Today’s Top News & Analysis

KIA said to finalize acquisition of The United Bank soon, potentially at 2x BV

Eni discovers a new gas field in the Mediterranean

TALM Q2 2022/23: Strong y/y performance

CIRA H1 2022/23: Strong revenues, yet lower net profits

FWRY's OGM approves retaining 2022 net profits

CICH's OGM approves retaining 2022 net profits

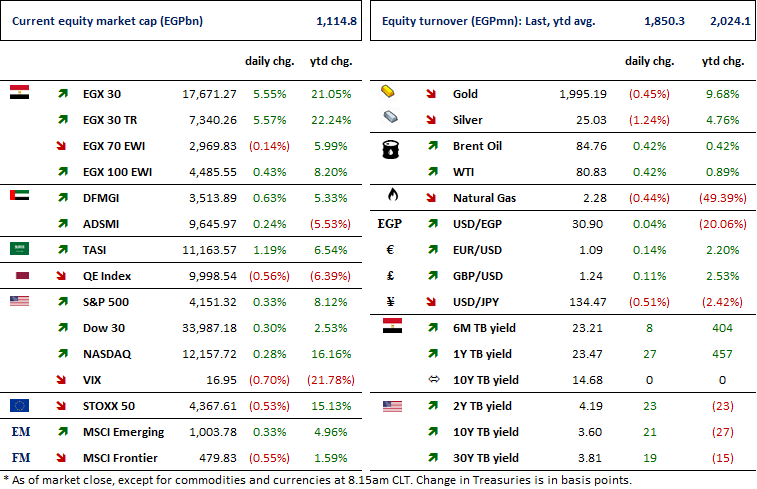

Macro

KIA said to finalize acquisition of The United Bank soon, potentially at 2x BV

Circling news allegedly said that Kuwait Investment Authority (KIA) acquired state-owned The United Bank (TUB) in a deal of c.USD660mn, with the official signing scheduled after Eid El-Fitr's holiday.

We note that TUB recorded net profits of EGP1.3bn in 2022 and registered a total equity of EGP10bn. This implies a return on equity (ROE) of 13%. If such rumor were confirmed, this potential deal would imply a P/BV of 2x for TUB, which is a very high multiple that might reflect the buyer's positive outlook for the bank's growth potential. This compares to Commercial International Bank's [COMI] 2022 P/BV of 2.3x.

We remind our readers that the previous negotiations with the Saudi Public Investment Fund (PIF) was around the USD600mn mark but at a time when the FX rate was c.EGP18/USD. So, despite the recent weakness seen in the EGP, a higher offer of USD60mn adds to the positive outlook for the bank in specific and for the banking sector in general. (Prime Research)

Eni discovers a new gas field in the Mediterranean

Italy’s Eni discovered a new deep-water gas field in the Eastern Mediterranean. The new field, Orion-X1, will reportedly have an investment cost of c.USD130mn. Eni has not disclosed the size of the field yet. (Aktsadna)

Corporate

TALM Q2 2022/23: Strong y/y performance

Taaleem Management Services [TALM] reported consolidated H1 2022/23 net profits of EGP192mn (+38% y/y) on higher revenues of EGP429mn (+28% y/y). Revenues grew due to a 13% y/y increase in student enrollments in the academic year 2022/23 vs. 2021/22, reaching 6,913 enrollments in Nahda University (NUB). Moreover, gross profit and EBITDA margins improved to 73.2% (+2.8pp y/y) and 62.2% (0.9pp y/y), respectively.

Regarding Q2 2022/23, TALM's net profits grew by 25% y/y to EGP84mn (-22% q/q) due to 23% y/y higher revenues of EGP199mn (-13% q/q). Gross profit margin was flat at 70.2% (-0.02pp y/y); however, it declined by 5.3pp q/q. As for EBITDA margin, it declined to 58.8% (-2.9pp y/y, -6.4pp q/q). (Company disclosure)

CIRA H1 2022/23: Strong revenues, yet lower net profits

CIRA Education [CIRA] reported H1 2022/23 net profits of EGP220mn (-22% y/y) on higher net finance expenses of EGP181mn (+119% y/y). However, revenues grew by 38% y/y to EGP1.3bn due to higher tuition fees of EGP1.07bn (+22% y/y). Gross profit margin dropped by 8.6pp y/y to 50.3%.

Regarding Q2 2022/23, net profits declined by 38% y/y to EGP113mn (+6% q/q) due also to the higher net finance expenses, coming at EGP101mn (+128% y/y, +26% q/q). Meanwhile, revenues grew to EGP673mn (+31% y/y, +6% q/q), while gross profit margin declined to 52.1% (-12.1pp y/y, +3.9pp q/q). (Company disclosure)

FWRY's OGM approves retaining 2022 net profits

In an OGM held on 12 April 2023, Fawry [FWRY] approved retaining 2022 net profits. (Company disclosure)

CICH's OGM approves retaining 2022 net profits

In an OGM held on 12 April 2023, CI Capital Holding [CICH] approved retaining 2022 net profits. (Company disclosure)