait Holding Co. [EKHO] announced the opening of a new sulfuric acid factory and expansions of current production lines for its wholly-owned subsidiary Sprea Misr at a cost of USD46mn. The details of the expansion plan are as follows:

· A sulfuric acid plant with a production capacity of 165,000 tons/year, where 80% of its production will be dedicated to EKHO’s subsidiary AlexFert (a 69% stake).

· A production line to produce 3mn Formica panels annually for export.

· A production line for dry sulfonated naphthalene formaldehyde with a capacity of 15,000tpa.

· Upgrades to the third and fourth lines for the production of liquid sulfonated naphthalene formaldehyde which will add 88,000 tons/year.

· Expansion of the dry and liquid glue production lines with a capacity of 25,000 tons/year.

· Expansion of the Novolac and Formica resins production lines with a capacity of 10,000 tons/year.

We note that Sprea Misr recorded an impressive 97% y/y growth in net income to USD34.3mn (+873% q/q) in Q1 2023 with a combined production capacity of 270,000 tons/year for formaldehyde and formaldehyde derivatives in addition to 3.7mn Formica sheets per year. This expansion will help further maximize Sprea Misr’s added value to EKHO and increase export revenues. (Company disclosure)

Qalaa Holdings’ National Printing to list on the EGX

Qalaa Holdings' [CCAP] chairman revealed that National Printing Co. (CCAP’s 31%-owned printing subsidiary) will be listed on the EGX in the near future. Similar to its subsidiary TAQA Arabia [TAQA], shares of National Printing Co. will be available for direct trading. This listing is part of CCAP's strategy to reorganize ownership of its subsidiaries and to swap partial equity stakes to settle existing debts. Tentatively, the required paperwork is expected to be submitted by September or October, and trading is anticipated to commence within six months of the listing. (Hapi Journal)

Palm Hills Developments plans to securitize EGP5bn

Palm Hills Developments [PHDC] is planning to start a securitization program worth EGP5bn over three years. PHDC is currently obtaining approval for the first phase which should be worth EGP472.5mn over three tranches. (Al-Mal)

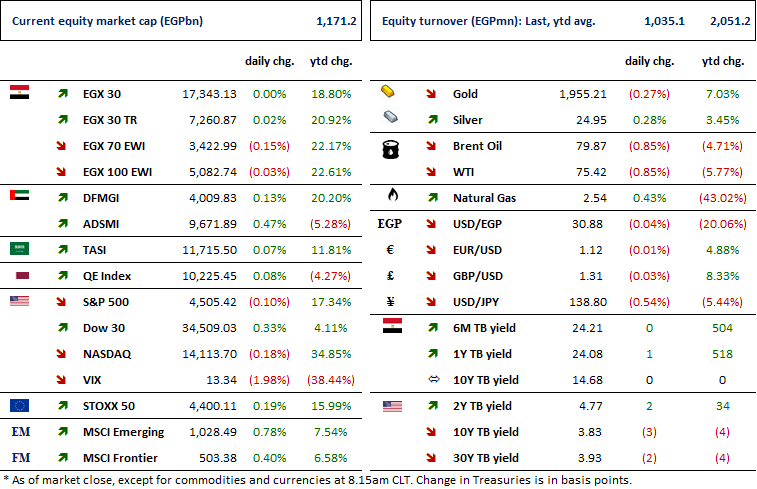

Markets Performance

Key Dates

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.