Today’s Top News & Analysis

The House signs off auto-related bills

Obour Land reported Q3 2022 consolidated results

Cairo Poultry addresses higher fodder prices

Juhayna sign a contract with KarmSolar

OIH to obtain an interest-free loan and launches a share buyback program

EGAL shareholders approve cash dividends

e-finance led a funding round for Nexta

MACRO

The House signs off auto-related bills

The House of Representatives (HoR) reportedly greenlighted the establishment of the Supreme Council for Vehicle Manufacturing and a new electric vehicle (EV) finance fund in a bid to localize the automotive industry. Moreover, the HoR approved allowing Egyptians who are residents abroad to import a new car and eventually get a full rebate on all customs fees and taxes, if they pay the dues upfront in foreign currency. (Enterprise)

CORPORATE

Obour Land reported Q3 2022 consolidated results

Obour Land Food Industries [OLFI] reported extraordinary Q3 2022 results, hitting its highest ever quarterly net profits and revenues. Bottom-line reached EGP146mn (+31% y/y), and revenues exceeded the EGP1bn mark, at EGP1.34bn (+64% y/y), on higher selling prices and sales volumes. Cheese segment contributed 95% to total revenues with EGP1.28bn (+66% y/y), while juice & milk contributed 5% with EGP66mn (+36% y/y). However, margins were pressured, where GPM recorded 20% (-4pp y/y) on higher raw material costs, and EBITDA margin was 15% (-2pp y/y). OLFI is currently trading at a TTM P/E of 4.9x. (Company disclosure)

Cairo Poultry addresses higher fodder prices

Cairo Poultry [POUL] reported that the impact of fodder higher prices will be reflected in the next financial statements. POUL said that they cannot measure the impact right now. (Company disclosure)

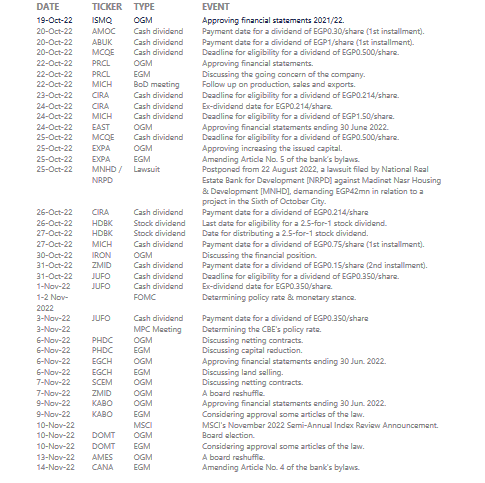

Juhayna sign a contract with KarmSolar

Juhayna Food Industries [JUFO] has reportedly signed a contract with KarmSolar worth EGP130mn to launch a solar power plant. The plant is aimed to generate the electricity needed for JUFO's farm in New Valley. (Arab Finance)

OIH to obtain an interest-free loan and launches a share buyback program

Orascom Investment Holding’s [OIH] BoD approved to obtain a EUR81mn interest-free loan given by North Korea’s Cheo Technology, a sister company to OIH. However, the loan amount will be held in OIH’s bank account in North Korea. Furthermore, OIH’s BoD agreed to launch a share buyback program to buy back up to 10% of its total outstanding shares at market prices between 18 October 2022 and 17 October 2023. (Company disclosure)

EGAL shareholders approve cash dividends

Shareholders of Egypt Aluminum [EGAL] approved a DPS of EGP4.50/share for 2021/22, implying a 19% yield. (Company disclosure)

e-finance led a funding round for Nexta

e-finance [EFIH] led a USD3mn funding round for Nexta, a fintech startup launched in 2021. EFIH announced that part of its strategy is supporting the fintech industry, which aligns with the CBE’s agenda and policies to accelerate the financial inclusion process. (Company disclosure)